Bitcoin (BTC) prices continue to hover about $ 108,000 after a less 0.33% profit over the past 24 hours. Flagship Cryptocurrency continues to stay stable within a wider consolidation area between $ 100,000 and $ 110,000reflects a period of determination in the market. In the midst of the current market status, the popular trade expert with X username daan Crypto has emphasized important liquidity clusters that can play an important role in designing Bitcoin’s short -term price measures.

The imminent bitcoin battle fronts: $ 107,000 and $ 110,500

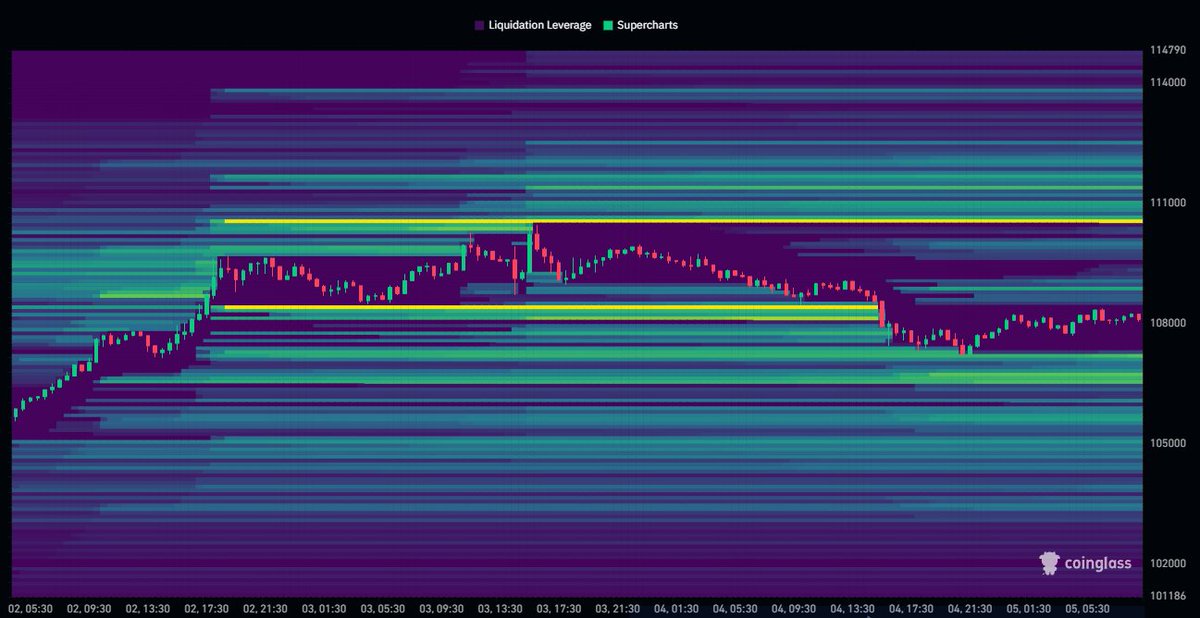

In one X post On July 5, Daan Crypto shares a critical insight into Bitcoin’s potential price measure in relation to liquidity levels. With Data from Coinglass, the famous analyst explains that Friday’s price activity led to a large-scale liquidation of leverage centered around the $ 108,000 region. Following this development, investors’ interest is now focused on new liquidity zones and forms about $ 107,000 and $ 110,500.

Of the marked regions, the $ 107,000 region seems to serve as the immediate support, with some traders defending positions that survived the latest liquidation. Therefore, BTC is likely to experience a short -term recovery when testing this level. However, a price dip below $ 107,000 would trigger large -scale liquidations that force prices to regions as low as $ 100,000 in line with the recent time -bound movement.

Meanwhile, $ 110,500 shows up as a short -term resistance Where potentially sales pressure or short items can be stacked, especially if Bitcoin tries another outbreak. A successful price near this level would eliminate multiple short positions that induce a short pressure that could result in Bitcoin quickly moving past its current maximum time of $ 111,970 to unknown price area.

Overall, the BTC market seems to stabilize within $ 107,000- $ 110.5,000 zone after Friday’s sharp liquidation sweep. This lateral price movement usually sets the scene for a rapid outbreak or division.

Bitcoin Exchange -Hävstångse effect reaches new high

In other developments, Cryptoquant Data reveal The fact that Bitcoin retailers shows appetite with a high market as the estimated leverage rate in all exchanges has reached a new annual height of 0.27. This metric that traces the amount of open interest rate in relation to the exchange of BTC reserves shows an increased risk behavior as traders are increasingly distributing borrowed capital in anticipation of greater price movements.

At the same time, the main Cryptocurrency continues to trade approximately $ 108,232, which reflects market gains of 0.70% and 6.41% respectively on the weekly and monthly diagram. With a market value of $ 2.15 trillion, Bitcoin retains a market dominance of 64.6% as the largest virtual asset in the world.

Image from Pexels, Chart from TradingView

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.