Gamestop’s bitcoin purchase of $ 4,710 coins worth $ 512 million has catalyzed an important moment in the company’s Bitcoin assumption, and at the time of writing, this move continues to generate significant market attention. Gamestop’s Bitcoin Purchase Pettade led one of the largest Cryptocurrency investment by a traditional retailer, which also comes in the midst of increased crypto -market voltility and growing Bitcoin investment risks. This strategic movement by CEO Ryan Cohen has accelerated many significant discussions about share -price reaction when investors evaluate the consequences of Gamestop’s bold entry into digital assets.

Only in: Gamestop $ Gme Buying 4,710 bitcoin worth $ 512 million.

– watcher.guru (@watcherguru) May 28, 2025

Also read: Strategy misses BTC Rally when Saylor hides $ 14B reserves

How Gamestop’s bold bitcoin movement affects crypto, stock and risk

Strategic reasoning behind Gamestop’s Bitcoin Investment

Cohen’s attitude to the company’s Bitcoin adoption has been groundbreaking for a philosophy of putting the skin in the game over many significant business areas. The company has transformed one of the most disciplined turns in retail, and Cohen has designed intensity at the basic level on Gamestop and reduced the executive salary from $ 55 million to $ 2 million while refusing all compensation.

This Bitcoin investment risk strategy has optimized Cohen’s track record to make calculated investments with surplus capital, and this shows his commitment to long-term shareholder value through several important strategic developments.

Market volatility and risk assessment

Crypto Market Volatility around Gamestop’s announcement has established important problems for the company’s Bitcoin assumption over several important market segments, and this shows the challenges that companies face when allocating tax funds to digital assets through various major investment strategies. Bitcoin investment risks comprise significant price swings that directly affect companies’ balance sheets, even with Cryptocurrency that experiences several corrections this year alone with many significant market factors.

Financial basis that enables bold movements

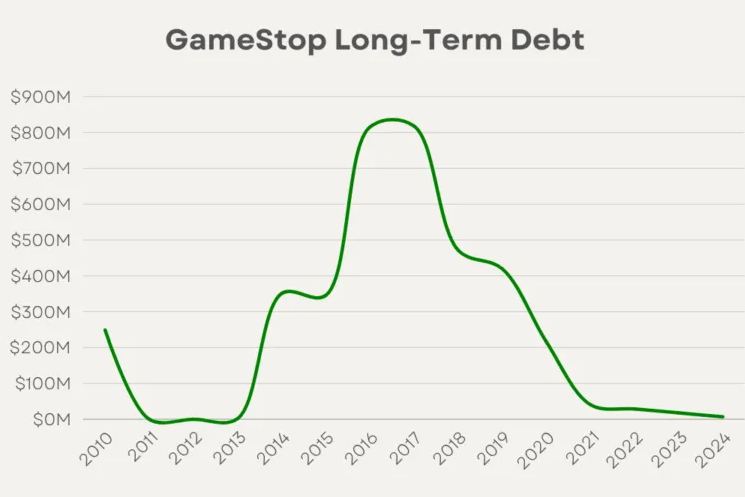

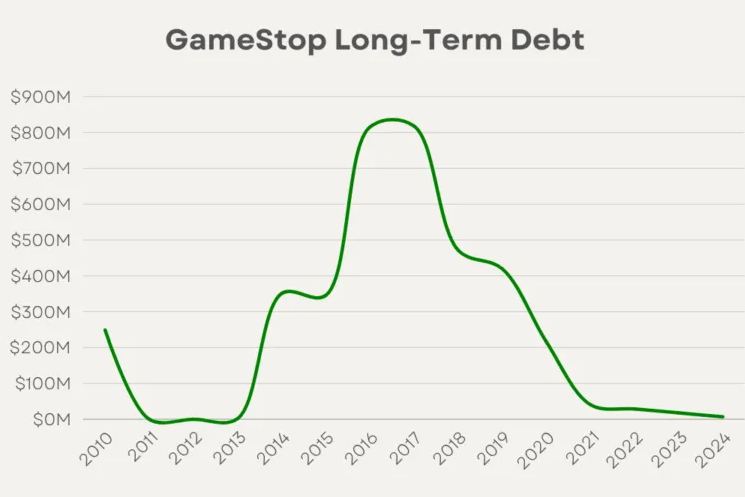

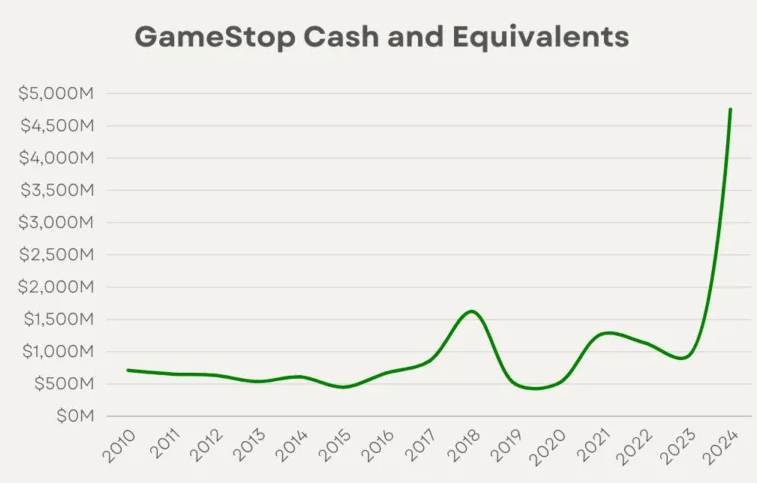

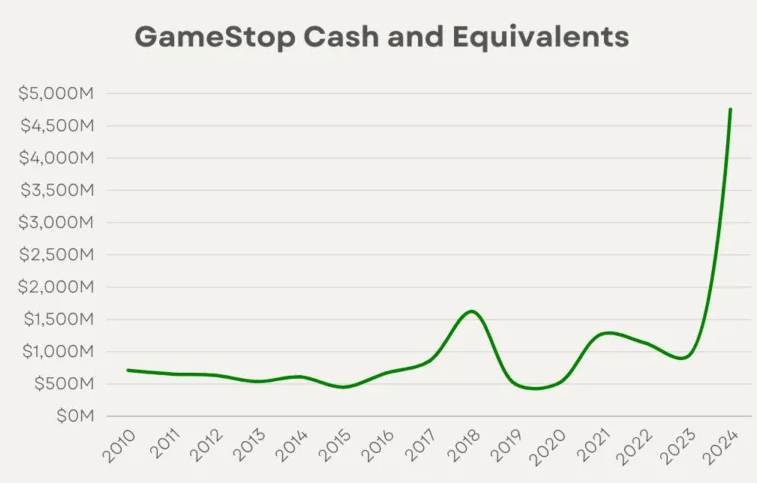

Cohen’s leadership has restructured Gamestop’s ability to carry out this bitcoin purchase through dramatic economic improvements, and several significant operational changes have architated the transformation. The company eliminated over $ 800 million in long-term debt while building massive cash reserves, which also created flexibility for strategic investments and bold features such as this bitcoin acquisition over many significant business areas.

This company’s bitcoin adoption strategy has maximized gamestop strengthened balance sheet, with bitcoin investment risks regulated by significant remaining cash reserves and zero debt obligations through various large financial restructuring initiatives. The company’s gross margins have been significantly optimized and operational losses have been dramatically reduced from previous years over several important performance indicators.

Broader consequences for retail and crypto

Gamestop’s Bitcoin purchase has established growing acceptance of Cryptocurrency as a legitimate Treasury among traditional retailers, and it can affect other companies to consider similar features through several significant strategic frameworks. This crypto -market vollatility tolerance of established companies has accelerated a broader company Bitcoin assumption in the retail sector involving many significant market developments.

Gamestop’s features have followed companies such as Tesla and Micro Strategy, but still differ because of the company’s unique financial position and transformation history of various large business segments. The stock price reaction is likely to affect other retailers who are considering similar Cryptocurrency investments, which also makes Gamestop’s results a careful case study for Bitcoin investment risks in the companies’ environments.

Also read: Bitcoin just got bigger: Block to start BTC payments on Square at the end of 2025