Key dealers

- Michael Saylor advises Microsoft to buy bitcoin instead of bonds to increase the shareholder’s value.

- Saylor claims that Bitcoin surpassed Microsoft’s warehouse and suggests it as the 21st century money.

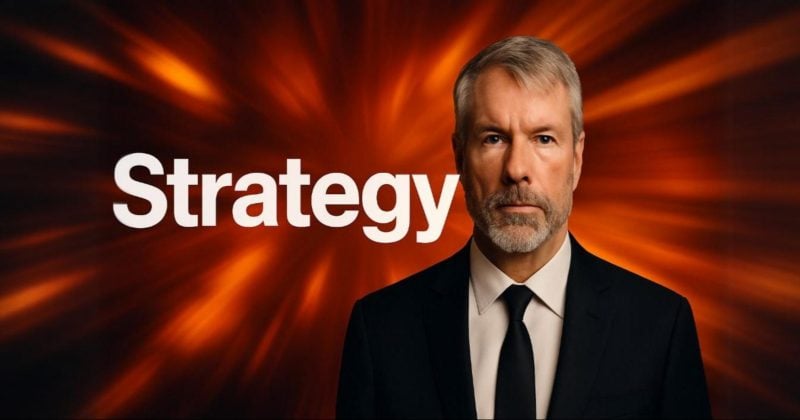

The President of the Strategy Michael Saylor has urged Microsoft to abandon bonds and repurchases of shares in favor of assuming bitcoin and claiming that it would create more shareholder value while decreasing the company risk.

“Microsoft should be driven by digital capital,” Saylor on Strategy world 2025The company’s annual flagship conference. “Bitcoin is the highest performing uncorrected asset.”

Bitcoin has dramatically exceeded Microsoft’s warehouse (MSFT) over the past five years. According to Tradingview dataBitcoin has delivered an average annual return of 53%, compared with about 6% for Microsoft.

During the five -year period, Bitcoin is up more than 950%, while Microsoft has won about 148%.

He criticized Microsoft’s current financial strategy and claimed that, instead of reinvesting in high -performance assets such as Bitcoin, the company uses its huge cash flow for repurchasing shares, dividends and low -return bonds.

As a result, Microsoft’s equity becomes weaker collateral, less attractive to investors and less useful, according to Saylor.

He said that the company is leaving more vulnerable to market volatility and competitiveness. Shareholders, he warned, is exposed to increase the long -term risk while the company loses flexibility to adapt.

“Buying Bitcoin would be 10 times better than buying your own warehouse,” Saylor said. He claimed that “bonds are toxic” and to buy back stock “destroy 97% of your capital for 10 years.”

Saylor repeated that Microsoft, after returning over $ 200 billion to shareholders over the past five years, is effective surrender capital that could Increase the value of the company with up to $ 5 trillion if redirected to bitcoin.

“Bitcoin … appeared as the alternative to bonds in 2024. That was the point where Sec approved Bitcoin ETFs,” he added. “It was a little year zero. We are now in year one.”

Saylor said that Gold was the best idea of the 1800s, Treasury and government debt defined the 1900s, but now in the 2000s it is the Bitcoin era. Bitcoin is a liquid, fungal capital asset and acts as a modern alternative to bonds, he added.

“Bitcoin is the universal, eternal, profitable fusion partner,” said Saylor, describing it as an investment opportunity that is “dirt cheap, one -off revenue that grows 30% to 60% per year.”

Saylor had before Trusted Bitcoin Investment Idea Directly to Microsoft’s Board of Directors. In a three -minute presentation supported by 44 images, he urged the company to move its capital strategy by redirecting cash flows, dividends, repurchases and even debt against bitcoin.

In spite of his efforts in the end voted against A related proposal from the National Center for Public Policy Research, which required the allocation of 1% of the company’s cash and turnover securities to Bitcoin as inflation.

The rejection was Not entirely expectedGiven that Microsoft’s Board of Directors had recommended a vote against the proposal after a comprehensive review of its investment strategy.