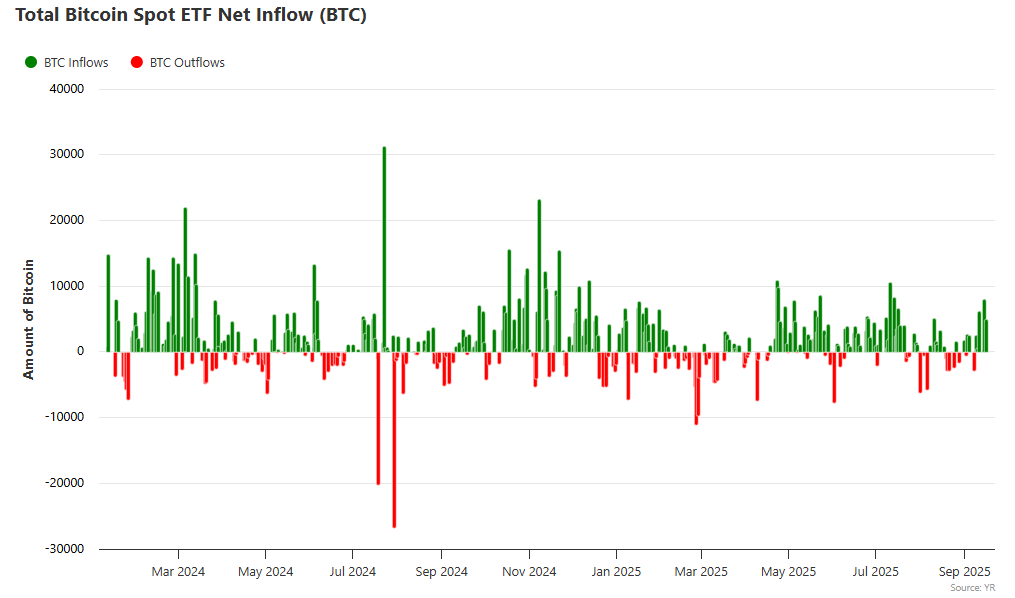

Bitcoin ETF outflows reached $ 51 million on September 17, and this marks the first major withdrawal after seven straight days of inflows when institutional investors quickly moved their Cryptocurrency holdings. The massive bitcoin ETF outflows signal a change in the marketing position right now, while Etherum etf Products also experienced some sales prints with $ 1.89 million in withdrawals during the second day in a row with outflows.

Bitcoin ETF outflows, Ethereum ETF pressure, fed political influence

Major Bitcoin ETF outflows dominate trade

So right now, Fidelity FBTC actually led Bitcoin ETF outflows with $ 116.03 million in withdrawals, and this was followed by Gray scale gbtc$ 62.64 million departure. The retreat of the institutional investors included also Ark & 21Shares ArkB with $ 32.29 million in outflows along with Bitwise bitb Registration of $ 12.58 million in withdrawals.

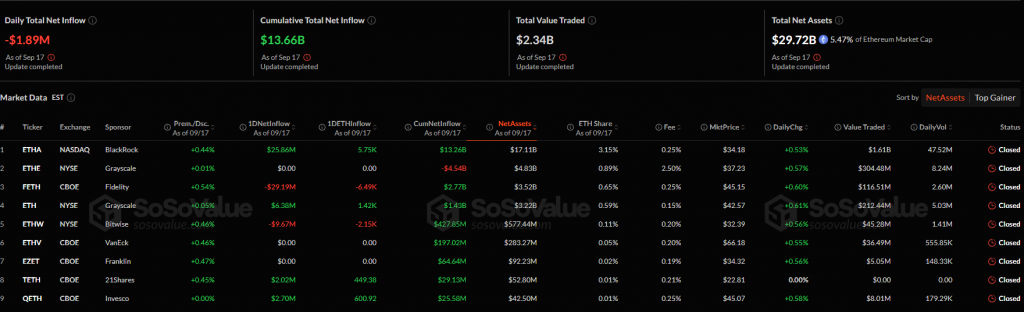

Ethereum ETF markets are facing similar pressure

The Crypto market turbulence was also expanded to Ethereum ETF products, with Fidelity’s Feth that led outflows to $ 29.19 million. Bitvis ETHW also registered $ 9.67 million in withdrawals, although some funds showed resilience to the sales pressure that happened.

Blackrock Etha actually published $ 25.86 million in inflows, while Gray -scale ETH Added $ 6.38 million. Minor profits came from Investco Fleece and 21 Shares with $ 2.70 million and $ 2.02 million respectively. The total Ethereum ETF trade volume increased to $ 2.34 billion, along with net assets up to $ 29.72 billion.

Also read: Ripple CEO Tips XRP will be part of the White House Crypto Stockpile, ETF

Fed Policy creates market uncertainty

Bitcoin trading reached $ 60,878 billion in daily volume and climbed more than $ 20 billion in a single day, while Ethereum’s trade volume jumped to $ 44,462 billion. This activity suggests that while institutional investors take gains through Bitcoin ETF outflows, retail and other market participants remain engaged right now.

Also read: SUI CRYPTO EYES 200% breakout on Google Deal + ETF Hype

Market dynamics reflect how quickly institutional emotion can change in the crypto market, with Bitcoin ETF outflows that represent profit-making behavior rather than basic stentage at digital assets at the time of writing.