After reaching a three -month altitude of $ 103,800 on Friday, May 9, the price of Bitcoin had a slow start to the weekend before resuming his driving against $ 014,000. While the main Cryptocurrency continues to stay over $ 100,000 brands, the market operators appear to be Trust the coin to play for fresh heights in the coming weeks.

Interestingly, the Bitcoin miners, which have become increasingly reactionary since the fourth halving in 2024, seem to have renewed the confidence in the price of BTC. The latest information on the chain shows that the miners have adhered to their assets in recent weeks and coincide with the coin’s latest price collection.

Prepare Bitcoin miners for an extended rally?

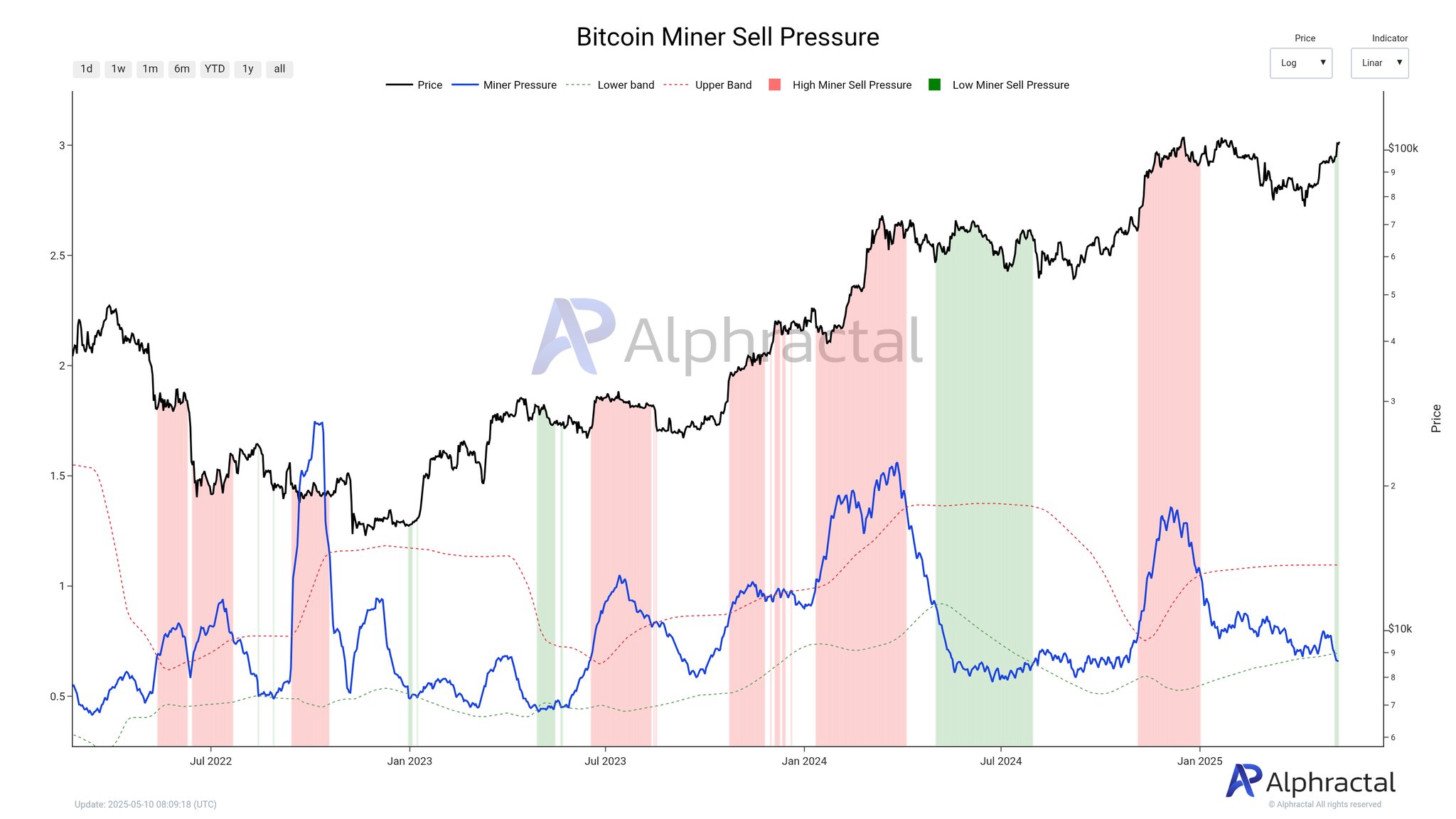

In a May 10 post on X, Crypto Analytics Platform Alphractal revealed That Bitcoin miners become less active in the market and collect their mining rewards rather than sell them for profit. The relevant indicator here is the miner’s sales pressure, which measures the sales force for Bitcoin miners for a certain period.

This metric compares the total BTC outflows from miners over the past 30 days with the average amount of coins in their reserves within the same period. The mining indicator provides valuable insight into the behavior and feeling for a relevant group of network participants.

In the marked chart, the red color represents high sales pressure among these Bitcoin miners and is often correlated with a sluggish market condition. The green color, on the other hand, reflects a low mining pressure, which can be a positive sign for the price of bitcoin.

Source: @Alphractal on X

As shown in the diagram above, the miner’s pressure metric into the red territory when the mining pressure moving mean (blue line) crosses above the upper band (red line) – signaling Intense baiss pressure from miners. At the same time, the mining pressure crosses under the lower band (green line), which suggests low sales pressure from miners.

According to data provided by Alphractal, the mining pressure line crossed the lower band recently, which indicates that the network mines have stuck to their coins in recent weeks. The analysis company on the chain added that this metric is at its lowest level since 2024, as miners seem to wait for the Bitcoin price to require fresh heights.

While Bitcoin Market has something matured So that the miners’ sales do not have very significant impact on prices, a longer period of low sales pressure from network participants can of course be Hausse for the foremost Cryptocurrency. However, Alphractal noted that the market can see renewed sales rate when prices will be moved in the coming weeks.

Bitcoin price

From this writing, the price of BTC amounts to approximately $ 104,250, which reflects an over 1% increase over the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Image from iStock, chart from tradingview

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.