In recent weeks, Blackrock Bitcoin ETF has attracted over $ 1 billion from institutional investments, with major players such as Abu Dhabi’s superb wealth fund and also several Hong Kong -Investors who dramatically increase their Bitcoin ETF -holding. At the time of writing, the Cryptocurrency has responded quite positively to these significant ETF inflows, which highlight the growing institutional confidence in digital assets.

Also read: Apple Stock (AAPL) hits $ 211 when Trump tells Tim Cook, “No Building in India”

Blackrock Bitcoin ETF grows with growing bitcoin ETF holding and institutional investments

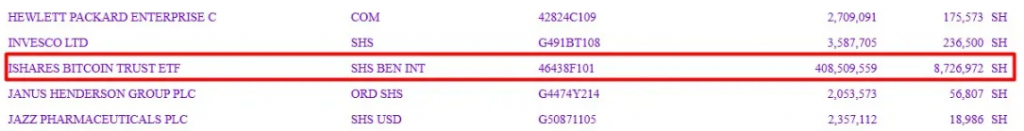

Abu Dhabi’s Bitcoin position of $ 408 million

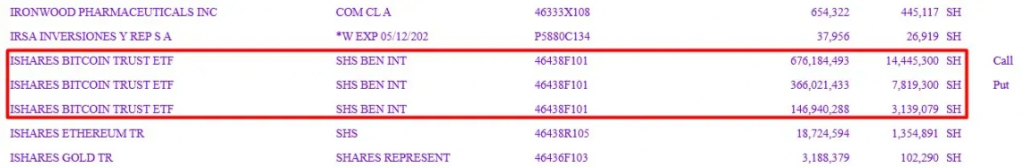

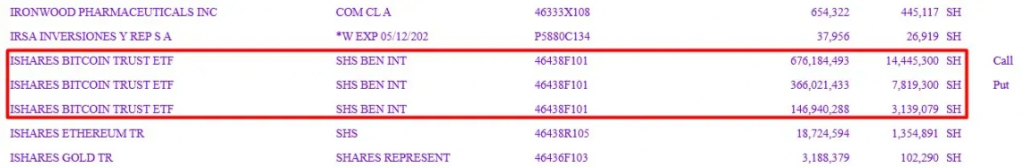

In a 13F submitted today, Mubadala, Abu Dhabi Sovereign Wealth Fund, revealed to own 8,726,972 shares in IBIT from March 31, valued at $ 408.5 million.

This is an increase from 8,235,533 shares previously reported on December 31.

This is an important.

File: …

– Macroscope (@macroscope17) May 15, 2025

Macroscope, a financial analyst that closely complies with Cryptocurrency investments, pronounced:

“This is an important.”

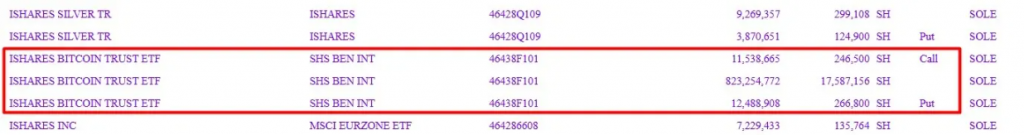

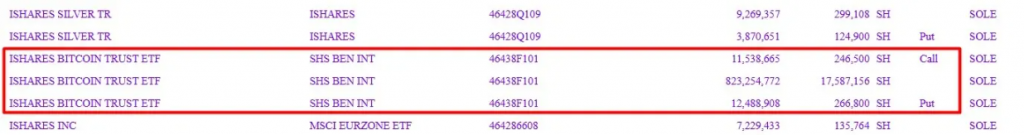

Hong Kong company adds huge investments

In recent applications, a securities company Hong Kong has also increased its Blackrock Bitcoin ETF holding to approximately $ 688 million, which shows the truly global appeal of institutional Cryptocurrency investments in today’s financial landscape.

Record breaking ETF inflows

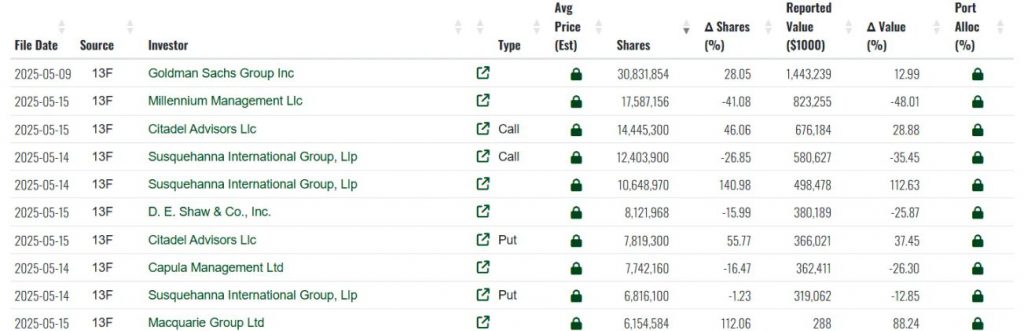

Blackrock Bitcoin ETF recently registered, about $ 232.46 million in net inflows on May 14 alone, which contributed to a total Cryptocurrency market inflow of approximately $ 319.12 million on the special trading day.

5/14 Bitcoin ETF Total Net Flow: $ 319.12 million$ 4 (Blackrock): $ 232.46 million$ FBTC (Fidelity): $ 36.13 million$ Bitb (Bit by bit): $ 2.82 million$ Arkb (Ark Invest): $ 5.16 million$ BTCO (Investco): $ 0.00 million$ Ezbc (Franklin): $ 0.00 million$ Brrr (Valkyrie): $ 0.00 million … https://t.co/hxsr8lzzs8 pic.twitter.com/zg3qlyuxhr

– Trader T (@ThePfund) May 15, 2025

Candert, an analyst who regularly tracks ETF flows, reported:

“5/14 Bitcoin ETF Total Net Flow: $ 319.12 million

$ Ibit (Blackrock): $ 232.46 million ”

Performance reflects the market’s trust

Blackrock Bitcoin ETF has currently delivered some fairly impressive returns with about 22.89% recent profit and net assets that reach about $ 56.5 billion, despite the typical and ongoing Cryptocurrency market vollatility problems that many investors still have.

Also read: Shiba Inu Price Presence: How $ 10K could 3.5x and make you a choice in 2027