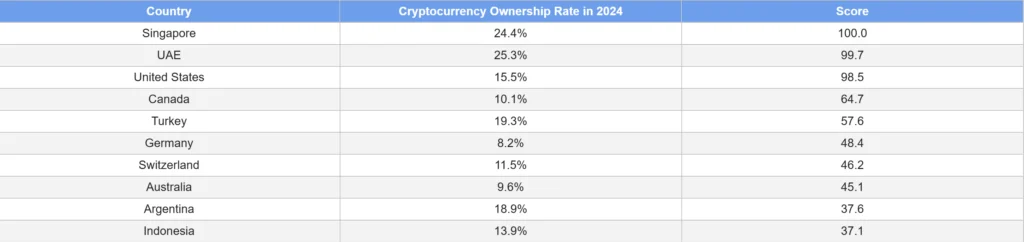

Singapore If the world’s most “crypto obsessed” land, a new report has revealed, with the United Arab Emirates and the United States rounds the top three.

The report from the APEX protocol ranked countries according to growth in the assumption in recent years, the proportion of the population that owns digital assets, internet search activity and the availability of withdrawals in digital currency.

Singapore made a perfect 100, with an ownership of 24.4% from 2024, the second highest global. It marks a remarkable growth from 11% of Singaporeans that owns digital assets in 2021.

The Asian country also ranked first for Internet Search activity, with over 120,000 searches, or 2,000 searches for every 100,000 inhabitants.

While it topped the latest report, Singapore ranked 15th overall in chain analysis’ Global Crypto Adoption Index, published in September. Its highest ranking was in the Defi value received on the 13th.

Singapore has become one of the global hubs for tokenizationwith Monetary authority in Singapore (MAS) Set the pace with Project Guardian. The tokenization project has global giants, including standard chartered (Nasdaq: SCBFF), Citi (Nasdaq: c), HSBC (Nasdaq: HSBC), S&P Global (Nasdaq: SPGI, Ubs (Nasdaq: Ubs) and Moody’s (Nasdaq: MCO), as members.

Singapore also positions itself as a leader in emerging Stablecoin’s sectorand this week beat Rival Hong Kong when he launched the first Stablecoin to his Singaporean Dollar (SGD). Local StableCoin company Straitsx, which launched XSGD StableCoin, says It “improves Singapore’s appeal as a hub for both global capital markets and Asia’s digital economy.”

United Arab Emirates Topp’s ownership, USA Leads in ATMs

At a composite score of 99.7, UAE ranked second after Singapore. The land of the Middle East topped Digital asset ownership Chart with 25.3%. According to Apex, ownership has increased by 210% since 2019, with clearer regulations and a driving force from the government to promote adoption that has been credited for the busy.

The United States ranked as third in total and received 98.5 and led in ATM accessibility with a significant margin. The country is home for over 30,000 Digital asset machines, almost ten times as many as other placed Canada, which has 3,700. It accounts for almost 80% of all digital currency marks globally.

In the chain analysis rank, the United States placed second globally, just behind India, and moved up two places from its 2024 place.

Canada and Turkey rounded off the top five. The first -mentioned strong ATM presence contributed to its ranking, with the latter high digital asset ownership of 19.3% and placed it in the third globally.

When he commented on the report, a spokesman for Apex said it proved that “crypto is no longer on Frans.

“It becomes part of how countries define their financial future, not only as an investment, but as a reflection of how people get involved in technology, money and confidence in the digital age.”

DBS: Hong Kong’s “Hard” StableCoin laws restrict derivative trade

Somewhere else, Sebastian Paredes, CEO of DBS Banks (Nasdaq: DBSDY) Hong Kong operations, claim that the city’s strict laws have limited the use of stablecoins in the derivative trade on blockchain platforms.

Paredes spoke at a new event and informed the participants that Hong Kongs Stablecoin frameworkswhich came into force on August 1, has introduced Strongent Know Your Customer (KYC) and Anti-Money Laundering (AML) standards at Stablecoin issuers and thus limit their use in certain financial applications.

Paredes goes with a variety of other leaders who have criticized The StableCoin regulation is too hard, especially on smaller players. Industry sources have revealed that several interested applicants have withdrawn from the license race waiting for the result to see how big players like Ant Group and JD.com (Nasdaq: JD) price.

This skepticism was reflected in the license applications, as in accordance with To HKMA applied only 36 institutions for the Stablecoin license in September, less than half of Applications In August. Although it did not reveal the applicants’ identity, it claimed that they included banks, technology companies and suppliers of payment services.

The city expects to issue its first part of Stablecoin licenses in early 2026, revealed Christopher Hui, the Ministry of Finance.

While DBS (Nasdaq: DBSDY) Expect that the Stablecoin regime will deter some companies, the Singaporian bank will continue to build Stablecoin infrastructure in Hong Kong, said Paredes.

Look at | Mica and the future of Stablecoins: What comes the next for Tether?

https://www.youtube.com/watch?v=wn5rw04wwiw Title = “Youtube video player” Ramborder = “0” Allow = “Accelerometer; Autoplay; Clipboard writing; encrypted media; Gyroscope; Image-in-Bild; Web Dividend” Reference Policy = “Strict-Origin-When-Cross-Origin” Allowing Lorscreen = “>”