In the development of digital assets, we have witnessed the increase in both centralized funding (CEFI) and decentralized funding (Defi).

CEFI, with the support of product design, risk control systems and large user bases on centralized platforms, has long been the primary liquidity hub in the crypto market. DefiHowever, during the “defi summer” in 2020, when new protocols for decentralized lending, Dex and liquidity mining rapidly expanded, which drives the development of increasingly experimental and autonomous financial applications.

With the emergence of Ethereum and defi, liquidity pools and lending protocol improved efficiency in capital turnover, but assets remained concentrated in native crypts such BTC and ETH. As the industry enters a new scene, the tokenization of real assets (RWA) takes large pools of real liquidity in the market. At the same time, CEFI continues to provide basic liquidity and entry points as he extends on the chain to get more openly involved with the decentralized ecosystem.

When the boundary between finance on the chain and outside the chain dissolves, the complementary development of CEFI and the defi tone for the development of the crypto Financial Ecosystem. This shift is driven by a change in the source of liquidity.

Web3’s new liquidity landscape

Ensuring continuous liquidity in the web3 market has become a nuclear focus in industry competition. Unlike the first days, when liquidity was almost entirely dependent on BTC, ETH and other crypto assets, today’s liquidity sources become much more diverse:

● CEFI platforms: Exchanges and other CEFI platforms are still the largest gates for both users and funds. They not only gather huge user bases and liquidity pools, but also provide the essential initial liquidity that defi protocol needs to start and scale and act as channels that direct liquidity in the ecosystem.

● Compatible StableCoins: As an anchoring for trade, payments and decommissioning on the chain, Stablecoin’s security ensures fund flows while offering infrastructure with low freesty for cross -border payments and institutional solution. According to Coytecko, Market Cap continued for Stablecoins to grow in 2025 and exceeded $ 283.5 billion and cemented its role as the hard currency of the crypto market.

● RWA -Tookenization: By mapping traditional financial assets such as bonds, bills and properties on the chain, Rwas creates a value management between actual markets and Blockchainsreleases new liquidity from previously dormant assets. The Boston Consulting Group projects the RWA tokenization market will hover to $ 16 trillion by 2030, with 30-50% of Stablecoins expected to be supported by Rwas.

● Participation of institutional means: As the crypto market becomes more compatible, traditional institutions such as hedge funds and investment banks enter the arena. They not only provide large -scale capital inflows, but also introduce stability in long -term capital and control the ecosystem towards healthier and more sustainable growth.

Obviously, CEFI’s user base, Defi’s governance mechanisms and Tradfi’s participation converge to a powerful force that improves both efficiency and safety for funds while at the same time as liquidity in breadth and depth. The development from “early experiments” to “diverse integration” not only reveals the most important industry dynamics but also provides a solid real basis for the convergence of CEFI and Defi.

Steering: The engine for web3 liquidity

If liquidity is the fuel that drives cryptofinance ecosystems, the control is the engine that drives it. For example, Aave V4 adjusts dynamic interest rates based on security quality and market liquidation, which ensures that fund pools are effectively used at the same time as systemic risk is minimized. At the same time, MakerDao utilizes control mechanisms that stabilize fees and security conditions to keep Dai properly anchored in turbulent markets. Both exemplifies how decentralized control mechanisms balance the relationship between asset likeness and market stability.

Evidence shows that DAO control frames in a fast-developing market with dynamic risks are often more adaptable and resistant than traditional CEFI structures.

In today’s macro context, this guiding benefit is even more critical. Uncertainty in the external environment, the user’s requirements for both safety and liquidity and the ongoing integration of CEFI and Defi all the market to seek more resistant control models.

It is at this important time that DAO cooperative Offers its answer: On the one hand, which draws on the successful methods of Aave, Makerdao and others, it balances dynamic risk and liquidity through control of control. On the other hand, it uses HTX to digest CEFI’s user base and role as a Capital Gateway with Defi’s open control and self -developing capacity, which creates a control structure that is both stable and efficient.

From Platform Sports to Ecosystems Media: HTX DAO’s governance path

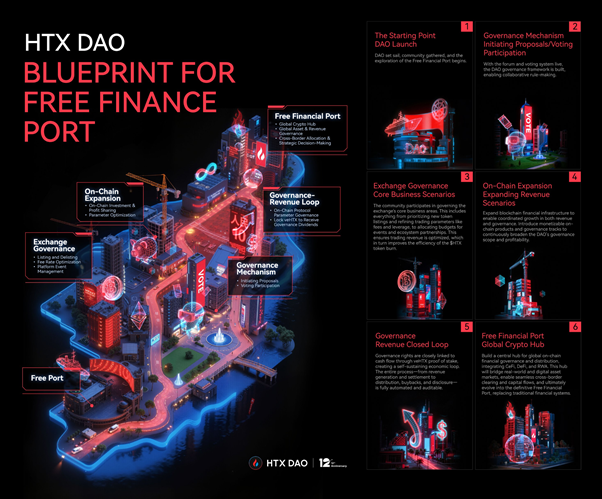

Recently, HTX DAO released an upgraded white paper. The latest edition sets out a clear development path from event tracking to controlling closed loops-from the “Platform Gateway Governance” to “Ecosystem Financial Co-governance”. At the same time, this structure drives user engagement through an open “token holder control” model, reinforced by behavioral incentives and deflation mechanisms.

In this model, users are not only the “user” of the platform but also its “builder” and “owner”. The shell effects of CEFI and the transparent control of defi is really brought:

● Real decentralization of force: Through Vehtx (voice -power htx) -Tokens, htx dao, the decision -making power of nuclear power happens to society. Users who hold and lock the HTX tokens receive VehtX, which gives them voting rights on important operational parameters such as token lists, trade paving adjustments, fee structures and incentive weights. This marks a fundamental change in exchange operations from centralized control to control on the chain.

● Depth integration of revenue and control: VEHTX symbols not only give users’ board law but also deliver dividends on the chain. This model binds close users’ financial interests for the long -term growth of the ecosystem and motivates them to actively participate in decision -making and jointly protect the health of the ecosystem.

● Bridge the gap between CEFI and defi: In its core, HTX DAO’s control mechanism creates a direct road for CEFI’s massive user base to access Defi control. Without wrestling with complex operations on the chain, users can enjoy the transparency and justice achieved through decentralized control through a familiar platform.

Thus, from exchange control to chain enlargement, from mechanism design to building a global financial hub, HTX DAO’s steering frame does not only take inefficiency and lack of compliance in traditional DAOs but also builds a truly user -centered “free financial port” which enables economic value distribution and institutional.

HTX DAO – A new paradigm for elastic financial infrastructure

It can be foreseen that the financial markets of the future will go beyond simple lending or other trade -use cases and develop into more complex washing chains, several asset networks with cross -border flows. Against this background, DAOs must answer existing questions about how governance mechanisms can coordinate liquidity and how capital pools can remain both robust and open in the middle of macroeconomic uncertainty.

HTX DAO positions itself as a “control chain” in this landscape.

According to the plan described in its white paper, HTX DAO will not only serve as a control platform but also as a Nexus connecting CEFI and Defi, as well as the leading parameter and liquidity outside the chain: On the one hand, it will continue to strengthen the chain’s control capacity. On the other hand, it will explore integration with real markets, including board models on the chain of compatible Stablecoins, Rwas and even tokenized representations of US shares and bonds. In the end, it aims to build an open, adaptive and cross -market control network that transforms DAO from a tool to adjust internal mechanisms into long -term strength restructuring of global financing.

This is a great story, no longer a zero sum game between centralization and decentralization, but their symbiosis and co -development on a higher level. What we are witnessing is the increase in a new, more resilient financial infrastructure.