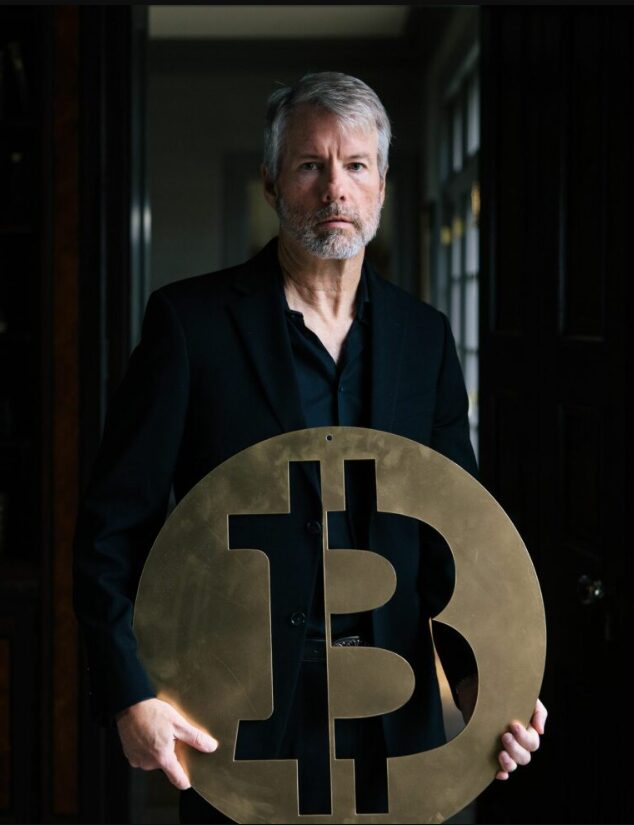

Michael Saylor Bitcoin purchases have recently sent shock waves through the crypto world when his company adds another massive piece to his Bitcoin Treasury. Business Intelligence Firm’s latest acquisition, which was completed just a few days ago, reinforces its position as the largest business owner in Bitcoin and also shows the company’s ongoing commitment to this alternative asset class.

Just in: Michael Saylor’s ‘Strategy’ buys 13 390 Bitcoin worth $ 1.34 billion.

– watcher.guru (@watcherguru) May 12, 2025

Micro Strategy, which is often called “strategy” today, announced another Michael Saylor Bitcoin purchasing strategy via social media on May 12, 2025, and the news has quickly spread over financial circles.

“Strategy has accepted 13,390 BTC for ~ $ 1.34 Billion at ~ $ 99,856 per bitcoin and has achieved btc yield of 15.5% surface 2025. As of 5/11/2025, we hodl 568,844 $ BTC ACQUIRA $ 39 bitcoin. ”

Also read: JP Morgan predicts $ 6000 gold price if this key as US assets changes develops

How institutional crypto purchases is to form bitcoin strategy today

This latest Michael Saylor Bitcoin purchase was in fact carried out at an average price of about $ 99,856 per bitcoin, which is significantly higher than their total average acquisition price. Despite some ongoing marketing problems, Micro Strategy Bitcoin Investment Strategy remains at the time of writing, aggressive and steadfast and shows no signs of slowing down at any time.

Strategy has acquired $ 13,390 BTC for ~ $ 1.34 billion to ~ $ 99,856 per bitcoin and has reached BTC exchange of 15.5% YTD 2025. From 5/11/2025, we Hodl 568,840 $ BTC Acquired for ~ $ 39.41 billion to ~ $ 69,287 per bitcoin. $ mstrers $ Strk $ STLF https://t.co/osxrmwitku

– Michael Saylor (@Saylor) May 12, 2025

The technology company now holds, quite impressive, an astonishing 568,840 BTC in total, after acquiring them for about $ 39.41 billion at an average price of $ 69,287 per bitcoin. This persistent accumulation of Bitcoins, led by Michael Saylor’s purchase strategy, which has been going on for several years now, reflects the growing institutional crypto purchase trends and also the generally positive cryptom marketing entry we see 2025.

Micro Strategy Bitcoin Holdings has grown significantly since the company first began converting its Treasury reserves to Bitcoin as early as 2020. The company’s Bitcoin Investment Strategy, largely attributed to Michael Saylor’s purchase decision, has essentially transformed it from a conventional company company for a traditional investor for a traditional investor Conventional company’s software companies to a de facto bitcoin proxy for traditional investors, and many marketing is to look at this conventional company.

Also read: Trump Eyes $ 1 trillion Saudi Mega-Deal, cutting Netanyahu bands when peace calls stop

This latest acquisition of Michael Saylor Bitcoin purchasing strategy again shows his continued confidence in Cryptocurrency as both a Treasury Reserve access and an inflation hedge. As institutional crypto purchases profit moment right now in the market, the bold approach of the micro strategy continues to influence broader crypto market terms among the companies’ government funds all over the world, and many wonder who can follow this path the next.