Ethereum (ETH) underwent a lot of bashing because of its stationary price. The asset was seen moving slowly in recent years. The world’s largest altcoin hit a maximum of $ 4,891.70 about four years ago. Access has failed to regain this peak since then. Despite a growth rate of 90313.41% since its launch in 2015, ETH has failed to make great sound. But investors could be looking for a treatment because the network registered increased haus activities.

Also read: PLTR: Palantir Falls 3% at $ 178 million Army AI store, Bofa Eyes $150

Ethereum kicks its haus phase?

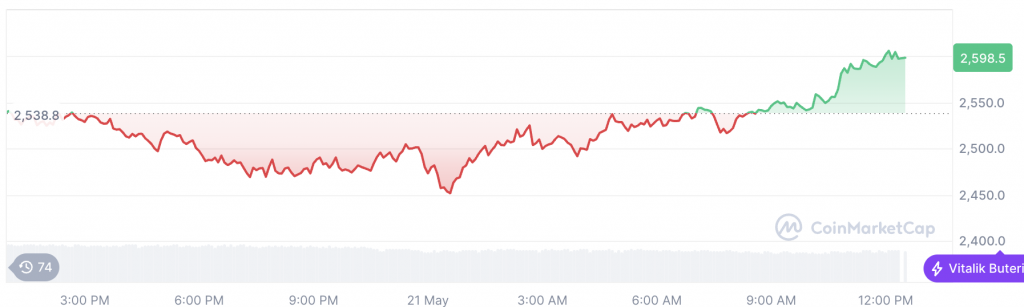

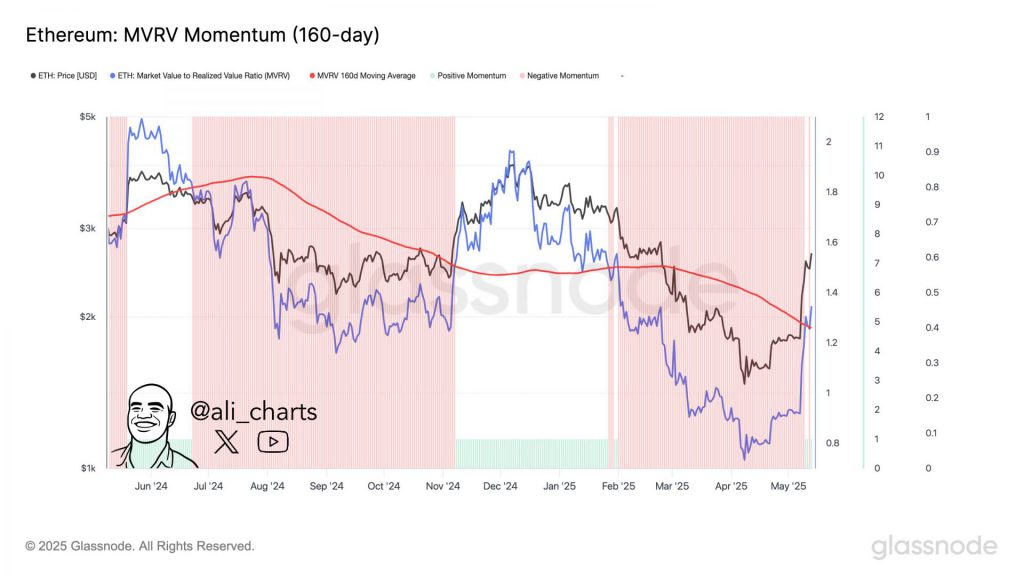

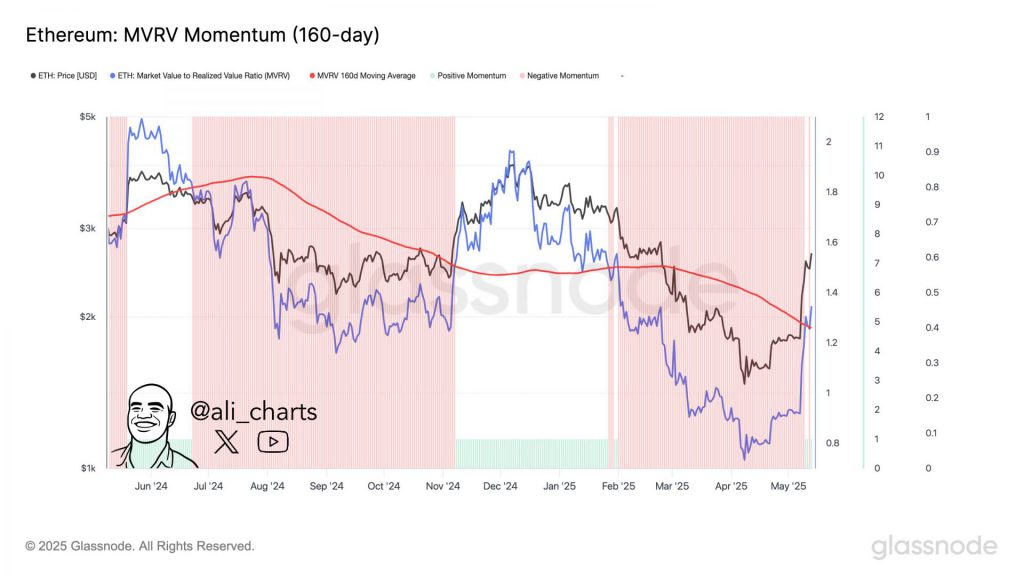

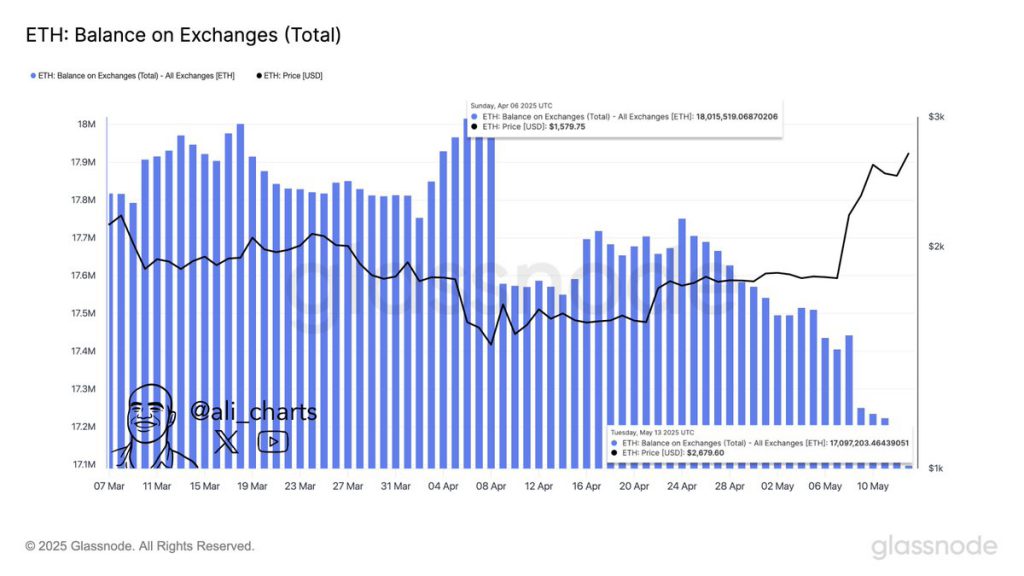

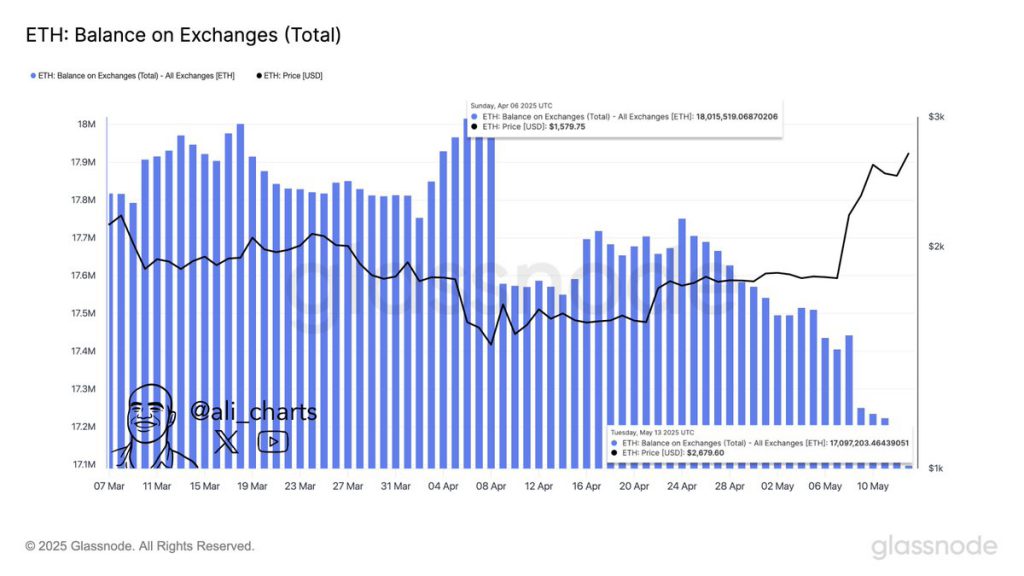

May has been quite eventful for the second largest Cryptocurrency. Ethereum network witnessed a massive change in the trend. A thread on X by analyst Ali Martinez illustrates how Ethereum moved past his recovery phase.

Also read: 71% say bitcoin will regain their peak at May end, are they right?

According to reports, Altcoin has changed from being baisse -like to Hausse, starting with the MVRV relationship. Martinez noted that this is a clear indication that the Ethereum bulls are now getting pace.

Finally, it was lit that about 1 million eth was withdrawn from exchanges. This took place in the last month. According to reports, this is a haus -like sign as it reduces sales pressure on the network.

In the middle of this, Blackrock made a massive buy of $ 45 million in Ethereum. This highlights the increasing institutional interest in Altcoin. All of these above signs point to a hooked drive for the second largest coin. While $ 3,000 can be a prominent milestone for access, society is investing in ETH recovering its peak.