Bitcoin’s CME GAP Pullback -oro is intensifying right now when a new gap formation threatens the $ 111,000 support level. CME Futures Gap Bitcoin retailers have monitored near opened when the futures markets resumed trade, and this created a price deviation between spot and also future prices. This Bitcoin -Price Risk has actually historically prejudiced, since CME hatches tend to be filled in about 77% of cases, making the current technical installation particularly significant for bitcoin technical analysis.

Analyze Bitcoin’s support of $ 111K in the middle of CME GAP problem

Understand bitcoin cme gap pullback pattern

Bitcoin Futures resumed trade with a gap between $ 111,000 and $ 109,700, which triggered the latest CME tow. This Bitcoin Formation CME futures gap came when access is currently traded on Spot Exchanges over $ 112,000, which is a technical magnet that would potentially pull down the bitcoin prices. The gap is one of the most important turning points for monitoring the possibility of Bitcoin Price return.

Also read: Gemini says XRP 5 -year -old Roi Beats Bitcoin, Ethereum

Crypto Trader Dann said about the subject:

“$ BTC has opened with a CME gap and has continued higher since the future was opened. It has been quite a while since we opened with a gap, like this. These used to close fairly quickly. If it were to happen here, the whole structure would look pretty bad in the short term considering that we almost never close to these very few gaps that are never closed or not.” “

Critical support levels and bitcoin technical analysis

The $ 111,000 support zone has become crucial for Bitcoin technical analysis, as it adapts to both the CME gap and even psychological resistance. Bitcoin CME GAP Pullback events often precede short-term corrections, especially when the gaps remain unfilled for longer periods. Traders over different platforms actively look at this level at the time of writing.

“Don’t think it’s generally in play until BTC starts shopping under $ 111,000.”

This threshold represents the activation point where the Bitcoin price for the return of the price becomes more immediate and also more for traders. According to CME Futures GAP pattern for bitcoin, the inability to maintain over $ 111,000 can actually increase the downward momentum towards the gap filling area. Market players will still remain divided if the gap will be closed soon or remain open.

Also read: Tim Cook owns Bitcoin and Ethereum, but Apple rejects Crypto

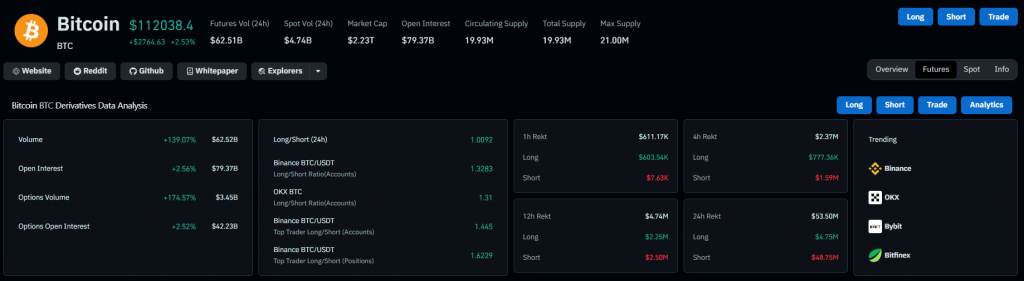

Traders have driven open interest higher in the derivative markets, while mixed long and short positioning reflects uncertainty whether the CME gap will soon be closed. Bitcoin analyst now identifies $ 111,000 as the most important impact land – either the relapse is materialized, or continued strength above this level annuls the gap risk.