The price of Bitcoin has been quite bubbling over the weekend and exceeded the mark of $ 85,000 on Saturday, April 19. This positive one-day performance caps away what has been a relatively stable over the past seven days of price measures for the foremost Cryptocurrency.

But BTC’s price Is still well below the bike, with the market leader currently more than 21% away from his maximum time. With the Bitcoin price stuck in a wider consolidation area, investors seem to lose patience with the world’s largest Cryptocurrency.

Does Bitcoin investor sell again?

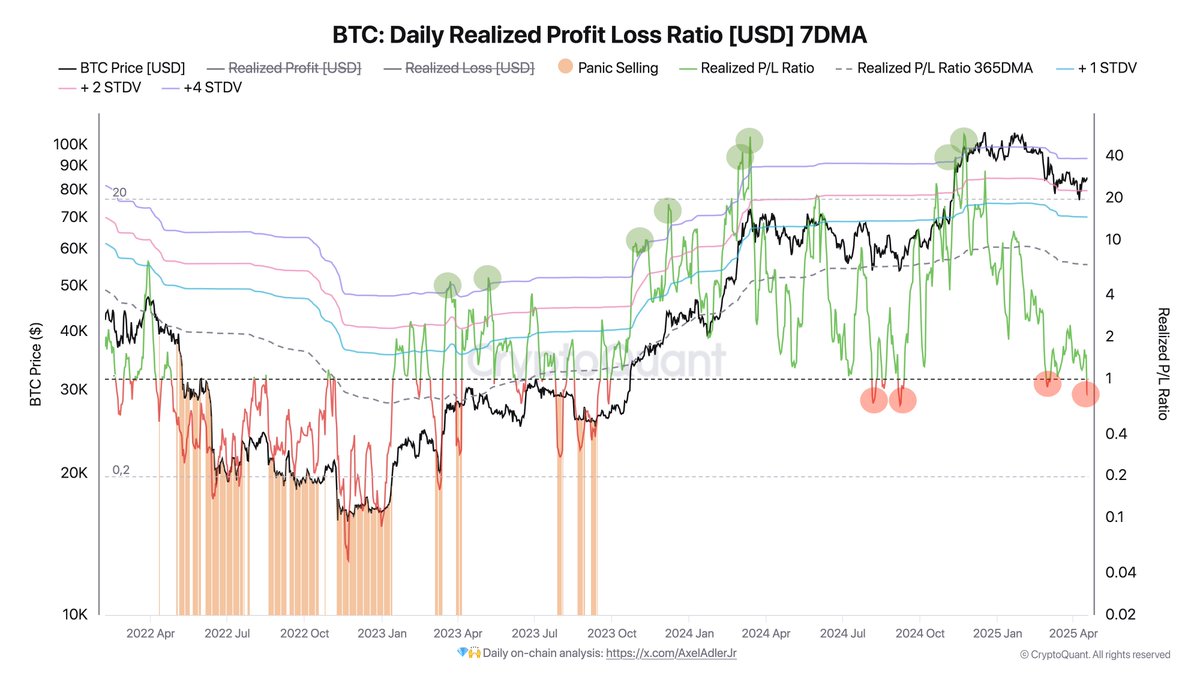

In its latest post on the X platform, on chain analyst with pseudonym Darkfost revealed that several BTC investors have resumed unloading their assets with loss. The relevant indicator here is Bitcoin Daily realized profit loss ratio, which appreciates whether more investors sell for profit or a loss.

This profit/loss ratio is calculated by dividing the total realized profit with the total real -life losses for a certain period. When the metric is over 1, this means that more investors sell in profit than at a loss. At the same time, a less than one value for the indicator suggests that more investors reduce their losses.

Source: @Darkfost_Coc on X

As shown in the diagram above, Bitcoin Daily realized the profit loss ratio has been over 1 for several last weeks. But the metric recently fell – for the second time in 2025 – under the key threshold, which signals that the majority of investors realize their losses.

According to Darkfost, the current level of the indicator is not yet to indicate full -scale market capitulation, but rather a uncertainty phase and potential accumulation. The analyst on the chain also mentioned that Metric’s current layout is similar to the structure at the end of 2024.

However, Darkfost noted that this does not necessarily mean that the main Cryptocurrency will witness the same results from this situation. When Bitcoin Daily realized the profit loss ratio fell to this level in 2024, the BTC price began on a price collection over $ 100,000 levels.

Darkfost Added:

We can also note that when the relationship reached the +4 STDV deviation from 365DMA, a local market top was formed consistently, followed by a short-term correction during the bull phase.

The analyst on the chain concluded that given the high level of uncertainty in the crypto market in recent weeks, the more likely result from this situation is a capitulation phase, where realized losses will continue to climb.

Bitcoin price

From this writing, BTC’s price is about $ 85,300, which reflects an increase of 0.8% over the past 24 hours.

Image from iStock, chart from tradingview

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.