Chief Investment Officer for Crypto Asset Manager Bitwise says he believes that a decentralized financial project (Defi) at Ethereum (Ethics) Blockchain is currently undervalued.

Matt Hougan says Market ceiling for uniswap (Uni), which is about $ 6 billion, “feels too small.”

“(Uniswap) would be the 400th largest financial services in the world – about the same size as the big fire, a savings and insurance business in Norway.”

In accordance with For Hougan, legislative security may be to operate Uniswap’s current undervaluation, but it can change in the middle of the US Securities and Exchange Commission (SEC) latest initiatives to provide the clarity of the legislation for crypto assets.

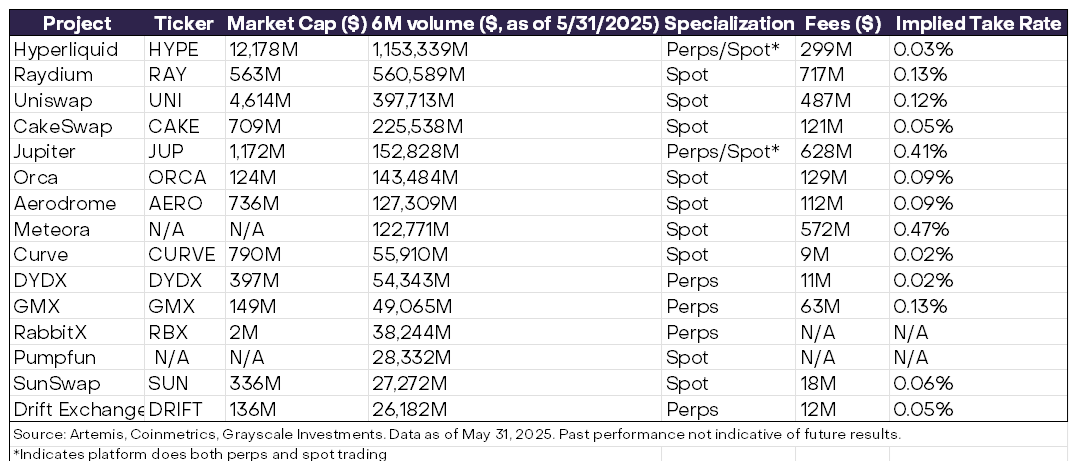

Per gray scale research Report Uniswap has been released at the end of June and is among the 10 decentralized exchanges.

For six months ending on May 31, Uniswap ranked third in terms of volumes. Uniswap generated $ 487 million in fees behind Solana-based decentralized exchanges Raydium, Meteora and Jupiter during that period.

UNI deals at $ 9.89 at the time of writing, up by 36% over the past month and down by about 78% from the highest period in May 2021.

Turns to Ethereum, Hougan Notes This site -traded funds (ETF) for the second largest crypto supply with the market ceiling registered $ 5.4 billion in net inflows in July, the highest monthly net inflow ever.

“When you think Ethereum is 20% on bitcoin, these flows really hit home. Imagine if bitcoin ETFS made $ 27 billion in a month …”

In accordance with For the Krypto ETFS Tracker Sosovalue, the highest net inflow for Spot Bitcoin ETFS was the $ 6.49 billion, which was reached in November 2024.

Image: Shutterstock/Philipp Tur/Vladimir Sazonov