Key dealers

- Arizona Senat on Thursday adopted a bill to create a state -managed bitcoin and digital assets reserve fund for seized assets.

- The fund enables secure storage, sale or retaining digital assets and updates storage standards for blockchain -based assets.

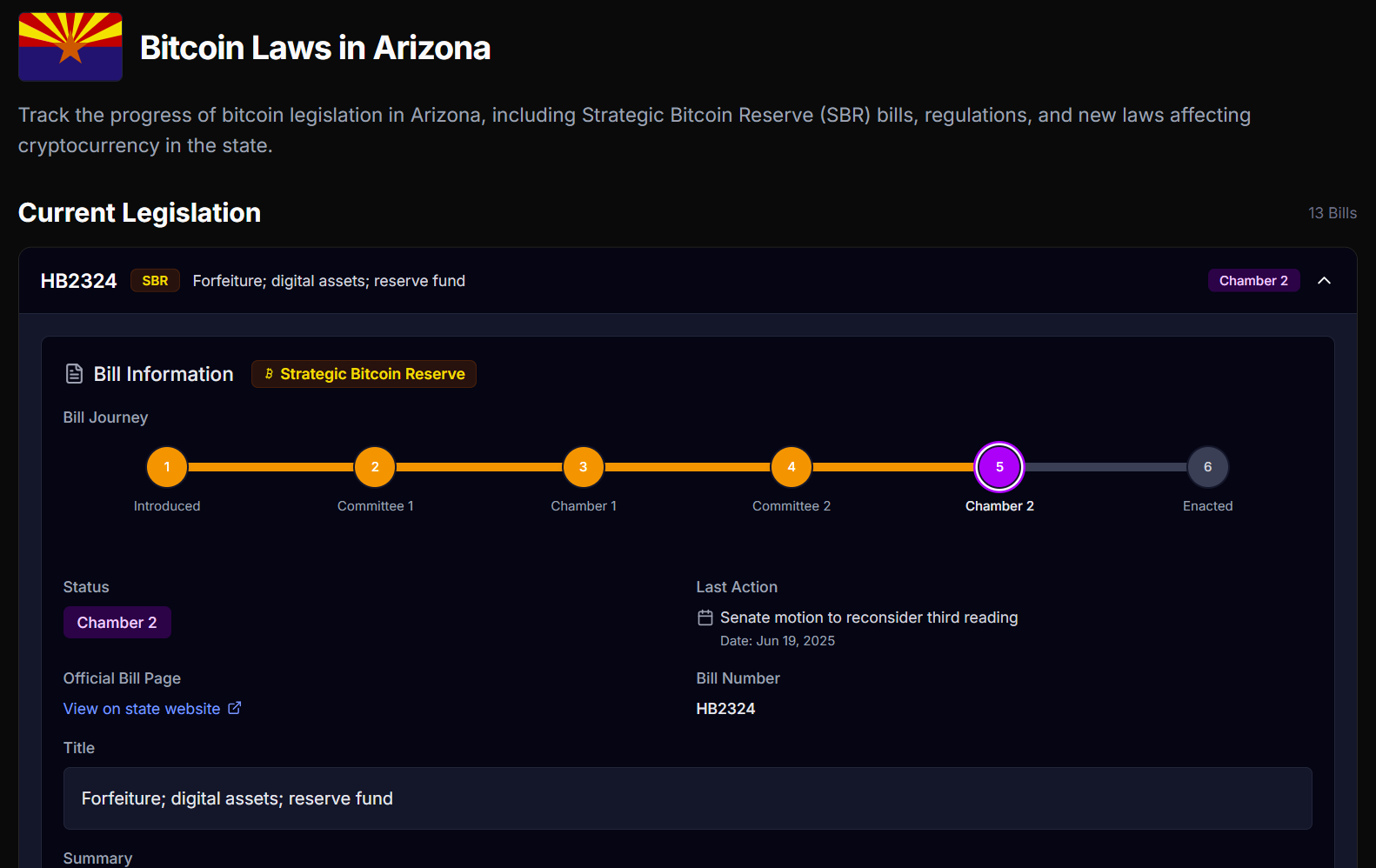

Arizona legislators revived and voted to promote the house Bill 2324 (HB2324), proposed legislation to create a state-managed fund for bitcoin and other digital assets seized through criminal loss, according to one Thursday update From Bitcoin laws.

HB2324 was introduced in the Arizona representative house in February and passed the Senate in early May. However, the house failed to approve the bill in its final vote, which effectively stopped its progress.

Through a series of procedure proposals to reconsider in both chambers, the bill was revived in mid -June, the Senate cleared in a narrow 16-14 vote on Thursday and is now in the chamber for a final vote.

HB2324 Trying to establish a bitcoin and digital assets reserve fund under the Swedish Treasury’s Surveillance. The fund would handle digital assets confiscated through criminal loss of assets.

The proposed legislation describes three options for managing seized digital assets, including storage in state approved digital wallets, sales through licensed crypto changes or in-depth form based on market and security factors.

The bill modifies Arizona loss laws to include digital assets and establishes modern custody standards, with blockchain-based access protocols and qualified third-party goods.

According to the proposed distribution structure, the first $ 300,000 from seized digital asset sales would go to the national lawyer’s office. Additional revenue would be shared, with 50% that go to the national lawyer, 25% to the state general fund and 25% to the new Bitcoin and Digital Assets Reserve Fund.

The legislation would make it possible to invest in fund assets in digital assets or crypto -etfs, with revenue returning to the state.

Several crypto bills were rejected in Arizona

Arizona has taken some significant measures against integrating digital assets into its financial infrastructure, but not without political friction.

On May 7, the state welcomed its first Bitcoin reserve proposal with the signing of House Bill 2749 (HB2749). The legislation establishes a state -managed Bitcoin and Digital Assets Reserve Fund, consisting of digital assets acquired through airdrops, investing rewards and interest.

HB2749 remains the first and only Bitcoin Reserve Bill Signed in team by governor Katie Hobbs to date.

Earlier the same month, hobbs VETOED Senate Bill 1025A proposal that would have approved government officials to invest up to 10% of the Treasury and pension assets in digital assets such as Bitcoin.

On May 12, she issued more veto, Reject Senate Bill 1373who tried to create a strategic reserve fund for digital assets and Senate Bill 1024, which would have enabled government agencies to accept crypto payments for taxes, fees, fines, rent and penalties.

Despite these, signed governor House Bill 2387, the on the same day and introduced consumer protection rules for cryptocios, commonly known as Krypto ATMs, operations in Arizona.