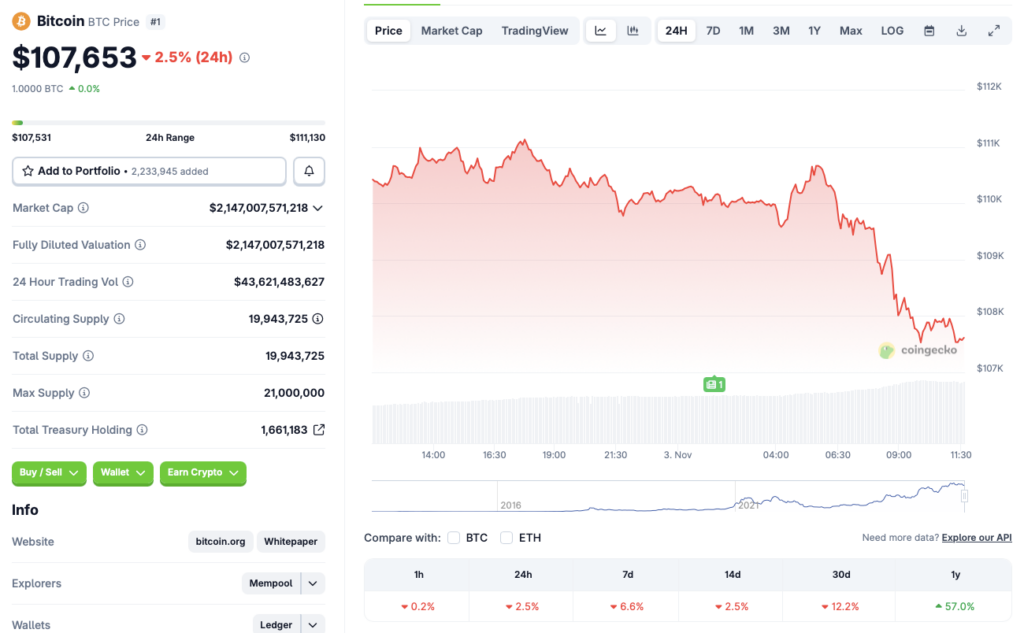

The cryptocurrency market continues its weak performance as we enter November 2025. Bitcoin (BTC) is struggling to gain momentum and is trading in the red zone across almost all time frames. According to CoinGeckothe native crypto is down 2.5% in the last 24 hours, 6.6% in the last week, 2.5% in the 14-day charts and 12.2% over the previous month. October, once considered a bullish month for crypto, has gone the other way around in 2025. Given the current market environment, there appears to be no recovery in sight for Bitcoin (BTC) or the larger crypto market.

When does Bitcoin enter a recovery phase?

The current market environment is quite surprising. The Federal Reserve cut interest rates by another 25 basis points after its October meeting. Interest rate cuts often lead to Bitcoin (BTC) and other cryptocurrencies rallying as borrowing becomes easier and investors take on more risk. But this time the trend is completely different. It’s possible that Federal Reserve Chairman Jerome Powell’s hawkish speech may have spooked investors. Powell highlighted the slow economic growth and challenges from rising inflation. In addition, the chances of another interest rate cut have decreased significantly.

Read also: Gold or Bitcoin: Which is the Real Hedge Against a Falling Dollar?

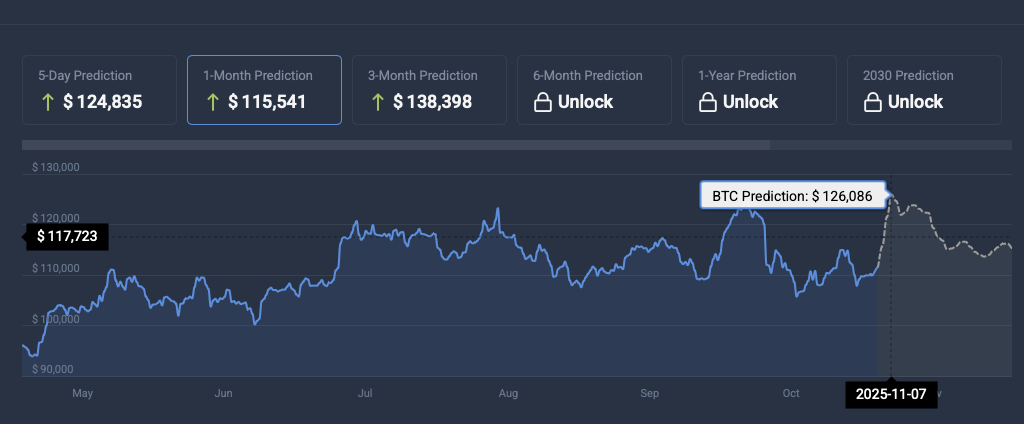

Bitcoin (BTC) may enter a recovery phase if the current challenges cool down. Economic growth and completed trade deals could restore investor confidence. CoinCodex Analyst predict that Bitcoin (BTC) will break out and reach $126,086 on November 7th. However, the platform does not expect BTC’s price to stay at the $126,000 level, predicting a correction shortly thereafter.