The price of Bitcoin seems to have returned to its choppy movement within $ 82,000 – $ 86,000 consolidation area, which reflects the level of indecision that is currently taking place on the market. But a Specific class of BTC investors Seems to move on the crypto market with the utmost confidence and conviction.

According to the latest observation on the chain, long -term investors seem to increase their exposure to the world’s largest Cryptocurrency through market value. Below is what this new change in market dynamics means for the current Bitcoin cycle.

Has Bitcoin Bear market begun?

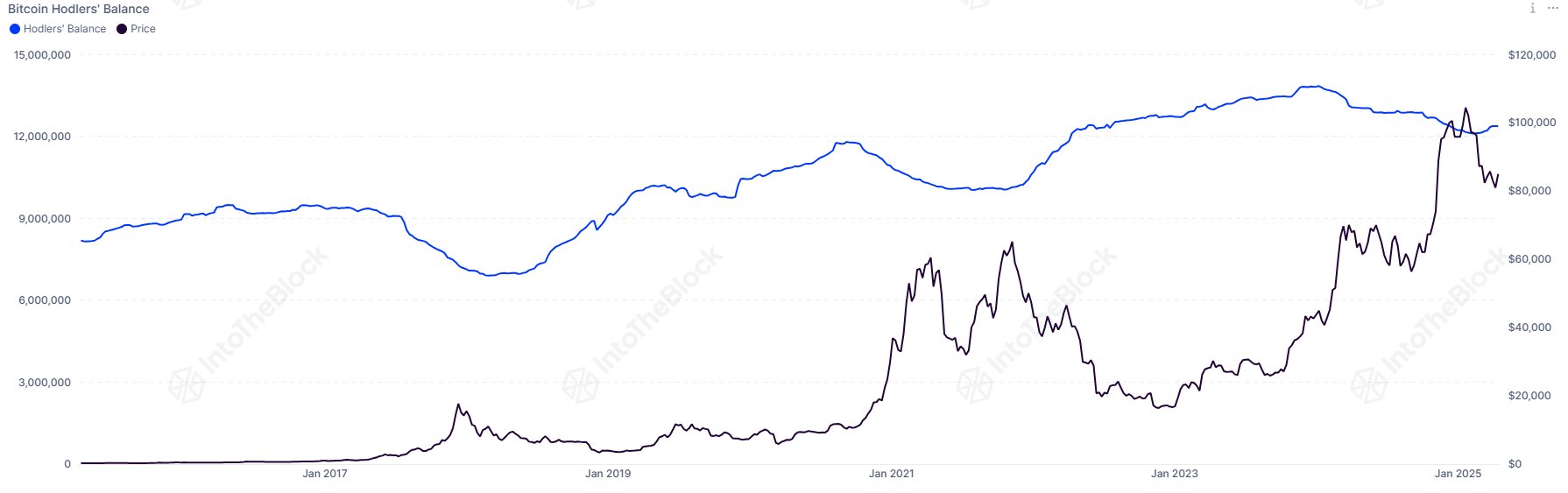

In a new post on the X platform, Crypto Analytics Firm Intotheblock shared That a reliable indicator that provides insight into bitcoin’s cyclic behavior flashes an interesting signal again. The relevant balance on the chain here is the long -term holders (LTH) balance, which tracks the amount of BTC held by wallets for more than a year.

According to Intotheblock’s post about X, the Bitcoin LTH balance has witnessed a sharp rise in recent months and coincides with the foremost Cryptocurrency case from the bicycle heights. The company on the chain mentioned that a rising long -term holding balance is historically correlated with the beginning of a bear market.

Source: @intotheblock on X

As observed in the diagram above, long -term investors tends to gather vigorously at the beginning of the bear markets and early accumulation phases. This pattern can be seen at the end of 2018 and 2022, where the LTH balances experienced a sharp increase followed by price extracts.

In the end, this accumulation pattern suggests that experienced investors can move their investment strategy pending large price movements. Nevertheless, it is worth mentioning that this can also be a mid-cycle breathing, with the Bitcoin Prize that is now being consolidated to resume its haus-like driving later.

Lack of retail activity indicates space for upward growth

Interestingly, a separate – and contrasting – paragraph in Data on the chain has appearedWhich suggests that the Bitcoin price may not have reached its bike peak yet. This evaluation is based on the volume of “retail activity through trade frequency” that the main Cryptocurrency experiences during its last wave from $ 70,000 to over $ 110,000.

According to the prominent crypto analyst Ali Martinez, Bitcoin Price Tops has historically coincided with surveys in retail activity. Martinez noted that retail activity lacked the same speed when BTC’s price migration from $ 70,000 to $ 110,000 to the end of 2024 and early 2025. If the story is to go, this suggests that there may still be room for upward growth for the Cryptocurrency flagship.

From this writing, the price of bitcoin amounts to about $ 84,730, which reflects a 0.4% jump over the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Image from iStock, chart from tradingview

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.