Peter Schiff’s Saylor warning has intensified when Bitcoin Price Dip problems continue to mount among investors and analysts right now. The pronounced Gold advocate has issued a fairly sharp caution in terms of Michael Saylor’s Bitcoin strategy, and also emphasized some serious crypto market risks that could achieve if prices should fall under the critical $ 70K threshold that many traders look carefully.

Also read: Musk’s Doge disaster: How $ 1k in Dogecoin (Doge) got rect

Crypto market risks rise when bitcoin faces another potential crash

Schiff’s warning tasks

Peter Schiff has specifically directed Michael Saylor’s Bitcoin accumulation strategy in its latest criticism of digital asset. Micro Strategy’s fairly extensive holding has created significant exposure to all Bitcoin price dips, and this has had renewed crypto market risks discussions between financial experts.

This Peter Schiff Saylor warning arose when Bitcoin showed some regarding signs of instability after its latest heights, with several technical indicators suggesting potential further disadvantages in the near future.

Micro strategy vulnerability

Under Saylor’s leadership, Micro Strategy has actually become one of the largest companies’ bitcoin holders, making it particularly vulnerable to all sudden Bitcoin Price Dip. The company’s aggressive strategy seems to lack adequate risk management protocols according to several critics and analysts.

Also read: Wonderfi will be acquired for $ 250 million as Robinhood Eyes Global Crypto Domination

Market indicators

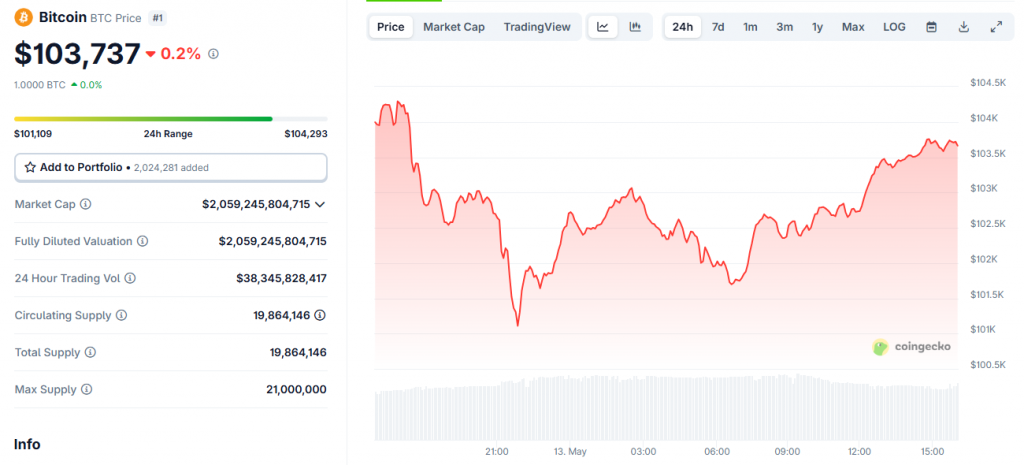

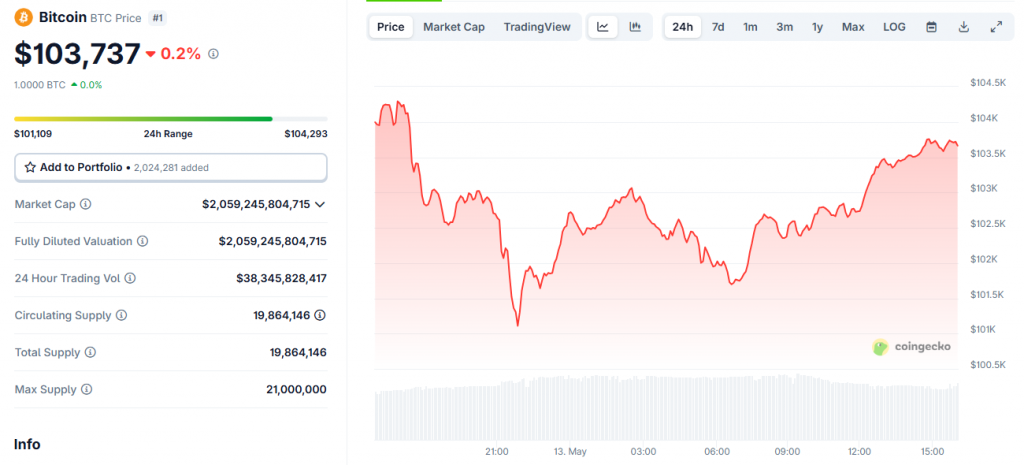

New market data shows that Bitcoin’s price measure is becoming increasingly volatile and unpredictable. Traders have repeatedly tested several important resistance levels in the latest sessions, while Momentum fighters over certain important thresholds add additional weight to the experts’ assessments of crypto market risks.

Michael Saylor’s Bitcoin acquisition method has continued despite these warning signs, with micro strategy that apparently increased to its holdings even when prices have fluctuated considerably.

Wider market consequences

The ongoing tension between Schiff and Saylor essentially represents the broader debate on Cryptocurrency’s uncertain future. The specific focus on the price point for $ 70,000 also highlights both technical and psychological importance in potential Bitcoin price scenarios that can be developed.

Investment reactions

The market response at Peter Schiff Saylor -the warning has been quite mixed at this time. Some passionate Bitcoin supporters have simply dismissed the comments as another attempt to discredit Cryptocurrency, while others recognize the inherent crypto market risks in such an aggressive acquisition strategy as Saylor.

Expert perspective

The market’s reaction to Peter Schiff Saylor’s warning has so far been quite mixed. Some of the burning bitcoin advocates have just brushed the comments as another trick to bring down cryptocurrency, while others admit the underlying crypto market’s dangers in such a fiery buying company to happen.

Also read: Bitcoin: Who dumps and who buys BTC?

Financial analysts who do not directly adapt to any of the figures point out that while the headwind definitely challenges Michael Saylor’s Bitcoin strategy, many other factors in addition to just the $ 70,000 mark will determine Bitcoin’s medium-sized performance.