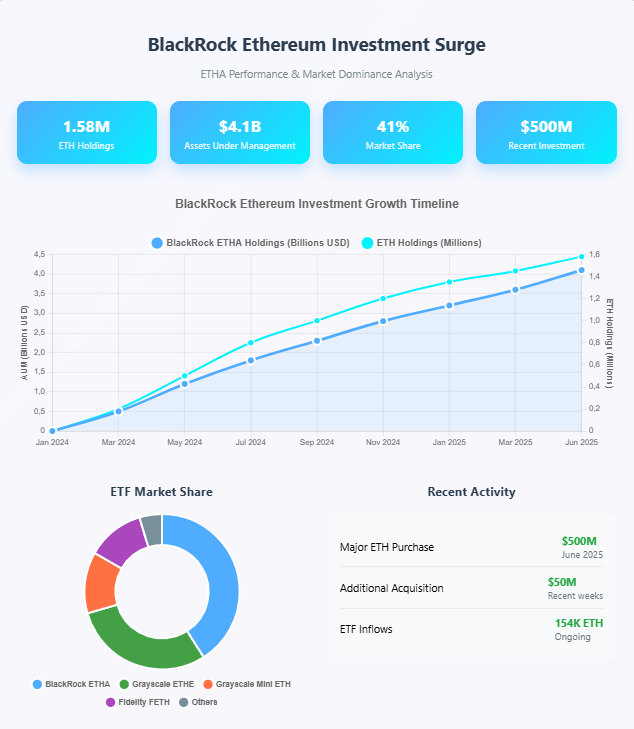

Ethereum’s Blackrock development shows massive institutional confidence as the world’s largest asset manager bought another $ 500 million in Ethereum during an 8% price correction. Blackrock’s strategic accumulation of Cryptocurrency positions shows how institutional investors utilize market vollatility, and the company added approximately 154,000 ETH to discover stock exchange trained funds. This Ethereum Blackrock moves signals growing confidence in Ethereum Price pre -starting models among large financial institutions and also highlights the increasing appetite for digital assets among traditional money managers.

Also read: Bitcoin ETF flows: Institutional money continues to pour in

Ethereums Blackrock Deal Signals Rising Institutional Crypto Trust

Larry Fink, CEO of Black Rock, pronounced:

“Ethereum’s role as a financial quality financial infrastructure is becoming clearer and we see a growing customer’s demand for tokenized assets.”

Strategic accumulation during market correction

Blackrock’s Ethereum Blackrock strategy shows sophisticated time when institutional investors recognize Ethereum’s resilience and potential. Cryptocurrency experienced a remarkable volatility, but still great players like Blackrock increased their positions rather than withdraw, and this pattern suggests that institutional investors see current prices as attractive entrance points right now.

Market consequences and technical analysis

Ethereum Blackrock movements coincide with Cryptocurrency that is approaching historical support zones, and this $ 2,200 level has historically provided a price floor during market corrections. Institutional investors operate on its items around these technical indicators and also seem to follow a playlist that has worked well in previous cycles.

The strategic buying behavior in this correction reflects former market cycles of Ethereum, because institutional purchases are characteristic followed by price tag and possible hilarious movement. Further funding from Blackrock further shows the idea that Ethereum will remain the basis for the new financial infrastructure, and in writing, other institutional investors move in a similar way.

According to market analysts, inflows up to 154,000 ETH to ETFs mean that there is deliberate accumulation of major players such as Blackrock among other institutional investors. The trend indicates increasing recognition of Ethereum as a platform behind tokenized asset systems and centralized applications, and shows that cryptocoirs will increasingly become massified in the world by conventional financial companies.

Also read: ETHEREUM PRICE PREGNING: What $ 2500 support means for bulls

Conclusion

The Ethereum Blackrock plan is also symptomatic for more general institutional awareness of Cryptocurrency as a legitimate investment category, and also with the uncertainty about its regulatory status and various technical issues, large financial institutions increase their digital participation. Even the active reaction to market vollatility proves the culture of institutional wisdom in the Cryptocurrency markets, and the second fund investment of $ 500 million in the company depicts additional security in the Ethereum scenario for price forecasts, which depends on more about the development of markets over time.

Right now, such an Ethereum Blackrock positioning shows both how institutional investors indexes significant cryptocurrency structures in such a market decline, and it also indicates that they believe that the current prices are attractive in accumulation strategies.