Key dealers

- Bitcoin shows stronger correlation with technical layers rather than gold.

- Bitcoin’s correlation with Nasdaq has reached as high as 0.7 over the past three years.

Bitcoin shows a stronger correlation with technical shares than gold, according to Franklin Templeon Digital Assets’ new Report“When Gold Ziggade, Bitcoin Moonwalked”, which discusses the common story that Bitcoin is “digital gold.”

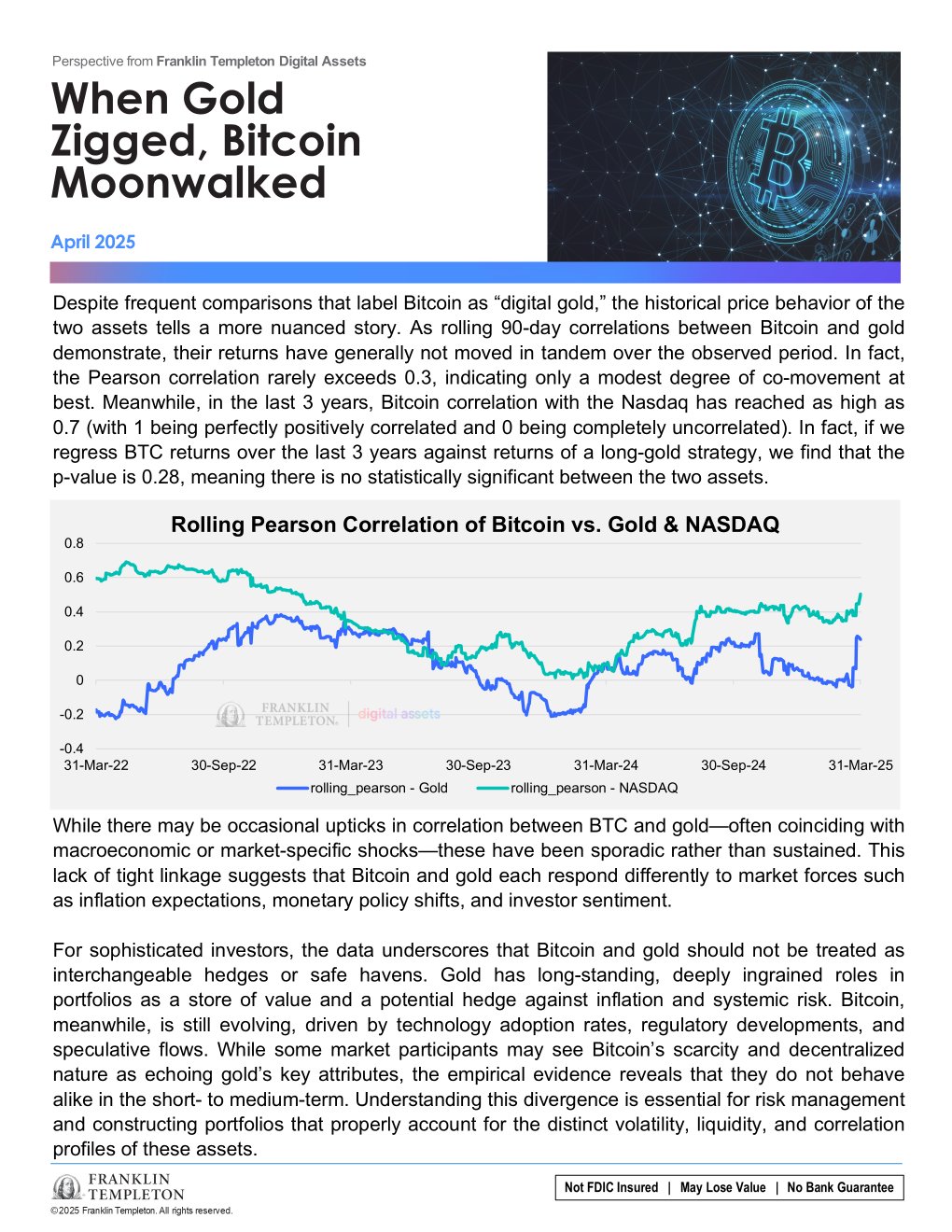

Franklin’s Digital Asset team analyzed three years of data and found that price correlation between bitcoin and gold is weak. Research shows that Bitcoin’s correlation with gold rarely exceeds 0.3 during rolling 90-day periods, which means that the two assets generally move independently.

While they can sometimes show a certain intercourse, they do not occur consistently in tandem.

Instead, Bitcoin has shown a much stronger and growing correlation with the Nasdaq share index and reaches as high as 0.7 over the past three years. This suggests that Bitcoin’s behavior tracks technical shares more closely than traditional safe refuge.

“In fact, if we regress the BTC return over the past three years against the return of a long gold strategy, we find that the P-value is 0.28, which means that there is no statistically significant between the two assets,” the report says.

According to Franklin Templeton digital assets, several important factors are behind the divergence. Gold has a long -term institutional adoption, deep liquidity and a robust market structure developed over the centuries.

Bitcoin, on the other hand, has only recently entered institutional portfolios and remains affected by new dynamics such as legislative changes, technical innovation and speculative flows.

Although there have been short periods where bitcoin and gold moved in tandem, usually under macroeconomic shocks, these sections have been more exceptions than the rule.

The report claims that Bitcoin’s resident volatile and technologically driven nature limits its usability as a golden set in diversified portfolios.

“The difference in maturity, in combination with bitcoins itself more volatile and technically driven character, continues to limit its correlation with gold, which means that the” digital gold “monikers can be more ambitions than to actually reflect market behavior-at least for now,” the report notes.

Gold prices float to fresh heights when trade tensions in USA-China escalates

Bitcoin rose above $ 83,000 early on Friday as US producer price index (PPI) reported lower than expected 2.7% against a forecast of 3.3%, according to TradingView data.

The decrease in PPI, along with a decrease in the US dollar index below the Key 100 level, has driven optimism among crypto dealers on potential hausse -like market conditions for bitcoin.

Despite these seemingly positive inflation numbers, however, large US stock indexes such as the S&P 500 and Nasdaq showed minimal change, which reflected ongoing concerns about the US trade war.

Bitcoin has experienced increased volatility over the past week, largely in response to President Trump’s sweeping customs message, which laughed global stock markets.

Despite Early signs of decouplingBitcoin continues to trade in line with technical shares. After briefly dropped below $ 80,000 on Thursday when the US-China trade conflict intensified, crypto supply recovered over $ 83,000 Today on PPI data.

At the time of publication, Bitcoin changed hand to about $ 82,600, an increase of almost 4% over the past 24 hours.

The gold grew to new record heights on Friday when investors flocked to safe assets in the midst of increasing trade voltages in USA-Kina. Spot Gold climbed over 1% to $ 3,207 per ounce, while futures reached $ 3,236.

The precious metal is now up about 20% for the year and exceeds most large asset classes.