Blackrock’s Ibit Bitcoin (BTC) ETF has been on a buying spree since the end of April. According to Farsidge Investors, the world’s largest asset manager has purchased BTC $ 1.5 billion since May 1. Blackrock has bought a total of $ 4.45 billion in the asset since April 21.

Also read: Buffett selects this foreign currency over the US Dollar to finance 5 major investments

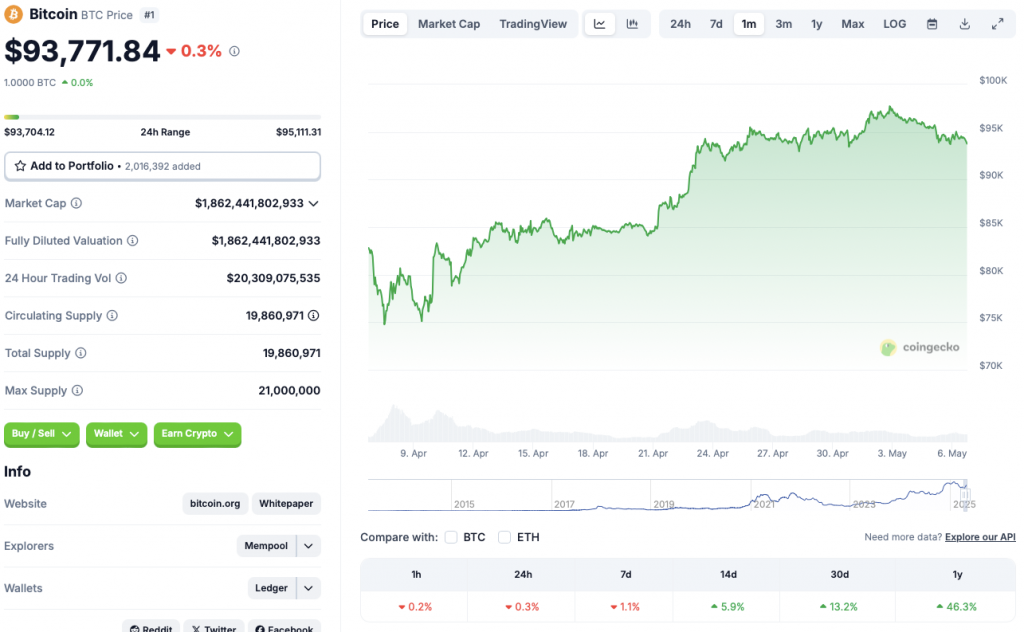

Bitcoin is facing correction despite Blackrock’s big purchases

Also read: De-dollarization: Why 2025 could be the year the dollar loses its global dominance

The recent market resuscitation was probably due to an increase in institutional investments. Retail investors have probably not participated much in rally.

Bitcoin’s latest dip may be due to Florida withdrawing two of its crypto reserve counts. The move came as a setback to crypto advocates and investors.

Will the asset gather soon?

Also read: Vechain on the way to past Trump -coin: Here’s when

A peak in retail investors can also drive BTC past the $ 97,000 mark. The original Krypton can recover $ 100,000 if it breaks its current resistance level. Breaking $ 100,000 can push BTC to a new highest time. The asset is currently down by 13.7% from its top of $ 108,786.