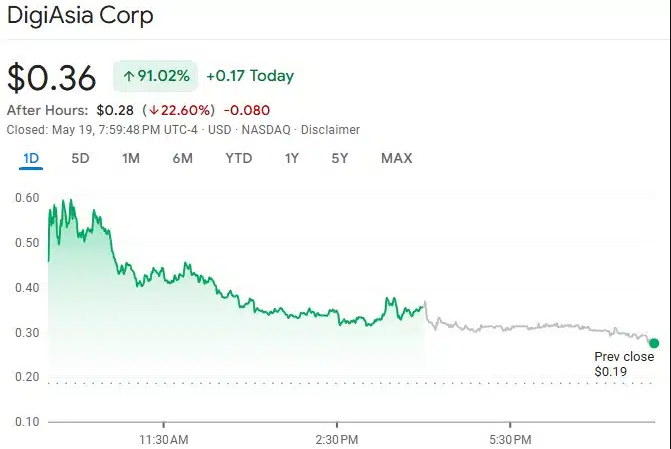

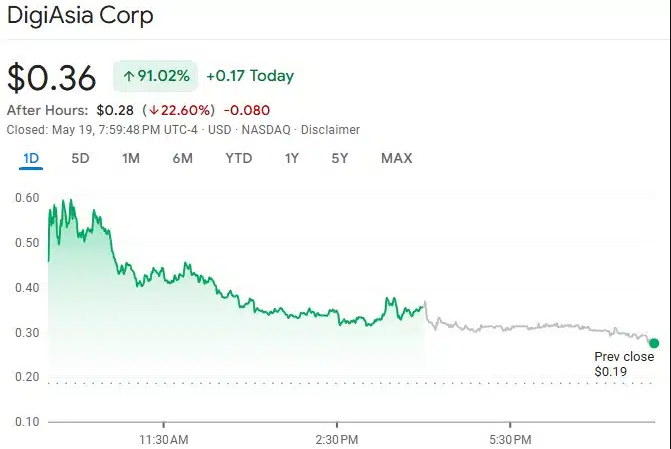

Digiasia’s Bitcoin investment plans have recently sent shock waves through the financial markets when the company announced a bitcoin acquisition strategy of $ 100 million. This bold feature comes at a time when the volatility in Cryptocurrency Market continues to challenge investors and has also resulted in an impressive 91% stock surveillance for the FAAS chic, which is quite remarkable by most standards.

Also read: MSTR -OBOnglas as strategy bags 7 390 BTC, faces the lawsuit, $ 1,800 target in view

How Digiasia’s $ 100 Million Bitcoin Movement handles volatility, price and regulations

The markets show some confidence

Equity over voltage after Digiasia’s bitcoin investment message really shows a strong marketing believer right now. FAAS shares experienced one of the most dramatic price movements related to the companies’ Cryptocurrency adaptation this year, and this is done in the midst of broader Cryptocurrency market vollatility that has affected many similar assets.

Martin Ruiz, Digiasia Representative, pronounced:

“The company launches this strategic path to improve its services through a 20% investment of available assets in Cryptocurrency.”

Also read: De-Dollarization: China gets $ 17 billion in capital when the US decreases

Strategic Bitcoin Prize Timing

Digiasia’s Bitcoin Investment Timing comes at a point when the Bitcoin prize pretext remains greatly discussed among analysts and financial experts. Cryptocurrency has shown typical market volatility in recent weeks, which reflects broader financial uncertainties and various market factors.

Market analyst Richard Thompson had this to say:

“This acquisition represents a large milestone in the Cryptocurrency space because the stock supervision indicates that the shareholders have a positive view of Digiasia’s long-term strategy.”

The planned allocation of $ 100 million will be implemented through a structured acquisition program to optimize entry prices in the midst of sustained legislative security and changed market conditions.

To deal with regulatory issues

Part of the Digiasia strategy in Bitcoin is to ensure that they remain informed of the changing regulations. The rules that the company sets help it to comply with regulations in all business places, as the sector continues to face uncertainty.

Economic compliance expert Jessica Wu noted: “Digiasia will start its planned Bitcoin acquisition strategy during the next financial quarter, which can potentially position them as an important player in the Cryptocurrency area if market conditions remain favorable.”

Also read: Historical crypto count moved forward by 66 senators in shifts

The approach includes a dedicated digital asset committee and also improved security protocols, which shows how serious companies can approach Bitcoin Price pre -premises trends responsibly in today’s environment.

Long -term investment prospects

By registering with Digiasia, these companies recognize the fact that Cryptocurrency can be used perfectly as a potential asset for their treasury. With the increase in the share price, some other listed companies were able to start exploring these strategies, while ignoring the volatility in the crypto market which has been a concern for many major investors lately.

With this action, Digiasia has a strong presence in the industry, while using Bitcoin’s functions and follows regulations through solid plans.