Digital wallets If the most popular platform for cross -border transactions and stands for twice as many respondents as the second best option, a new report has revealed.

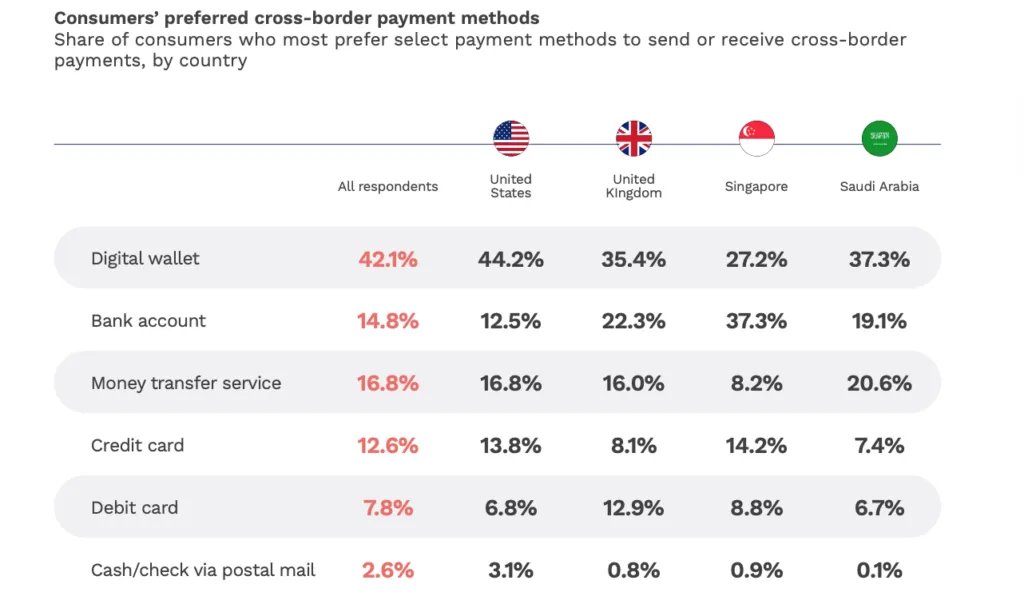

A survey conducted by pymnts and terrapay Funs that consumers are 2.5 times more likely to choose digital wallets as their best choice for cross -border transactions than money transfer services and bank accounts respectively. Overall, 4 out of 10 consumers prefer digital wallets, with the United States leading to 44%.

Of the countries surveyed, Singapore was outlier, by 37% chose bank accounts while 27% chose digital Wallets.

Cross -border payments are a gigantic industry. A report Funs That 2024, non-holy payments hit $ 40 trillion, with B2B payments that account for the most. Consumer-to-consumer payments hit $ 2 trillion and are expected to grow by 58% in 2032 to hit $ 3.1 trillion.

However, the market is still suffering from slow, costly and inaccessible channels, especially for consumers in developing countries.

While consumers regretted all these obstacles, speed was the most often cited challenge. This has driven more consumers to explore digital wallets, which are faster than traditional channels. 16% of the respondents quoted “payments are faster” because the main reason they chose digital wallets, with simpler use, reliability and wide acceptance and each gets 10%.

This need for speed is a universal demand, including in the Blockchain world. Network like BTC and EthereumStill caught in the advance limit where a handful of transactions per second was good enough, has been a primary obstacle to the mainstream blockchain assumption. BSV, on the other hand, continues to scale and with Teranode upgradeThe network will meet the ever -rising demands in payments, artificial intelligence (AI), social media and thereafter.

The report further emphasized the ongoing battle between traditional financing and fintechs in cross -border payments. It found that in the United States only 49% of banks allow consumers to send and receive cross -border payments via digital wallets. 98% enable transfers of bank account. It is similar in the UK, where only 58% of banks support digital wallet transfers, while 92% support ACH-same day.

The banks’ most quoted challenge was that digital wallets are “too complicated to use”, with high costs and poor security like the other common challenges.

Watch: Rockwallet is the go-to app for all

https://www.youtube.com/watch?v=bvrjhjoqlbg Title = “Youtube video player” Ramborder = “0” Allow = “Accelerometer; Autoplay; Clipboard Writing; Encrypted Media; Gyroscope; Image-in-Bild; Web Dividend” Reference Policy = “Strict-Origin-When-Cross-Origin” Allowing Lorscreen = “>”