According to Cryptocurrency -analyst Alex Adler Jr. Currently traded Bitcoin (BTC) is significantly under its over -bought threshold. In other words, the original crypto can be underestimated at its current position. Adler quotes Mayer Multiple’s 1.1x current metric to support its claims. The current value is significantly lower than the 1.5x value, which would otherwise have signaled an over -camera asset. The figures may mean that BTC can soon climb to a new highest time.

Why is Bitcoin consolidated even though he is undervalued?

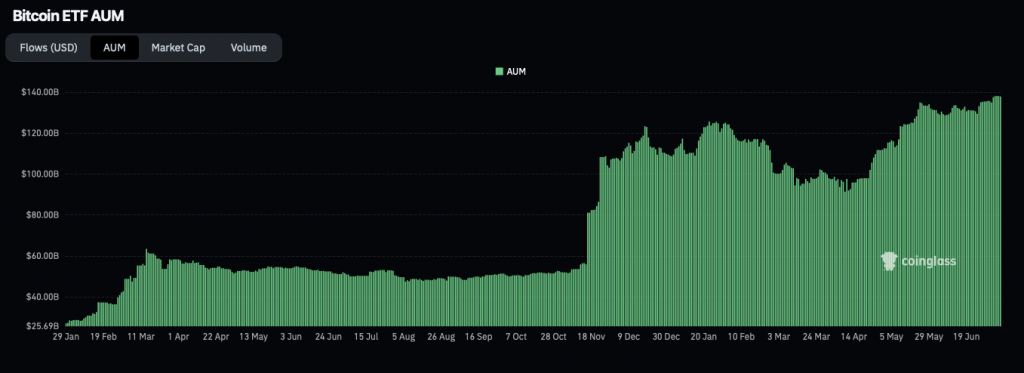

The recent BTC price increase was probably due to an increase in institutional investments in recent months. Retail money seems to be in a sleep right now. According to measurement values on the chain, the small wallet activity is at the lowest in many years.

On the other hand, it is also possible that small retail investors will surely play this bike. Global trade war and geopolitical tensions may have haunted retail money to hibernation. Many may have set their capital in safer investments, such as the US dollar, gold, etc. Bitcoin (BTC) and the larger crypto market are among the most volatile and risky assets. We can see an increase in retail inflows if and when the global economy sits down.

Also read: Bitcoin Breakout forward? Musk’s party might just trigger it

Another factor that may be to keep retail buyers in the remote, the Federal Reserve’s decision to keep interest rates unchanged. An interest rate reduction will facilitate borrowing for investors. Such a scenario can lead to an increase in risky investment. Bitcoin (BTC) and other risky crypto assets could benefit from such a development.