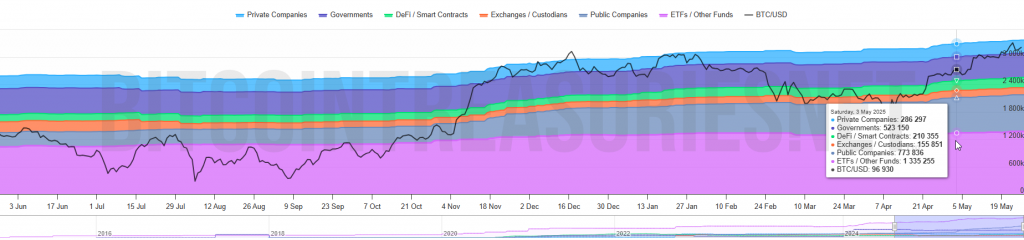

The Bitcoin Market Cap has reached one never before seen 2.3 trillion dollars milestone, and this makes it officially surpass both Amazon (AMZN) and Google (Google) To secure its position as the world’s fifth largest asset at Las Vegas Bitcoin 2025 Conference. This historical performance also shows BTC’s explosive adoption and varying investors’ feeling, with BTC prize pre -pregnancy models that really point to continued institutional Bitcoin accumulation. The Bitcoin Price Surge reflects some growing confidence in digital assets as legitimate value stores together with traditional technical giants.

Also read: 80% of Americans want bitcoin in national reserves over gold

Bitcoin Market Cap Soars: BTC Price Prediction & Institutional Adoption Insights

Historical Milestone

Caroline Bowler, CEO of BTC Markets, said:

“Today’s demand is driven by infrastructure for institutional quality and stronger regulatory clarity. Investors’ feeling has changed crucial and reflects assignments of institutional style.”

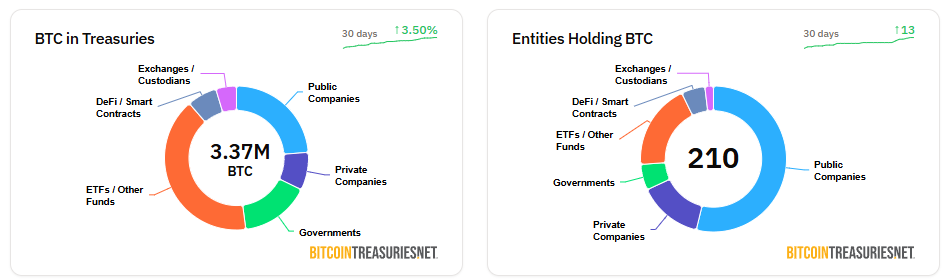

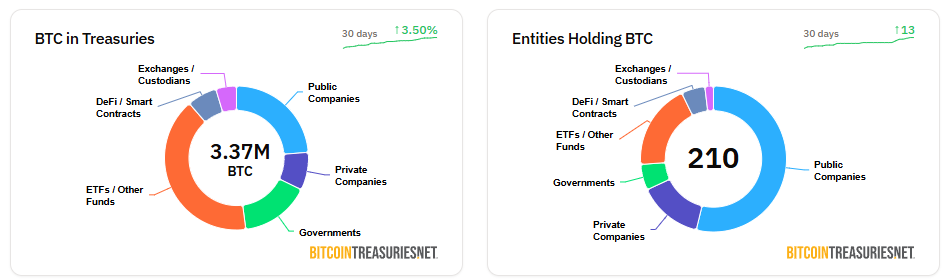

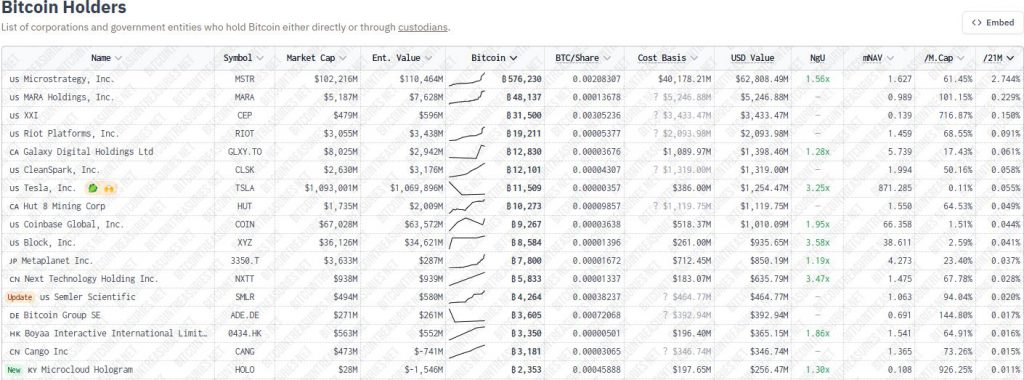

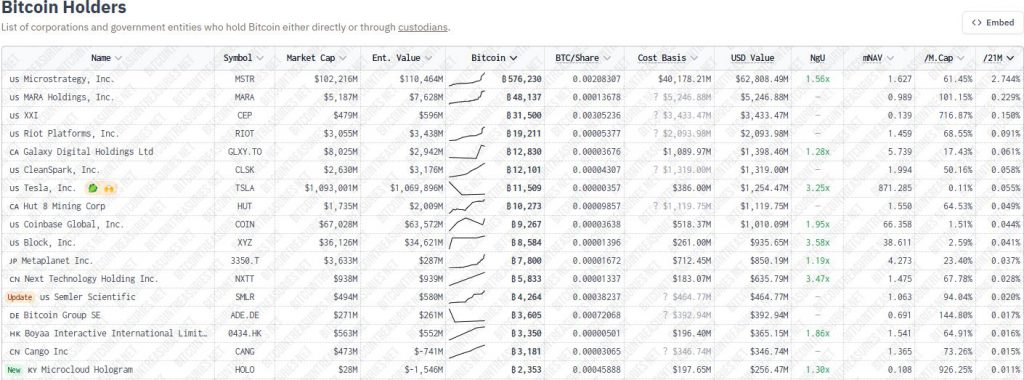

Institutional bitcoin demand drives growth

Ulli Spankowski, Chief Digital Officer at Boerse Stuttgart Group, noted:

“What was once considered a very speculative risk has evolved into a serious asset class.”

According to Geoff Kendrick, the standard chartered is sure that the price of bitcoin can increase to $ 500,000 before Trump’s four -year presidential period ends. Growing confidence among institutions and stable regulation plays a major role in predicting that more people will adopt Bitcoin.

Also read: Florida proposes 0% capital gains tax on bitcoin, XRP and shares