Key dealers

- Bitcoin grew over $ 93,000 after President Trump announced no intention to fire chairman Jerome Powell.

- President Trump’s softened position on China trade relations also contributed to Bitcoin Rally.

Bitcoin broke through $ 93,000 on Tuesday night and lined up to $ 94,000 after President Trump said he had “no intention” to shoot dining chair Jerome Powell, data From TradingView -Show.

“Never did it,“ Trump spoke to Reporters. “The press runs away with things. No, I have no intention to shoot him. I would like to see him a little more active when it comes to his idea to lower interest rates.”

The president has aroused markets in recent weeks by openly criticizing the Fed’s monetary policy. His repeated jabs on Powell triggered calls about one Potential terminationEnough because people started asking if it was even legally possible.

With each Trump -Push worried about the Fed’s independence, and so did investors’ anxiety.

This, together with long -standing trade voltages, sent money that flows to gold. Spot Gold climbed nearly $ 3,500 on Tuesday as a result of the market’s concern.

However, the limelight was on Bitcoin. The digital asset had already won all day and crossed $ 90,000 before Trump’s remarks. His statements gave the rally’s fresh legs and pushed Bitcoin over $ 93,000 in a sharp late day.

Market analysts say bitcoin’s latest price measures indicate it may begin Relaxation from technical shares. For most of its driving, Bitcoin has traced together with Nasdaq. But now it is starting to behave more independently.

Trump on Tuesday also softened his attitude towards China’s customs. He said they would come down significantly and that he did not want to play hardball, another heading that was further entered into Bitcoin’s rise.

Institutional appetite returns when bitcoin ETFs after big profits

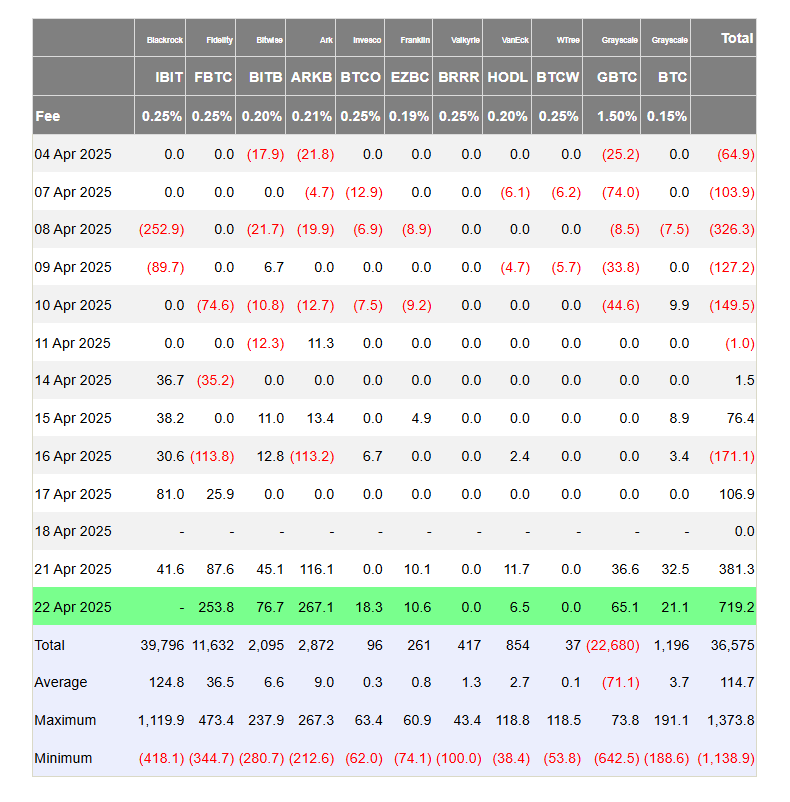

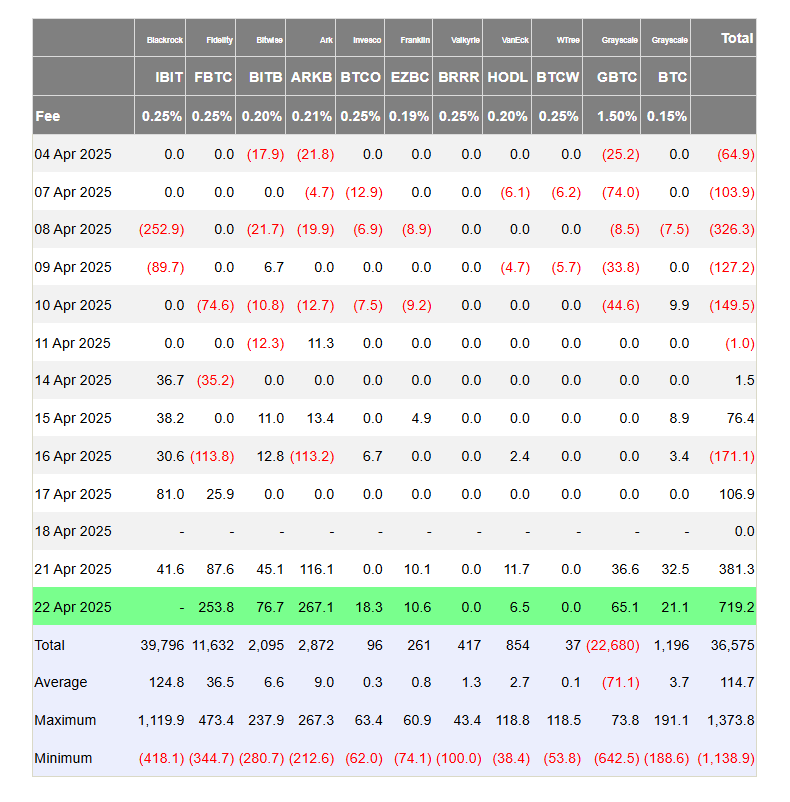

Elsewhere, in the ETF market, US-listed Tot Bitcoin ETFs have recovered with strong profits after a distance of outflows. On Monday, the group registered $ 381 million in net inflows, without any funds that published losses, according to data From Farside Investors.

From the latest update from Tuesday’s trading session, total net inflows over all Tot Bitcoin ETFs had risen to $ 719 million.

However, data from Blackrock’s Ishares Bitcoin Trust is still awaiting. If the fund also reports new inflows, the group could see its strongest single day since January.

After hitting $ 93,900, Bitcoin has withdrawn to $ 92,700 at press time, an increase of almost 5% over the past 24 hours.