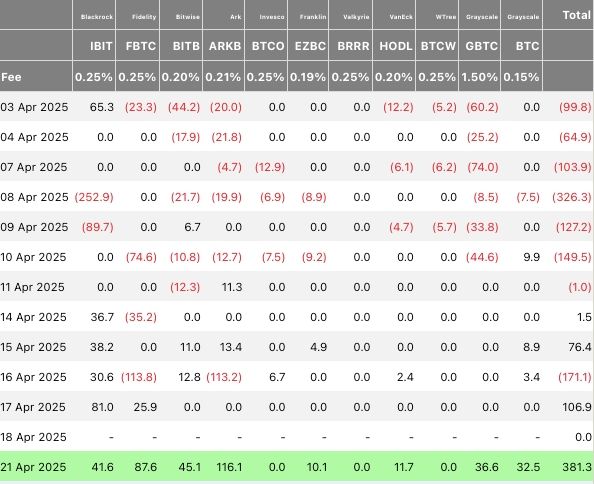

According to data from Farsidge Investors, Blackrock’s Ibit bought Bitcoin (BTC) ETF $ 41.6 million from Cryptocurrency on April 21. Blackrock’s buy was substantially dwarown by Ark’s 21 Shares BTC ETF, which bought $ 116.1 million for the asset. Fidelity bought $ 87.6 million in BTC, and Bitwise bought $ 45.1 million worth.

Also read: The dream of 1 cent: 3 things that can drive shiba inu to $ 0.01

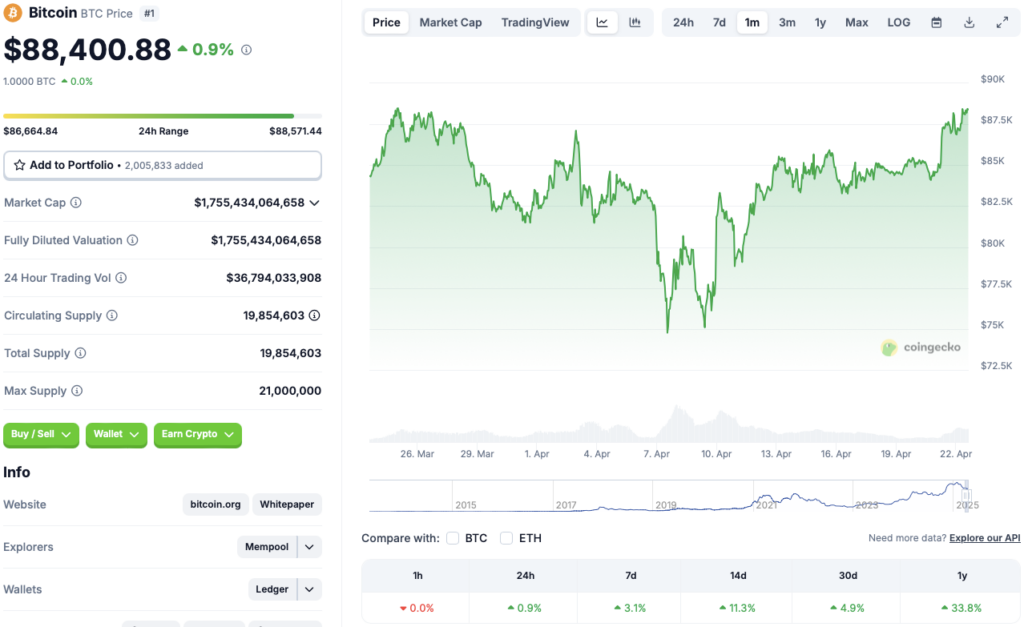

Bitcoin surges in the middle of Blackrock and Ark’s purchases

Also read: This asset surpassed Bitcoin and the US Dollar this year

Other hausse -like developments may also have helped BTC’s latest rally. Paul Atkins was answered as the new Sec chairman. Atkins has expressed its support for the crypto gym. Many are hopeful that he will take a more cautious attitude to the budding industry. Outgoing Sec -Manager Gary Gensler was often seen as a villain by the crypto community.

Will the asset recover $ 90,000 next?

Bitcoin (BTC) hit a maximum of $ 108,786 in January 2025. The price of the asset has dropped by 18.7% since January heights.

Also read: Top 3 Crypto courses that can make a recovery this week

There is also a possibility that BTC will continue its sideways in the coming weeks. The stock market has met a significant correction. Macroeconomic uncertainties can constitute significant challenges. There is also a lot of noise around President Trump who wants to replace Jerome Powell as the Fed Manager.