The price of Bitcoin started the new month in a rough way and continued with its tumultuous run from October. On the afternoon of Friday, November 7, the leading cryptocurrency briefly fell below the psychological $100,000 level for the second time in the past week.

The recent weeks of Bitcoin price struggles have been attributed to a change in investor behavior, particularly a class known as long-term holders (LTHs). A prominent crypto expert on X has come forward with more insights on the impact of LTH behavior on the BTC price.

BTC’s apparent demand growth turns negative

In his latest post on the X Platform, CryptoQuant’s Head of Research, Julio Moreno, recognized that Bitcoin long-term holders have indeed unloaded their assets in recent weeks. However, the crypto expert noted that this increased selling activity of LTHs is nothing new.

According to Moreno, it is quite normal for Bitcoin long-term investors to shave off some of their holdings during bull markets, as they look to take some profits while prices are high. What has been different this time is that there has been no commensurate demand to mop up these reliefs.

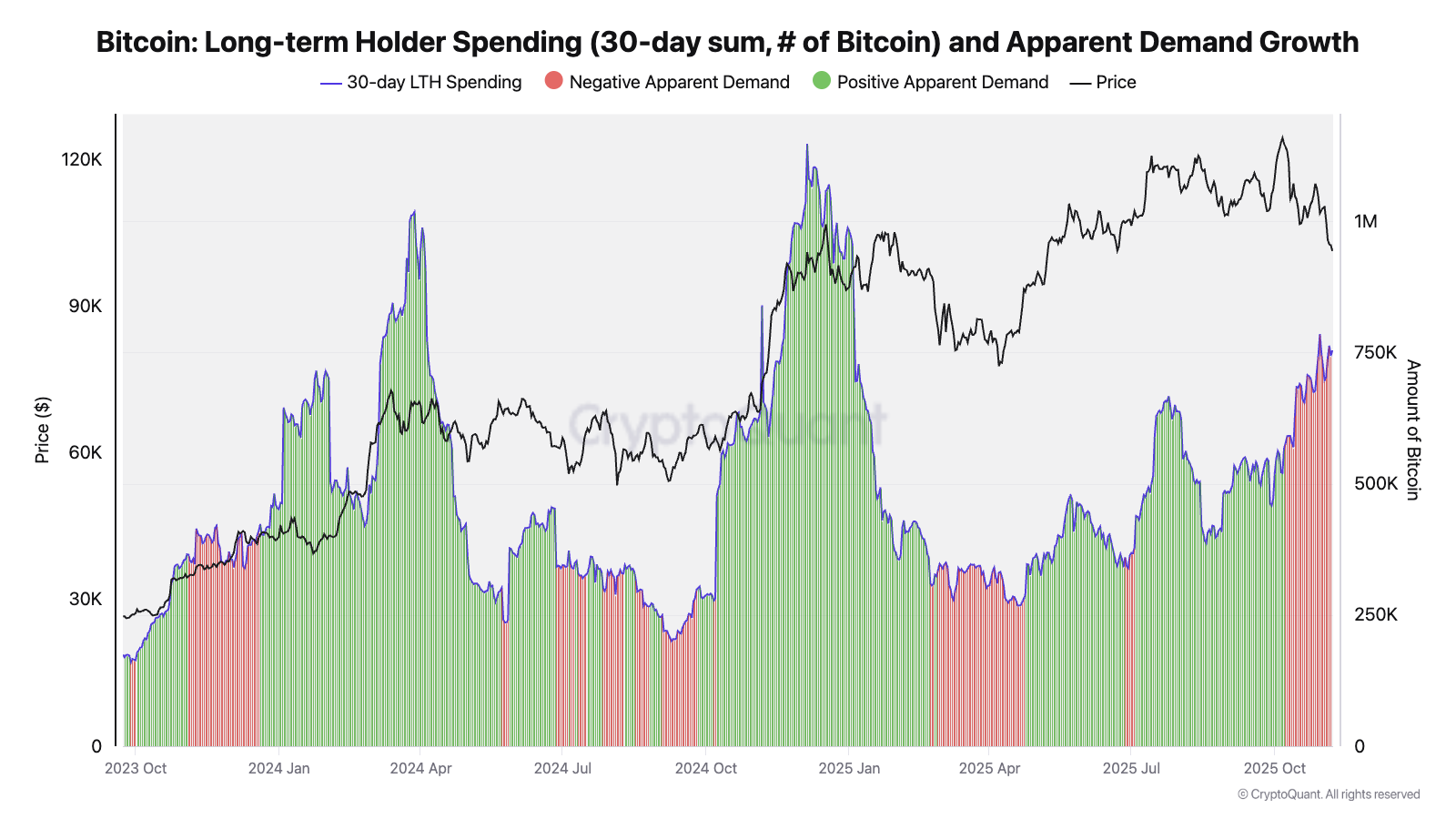

To support this, Moreno shared a chart covering the long-term holders’ spending and apparent demand growth over the past few years. For context, apparent demand growth measures the difference between how much of an asset (Bitcoin, in this case) is acquired versus the quantity created (mined).

Source: @jjc_moreno on X

The CryptoQuant Head of Research noted that the Bitcoin price had previously reached new record highs during periods of increased long-term holder selling – albeit with positive apparent demand growth. As observed in the chart, this occurred during the January-March 2024 and November-December 2024 all-time high rallies.

The highlighted chart also shows that Bitcoin’s long-term holders have been selling since October, which is not particularly out of place. However, apparent demand growth has declined, suggesting that it has not buy pressure to absorb The LTH range at higher prices.

Ultimately, this on-chain observation suggests that less focus should be placed on the selling activity of Bitcoin’s long-term holders. If there is to be a turnaround for the price of BTC in the coming weeks, positive apparent demand growth needs to be in place first.

Bitcoin price at a glance

As of this writing, the flagship cryptocurrency has recovered over $100,000 and is valued at around $103,700, reflecting a nearly 3% jump in the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial process for bitcoinist is focused on delivering thoroughly researched, accurate and unbiased content. We maintain strict sourcing standards and every page is carefully reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance and value of our content to our readers.