According to Farside Investors, Bitcoin (BTC) ETF inflows rose to $524 million on November 11, 2025the highest level since October 7. The surge in BTC ETF inflows is yet to be reflected in the price of the underlying asset, which is struggling to break past the $105,000 price level. Let’s discuss whether the surge in BTC ETF inflows will help BTC’s price.

Will ETF Inflows Help Bitcoin’s Price?

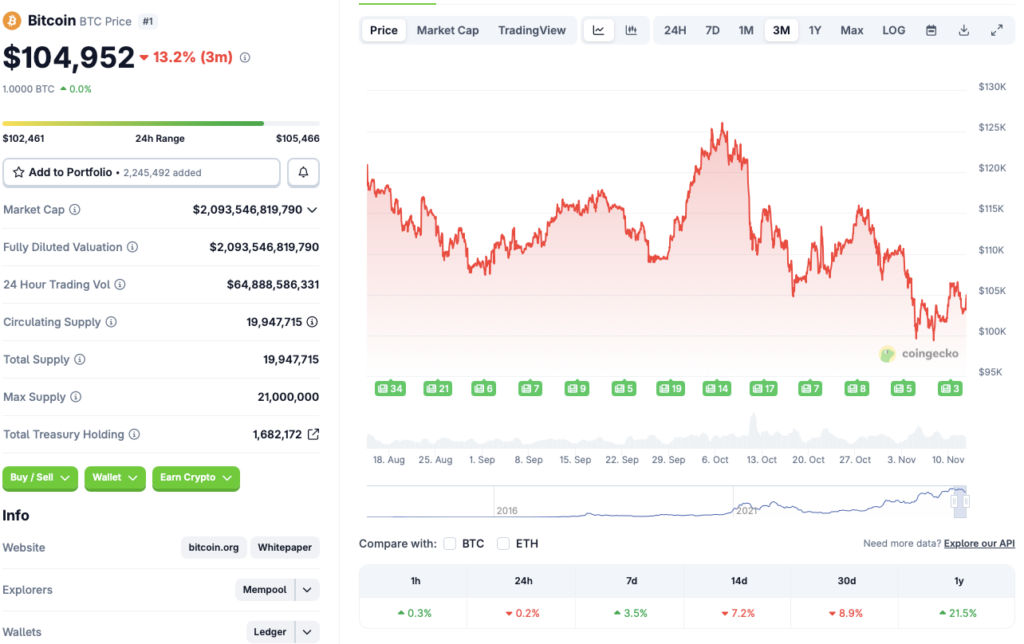

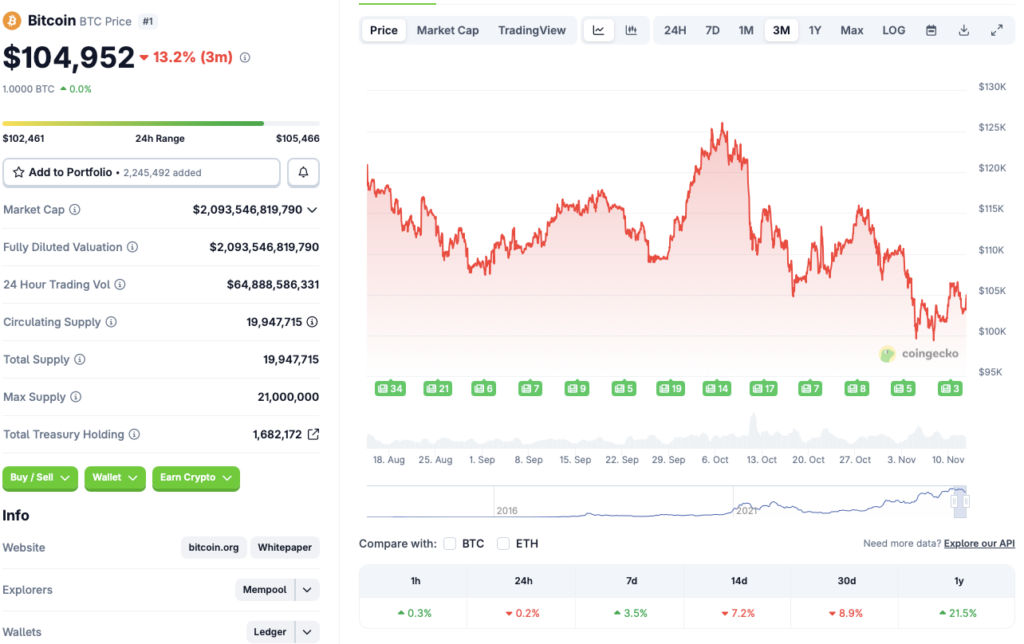

Recent ETF inflows have not led to any positive price action for BTC. According to CoinGecko data, Bitcoin (BTC) is down 0.2% on the daily charts, 7.2% on the 14-day charts, and 8.9% month-to-month. Despite the downtrend, the supply is up 3.5% in the past week and 21.5% since November 2024.

Additionally, the recent interest rate cut by the Federal Reserve could also help propel BTC’s price beyond $110,000. There is also a possibility that the Federal Reserve will roll out another rate cut in December, although there is no confirmation on that front. The Fed is reportedly split on whether to implement another rate cut or not.

Read also: Whales withdraw money: 738 large Bitcoin wallets disappear in one week

The ETF inflow spike is not enough to conclude whether the crypto market has fully recovered. Many would say that the market is still quite fragile and far from fully recovered. Bearish factors continue to weigh on investors. Bitcoin’s price can swing in any direction in the coming days.