Power Law predicts $ 200K Bitcoin at the end of 2025 because Cryptocurrency has actually recycled its mathematical trend line. Bitcoin’s last 11% each week to approximately $ 95,000 are adapted to different models that at the time of writing forecasts prices between $ 130,000 and $ 200,000. This Bitcoin price pre -preparation for 2025 seems to gain traction as BTC price forecasting models receive more attention from analysts that also track wider cryptom market trends.

Also read: Yuan hits 7,30061 against US Dollar today: What is the change in the FX market?

Bitcoin Price Presence for 2025: Will BTC hit $ 150K or reach $ 200,000?

Power Law shows the way to $ 200,000

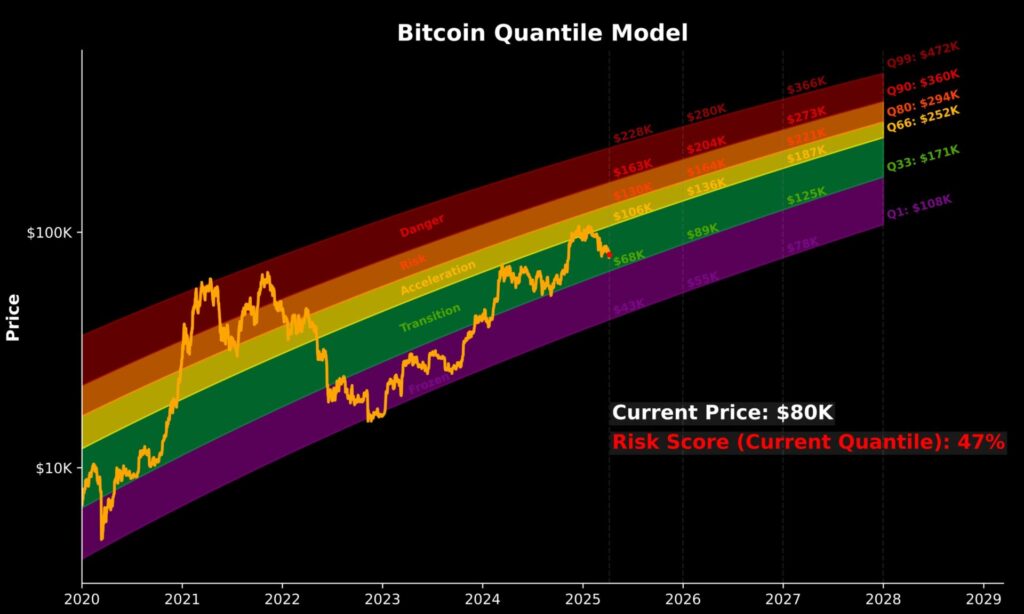

Based on TheirBitcoin-guarantee model, recover Power-Law Price keeps BTC on track to hit a price of $ 130,000 and $ 163,000 by the end of 2025.

Bitcoin is currently sitting in what is called the “transition” area where accumulation usually happens before he eventually enters the “acceleration” zone. This Bitcoin prize preliminary preparation for 2025 is really due to maintaining momentum through, yes, Q3 and thereafter.

$ 91 400 support critically for $ 155K target

In fact, analysts on the chain Ali Martinez have identified a very specific condition for bitcoin potential increase to $ 155 400 and it maintains support over the $ 91,400 level, which seems to be crucial for the next phase.

“Bitcoin could climb up to $ 155 400 but must keep a price over $ 91 400.”

This BTC price forecast mainly uses the Pi Cycle Top indicator, which basically tracks moving averages to predict market peaks. Power Law predicts $ 200,000 Bitcoin only if this critical support level manages to keep through the inevitable market vollatility that we are likely to see.

Also read: Shiba Inu to increase 124% by May 1 2025? Shib -Prism Goal ready to hit $ 0.00003

Four -year cycle points to the fourth quarter

Anonymous analyst APSK32 offers perhaps the most haus -like prediction based on power curve -time contours over four -year cycles, and their analysis suggests a strong Q4.

APSK32 stated:

“Look at two -year segments centered today, 4, 8 and 12 years ago. Price peel was performed with the help of the power curve.

This Bitcoin prices for 2025 is based on historical designs that have usually shown the strong quarter Q3 and especially the fourth quarter in previous cycles.

Exchange of outflows Signal Bullish Feeling

Over 40,000 BTC actually left exchanges in just one week – and this is usually a signal that often precedes price increases when the available supply for sale drops on the open market.

Ali Martinez reported:

“More than 40,000 Bitcoin has been withdrawn from exchanges over the past week!”

More than 40,000 #Bitcoin $ BTC Has been withdrawn from exchanges over the past week! pic.twitter.com/gytd1zfwev

– ali (@ali_charts) April 26 2025

This reduced supply, in combination with Bitcoin’s technical strength at an RSI of about 68.65, seems to support the BTC price forecast models aimed at $ 150K- $ 200K range that everyone is talking about.

Also read: Grayscale warns: $ 61 million lost when SEC delays Ethereum ETF Staking!

With Bitcoin that currently acts on important moving average values and power law models that remain intact, crypto market trends suggest that $ 200,000 targets remain quite likely as long as the critical support levels can hold through 2025. Power Law predicts $ 200k 200k bitcoin through q4 2025 -and almost all models, as this paragraph, in this point, as it is. Bitcoin through Q4 2025 – and almost all models are, at this point, which points out uninterrupted pricing conditions for the current market conditions are handled.