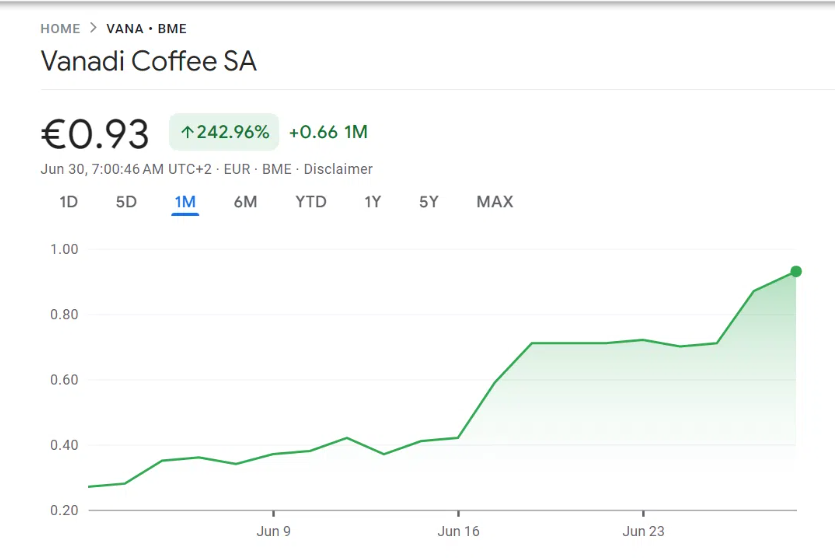

Vanadi CoffeeBitcoin Treasury Strategy has driven a remarkable 242% share over voltage after the shareholder’s approval of one 1.1 billion euro bitcoin investment plan. The Spanish coffee chain’s Vanadi Coffee Stock Surge reflects a growing investor’s confidence in the company’s Cryptocurrency assumption, despite the company’s ongoing financial challenges and also volatility for the Cryptocurrency market that many investors are facing right now.

Also read: JPMorgan launches a new stock market forecast model, shocking signal

Vanadi Coffee Bitcoin Treasury Plan Driver Stock Surge in the middle of the market volatility

The company has already purchased 54 BTC valued at approximately EUR 5.8 million, with assets kept in custody by BIT2ME Exchange. Vanadi Coffee Stock Surge shows how Cryptocurrency Market Volatility can create dramatic price movements when companies announce Bitcoin Treasury strategies and also show investors appetite for such traits.

Financial Strategy Shift Driving Bitcoin Investments

Chairman Salvador Martí leads this transformation of Vanadi Coffee Bitcoin Treasury Approach, and he tries to replicate successful models from companies as a strategy and also Metaplanet. Bitcoin Treasury plan represents a calculated response to increasing economic pressure and rising operating costs that have affected the business.

The company said:

Andrew BaileySenior Fellow at the Bitcoin Policy Institute, expressed skepticism about the strategy and had this to say:

“Most new” Bitcoin Treasury Companies “are Gimmicks and will probably fail. Although there are scale diskonomies that privilege new participants, a bad company will not be good just because it acquires sound money.”

Vanadi Coffee Stock Surge reflects a broader market enthusiasm for Bitcoin investment risks, although critics warn of the extent of the ambition in relation to the company’s sex places. The board members were authorized to increase capital by 50% and also negotiate convertible debt financing, which can potentially dilute existing shareholders while conducting the ambitious Cryptocurrency market volatility strategy.

Also read: The Meta plane issues 208 million bonds to buy more bitcoin

Despite economic struggles, Vanadi Coffee Bitcoin Treasury Plan places the company at the forefront of the company’s Cryptocurrency anticipation in Spain right now, although success remains uncertain considering the inherent bitcoin investment risks and also ongoing Cryptocurrency market volatility.