- The S&P 500 climbed to a maximum time of 6,409, while the total crypto market ceiling rose to almost $ 4 trillion.

- Ethereum was the prominent artist and significantly surpassed Bitcoin during the month of July.

The week led a striking combination of macroeconomic drivers and sector -specific catalysts that pressed markets into exciting territory. Early speed was driven by robust technical revenue, especially in the AI sector. Large investments in generative AI of large technology companies ignited optimism over risk resources. The S&P 500 climbed to a maximum time of 6,409, while the total crypto market ceiling rose to almost 4 trillion dollar-only shy for a large psychological milestone mentioned in Binance research Report.

Ethereum was the prominent artist and significantly surpassed Bitcoin during the month of July. It registered its best monthly profits in three years, which reflected increasing adaptation to growth shares. The wider crypto market reflected the raised tone, with institutional flows that took up the pace.

However, Rally was not immune to macro prints. On Thursday, a stronger US dollar index triggered in combination with Hawkish Central Bank comments a strong reversal between both equities and cryptocorate. A renewed caution swept across markets, especially affecting volatile sectors such as crypto.

CRYPTO SECTOR SNAPSHOT: DIEGERING PERFORMANCE AND SHIFTING Sentiment

Bitcoin has shown resilience throughout 2025 and published a 24% profit from the year before. But it has dragged behind more growth -oriented symbols such as Ethereum. The price measure reflected a shift in the interest of investors, with Bitcoin’s safe seas Story submitted by macro headwinds and customs -related uncertainty.

Ethereum, on the other hand, increased over 50% in July and was favored by increasing institutional adoption and positive feeling about its developing role in defi and AI-related infrastructure. The asset continues to move in closer correlation with large -scale shares than with traditional assets in stores of value.

Altcoins delivered a mixed bag of results. Big players such as BNB, Sun and XRP experienced sharp corrections mid week. Many of these corrections, however, brought relative strength indicators in a deeply over -sold territory, suggesting possible short -term twists or now.

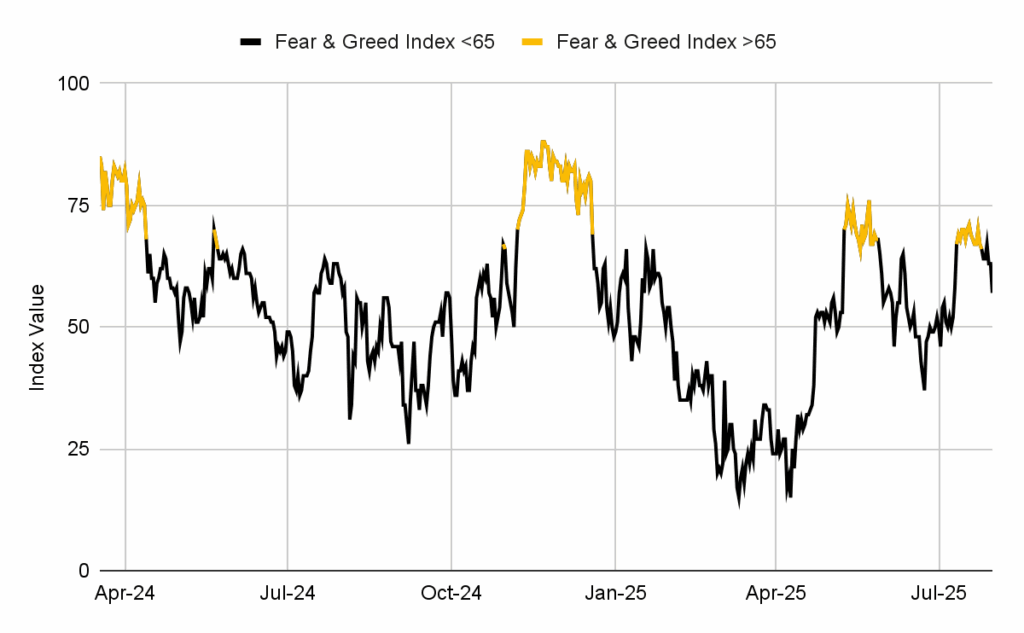

Investors’ feeling also reflected this volatility. Fear & Greed Index fell below 65 after an extended driving in the “greed” zone, which indicates that enthusiasm can cool just like institutional investments via ETFs take up steam. Metricians on the chain indicate reduced retail participation-which is to be suggested that institutional flows are now setting the pace.

Politics and regulatory development

Significant regulatory developments are starting to reshape the crypto landscape. An important displacement came with the roll -out of a large regulatory initiative that officially classified the majority of crypto assets as goods. This movement streamlined process for crypto -based ETFs and paved the way for faster approvals.

Further political progress included a remarkable proposal for a federal reserve-supported digital bitcoin reserve, which represented a significant deviation from previous CBDC discussions. The initiative reflects growing openness to integrate blockchain-based assets into the usual financial framework.

The US Federal Reserve’s most recent political meeting showed internal departments. While the official statement struck a moderate tone, two committee members voted for an immediate interest rate reduction – the first time such a shared vote has occurred since the early 1990s. Despite this, the chairman signaled a cautious position and prioritized inflation control in the midst of trade -related uncertainties.

Elsewhere, Bank of Japan revised its inflation expectations upwards and kept its negative interest rate policy unchanged. This introduced subtle pressure on global currency markets but had limited direct impact on crypto assets.

Market shocks and technical settings

The start of August led new geopolitical tension in the form of new commerce dampers, dampening global risk appetite. In response, Bitcoin fell to its lowest level since mid -June and dipped close to $ 114,250. This triggered over $ 630 million in liquidations over the crypto market, of which the majority were long positions.

From a technical perspective, Bitcoin broke several short -term support levels, including important variable averages. RSI and stocastic indicators pointed to sharply oversold conditions, while the volume of trading fell sharply – to perform that sales pressure can decrease.

If current support close to $ 114,000 holds, Bitcoin was able to recover against the range $ 116,000- $ 118,000. However, a break below may speed up a picture to $ 110,000 zone, where stronger historical support lies.

Altcoins also presented similarly oversized technical signals. Short -term charts revealed deep returns over BNB, ADA, LINK, SHIB and DOGE. Although this sets the scene for possible returns, confirmation through technical signals on lower time frames is necessary before re -entry.

Ethereum and TRX, on the other hand, seemed somewhat overheated on a 24-hour RSI basis, which indicates either further consolidation or mild corrections forward.

When you look forward, macroeconomic data will be forward and mine. Key US emissions include inflation readings, GDP growth figures, ISM manufacturing data and employment reports. These data points can greatly affect the market direction in the coming weeks, especially when we enter historically weaker months for both equities and crypto.

Investor focus is likely to remain divided between monetary policy changes and the pace of the regulatory conversion. With ETFs and institutional products that gain momentum, retail investors can find a varied landscape that increasingly reflects traditional financial markets.

Conclusion

July closed on a high tone for digital assets, with Ethereum leading the road in the middle of growing AI integration and regulatory clarity. Nevertheless, August has arranged enthusiasm with geopolitical uncertainty and monetary tightening.

Bitcoin remains close to an important technical level. Its ability to keep the support of $ 114,000 is likely to dictate the feeling in the short term. At the same time, altcoins may be founded for short -term recovery if the current overall conditions hold.

Institutional investments continue to gain traction, while regulatory clarity is moving forward in important markets. These structural rear winds can drive the next leg of Crypto’s journey – if macro headwind does not track speed.

As August develops, market participants should remain smooth and balance short -term trade opportunities with long -term changes that form the digital asset ecosystem.