Key dealers

- Moscow Exchange launched Bitcoin Futures tied to Blackrock’s Ibit, available to qualified investors.

- The futures agreements are decided in Russian rubles and expire in September 2025.

Russia’s largest trading place, Moscow Exchange (Moex), has introduced future contracts on Blackrock’s Ishares Bitcoin Trust (Ibit) and offers regulated exposure to the world’s most prominent Bitcoin fund, the company said in June 4, June 4 press release.

In accordance with Russian law, only qualified investors can trade the contracts, which are quoted in US dollars and residents in Russian rubles. Instead of offering direct exposure to IBIT shares, the contract is structured as a derivative that reflects ETF’s price performance.

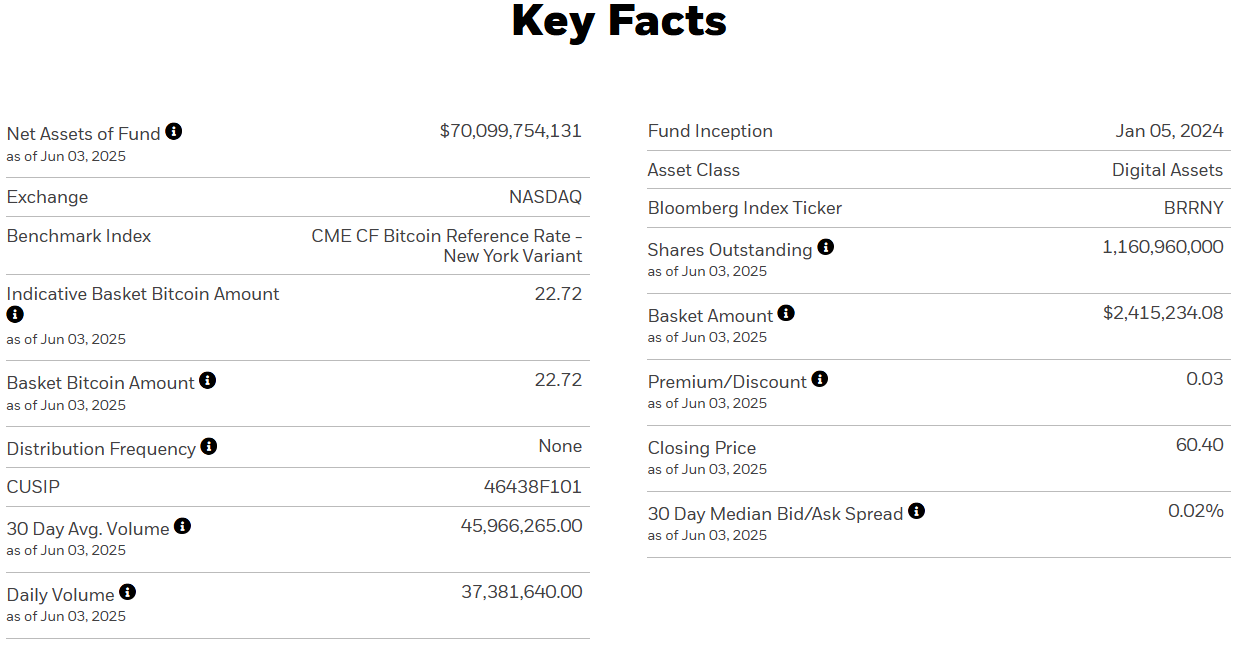

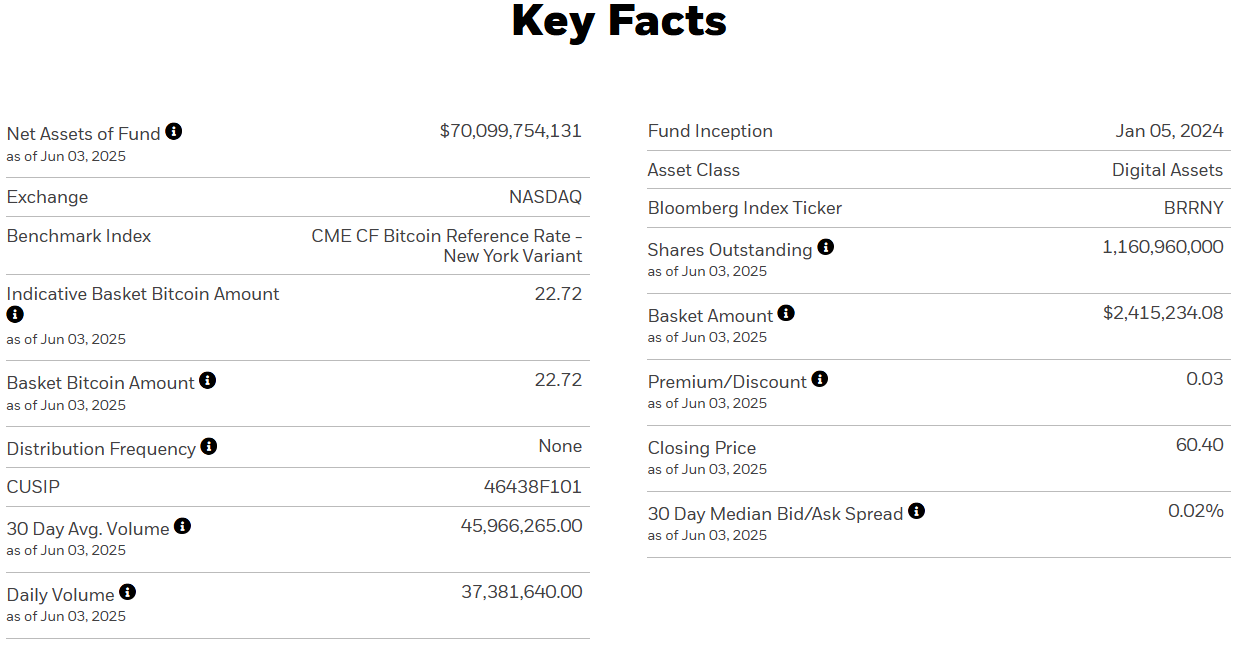

Ibit, which was launched in January 2024, has quickly climbed the Ranger for Global ETFs, now part of the 25 largest ETFs after assets, although it is barely over a year old, said Bloomberg ETF analyst Eric Balchunas in June 3, June 3 statement.

From June 3, Blackrock’s Bitcoin ETF surpassed $ 70 billion in assets under management, according to its official website. Data From Farside Investors show that Ibit has raised more than $ 48 billion in net inflows since its launch.

Bank of Russia authorizes banks to offer crypto products to accredited investors

The launch follows a series of positive development in Russia’s crypto landscape. Russia’s bank has recently Authorized financial institution To provide accredited investors with crypto investment products, including derivatives and digital financial assets.

Although these offers may not include the actual delivery of crypto assets, and the central bank continues to advise against direct investments in crypto, the decision signals a growing openness to regulated exposure.

Following the central bank’s announcement, T-Bank introduced Bitcoin-related investment options for accredited investors, activated by the tokenization platform Atomyze.

May 30 SBER, Russia’s largest bank, launched a new bitcoin-linked bond Product for qualified investors on the market without disk. The product tracks Bitcoin price in relation to the US exchange rate to dollars and is expected to be listed on the Moscow exchange.