According to the Data From Farside Investors, Blackrock’s Ibit Bitcoin (BTC) ETF Purchased $ 643.2 Million Worth of BTC on Apr. 23. The World’s Largest Asset Manager Had Previous Purchased $ 193.5 Million Worth of the Asset on Apr. 22, and $ 41.6 Million Worth on Apr. 21. The Firm Bought A Total of $ 878.3 Million Worth of BTC In Just Three Days.

Also read: How 2 brothers met $ 9 million with Shiba Inu: Throwback Thursday

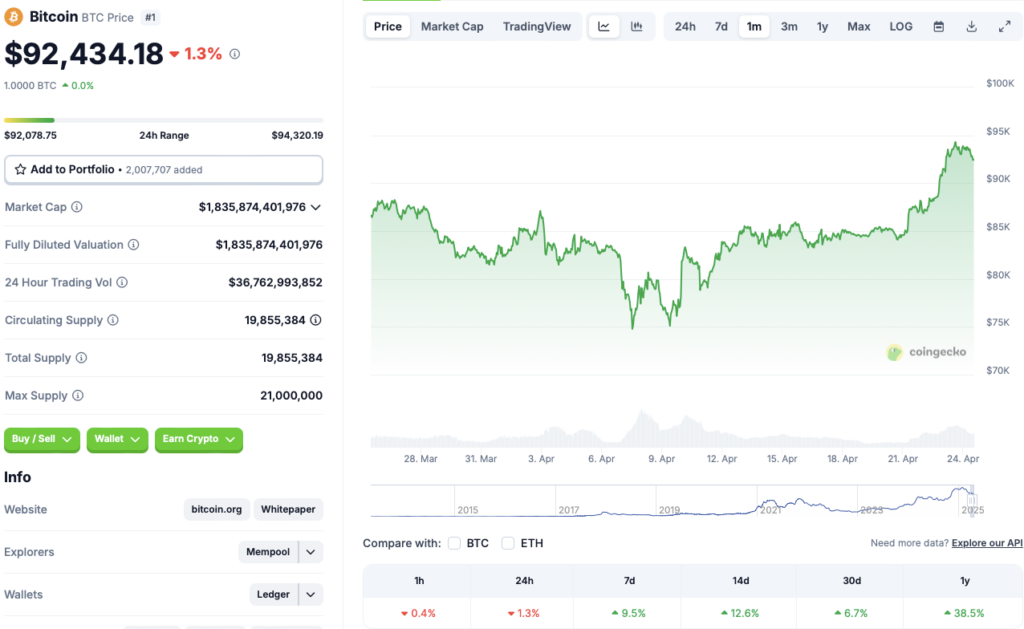

Bitcoin surges in the middle of Blackrock’s buying spree

Also read: SEC Chairman Paul Atkins Priority: Crypto Regulation or Ripple (XRP) ETFS

Other hausse -like developments may also have helped BTC’s latest rally. The appointment of Paul Atkins to the new Sec’s head has led to an increase in investors’ confidence. Atkins is a supporter of the BTC and the crypto industry. The returned SEC head Gary Gensler was often regarded as a villain by the crypto community.

Will the asset recover $ 100,000 next?

Coincex expects Bitcoin (BTC) to continue its haus -like path for the next few days. The platform predicts BTC to meet a new highest time of $ 131 019 on May 3. The asset price will rally with 41.74% if it hits the $ 131,019 goal. Coincex does not expect BTC’s price to hold over $ 130,000. The platform expects a correction to $ 102 747 on June 1st.

There are still many obstacles to the crypto market. Global macroeconomic headwinds can provide significant challenges for Bitcoin (BTC) rally. There is a possibility that the asset may not rise that is predicted by Coincex.