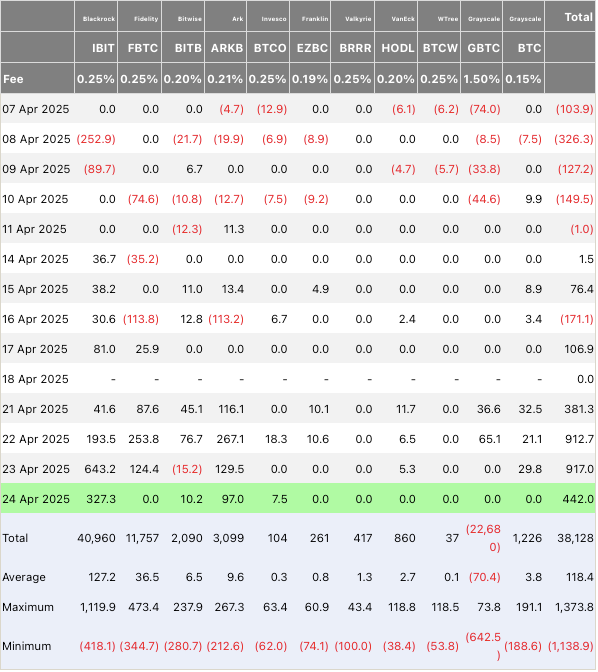

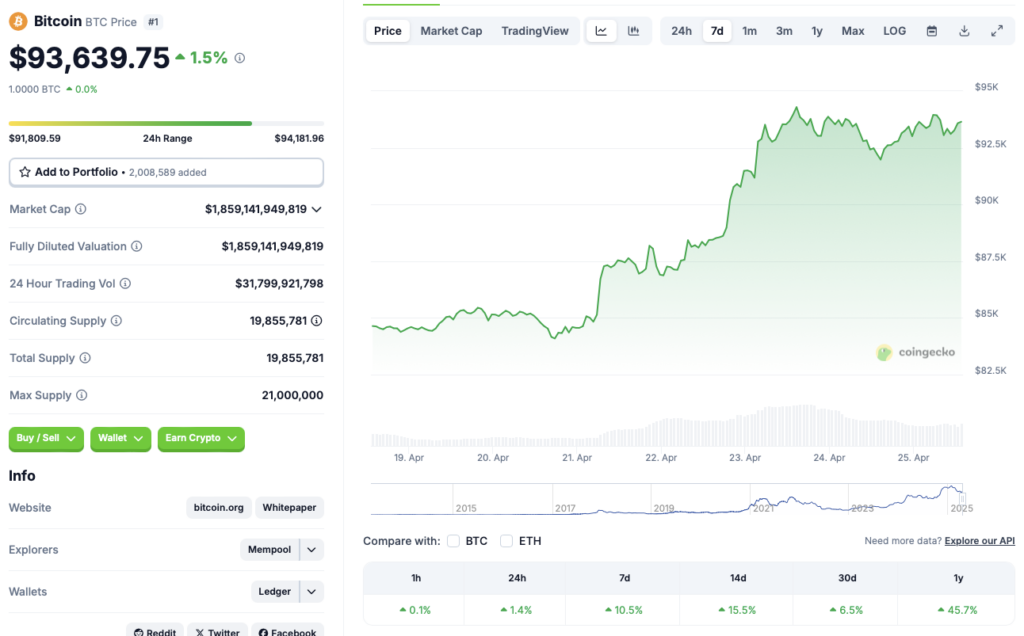

According to Data from Farside Investors, Blackrock’s Ibit Bitcoin (BTC) ETF has purchased $ 1.1 billion in BTC for three days. The world’s largest asset manager BTC bought $ 193.5 million on April 22, $ 643.2 million worth a value of April 23 and $ 327.3 million worth on April 24. Blackrock’s latest buying spree comes in the middle of a market -comprehensive resuscitation.

Also read: Why no currency can replace US Dollar’s power: IMF data is clear

Bitcoin is growing after Blackrock’s purchase of $ 1.1 billion

Also read: Shiba Inu: $ 18 million wins in Shib if you invested “right now”

Other hausse -like factors may also have driven Bitcoins (BTC) price. A new Pro-BTC SEC manager has probably led to an increase in investors’ confidence. Paul Atkins was responded as chairman of Sec on April 21. Atkins is likely to take a more relaxed attitude to the budding asset class.

Global trade war also decreases. The development may also have led to increased investors’ confidence.

Can the asset hit a new highest time soon?

According to Coincex research, BTC can continue its rally in the next few days. The platform expects the asset to hit a new highest time of $ 131,287 on May 3. BTC’s price will meet a 40.2% rally if it hits the $ 131 287 goal.

Also read: De-Dollarization: EU with the risk of US financial compulsion, ECB drives digital euro

The Federal Reserve is also expected to lower interest rates soon. An interest rate reduction can lead to an increase in risky investments. Bitcoin (BTC) and other crypto courses can witness a rally if interest rates are oblique.