Fintech industry in Southeast Asia recorded a fifth quarter in a row Start investment Because global socio -economic and political factors take their fee. But virtual suppliers of asset services (VASP) were the best artists, with Singapore that dominated the region’s financing charts, reveals a new report.

Elsewhere, payroll payments continue via digital platforms to fight in Japan and account for only 3% of all payments.

Vasps shines when sea starts fight

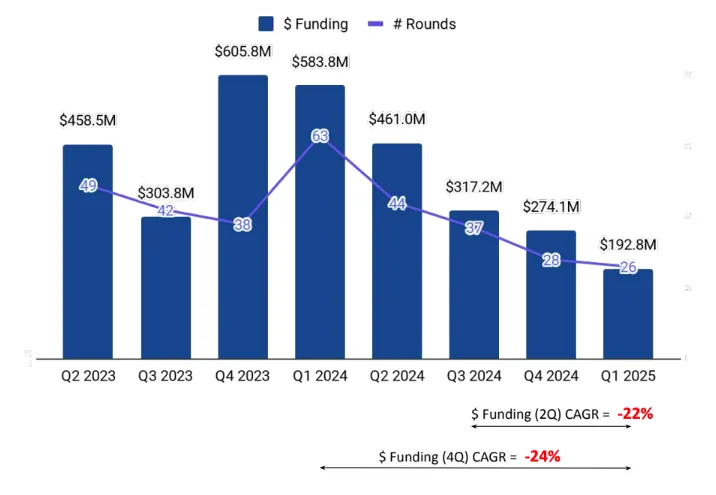

During the first quarter of the year, Sea Startups attracted $ 193 million in funding, Southeast Asia Fintech report from Startup Data Platform Tracxn reveal. This marked a 66% case from year to year, compared to the $ 584 million they collected during the first quarter of last year. It is also 30% dip from Q4 2024 and marks the fifth quarter in a row that the financing has dropped.

“Southeast Asia Fintech -Ecosystem saw a strong financing decline during the first quarter of 2025, affected by global financing challenges, investors caution and market saturation,” Tracxn noted.

While fintech startup financing dipped, the overall technical sector in Sea 30% increased to $ 909 million during the first quarter, a separate Report from Tracxn revealed. However, the figure was primarily down to the Singapore company Digital Edge at $ 600 million elevated in January.

Startups for digital assets were the best funded and collected $ 97.5 million, which was a small decline from Q4’s $ 101 million. Sygnum, a Digital asset bank Based in both Switzerland and Singapore, the lists topped with their funding round of $ 58 million in early January, which raised it to the unicorn status. It was the only fintech hearing coined globally in what was a quiet quarter for the sector.

Voox Exchange had the only other major funding round in the sea. The Singaporean Bourse, which focuses on using AI to improve the trading experience, collected $ 50 million in January from Pinnacle Capital to expand its infrastructure and strengthen security.

Another blockchain Fixed with remarkable collection in the sea was 129 knots, a Singaporean asset tokenization fixed Launched with an investment of $ 10 million in January. The start was incubated during a program led by Singapore Economic Development Board (EDB) and counts IBM (Nasdaq: IBM) and McKinsey & Company as partners.

The sector also registered an acquisition, with Titanlab that scooped up Blockchain Intelligence Platform Coinseeker in a deal worth $ 30 million.

In addition to the Blockchain sector, alternative lending starts in $ 34.6 million, while Investment Tech attracted $ 34.3 million. Both sectors saw at least 45% dip from Q1 2024.

Singapore remains southeast asia’s startup funding darling. During the first quarter, 74% of all investments, with Vietnam and Malaysia, attracted the other remarkable destinations.

Japan fights with digital pay payments

In East Asia, a driving force of the Japanese government has to stimulate wage payments via digital and mobile platforms failed to start, two years after launch.

A Report By Local Daily, Mainichi revealed that less than 3% of Japanese employees had chosen to get their wages digitally. With reference to research from MMD Labo Inc., a Tokyo-based market research company, the essay revealed that while 62% of the 20,000 respondents were aware of the initiative, it did not address them.

Japan remains the most notorious cash tung Larger economy. High confidence in physical currency, an aging population and low crime has all played a role, with 60% of all transactions done in cash. However, only 4% of the payments in neighboring country were cash last year.

To stimulate digital paymentsThe Japanese government approved the payment of wages via digital platforms in April 2023. But according to the report, most workers still prefer traditional methods. One in five respondents said they would consider switching if they could earn reward points.

It’s not just the workers; A report in October last year revealed that 89% of companies had no plans to switch to digital payments.

The digital push is strongest for companies with significant youthful labor, reports the paper. Such a company, Yoshinoya Co., a beef chain operator with over 20,000 part -time employees, announced that it began this month, it would enable digital salary payments.

“Most of our part -time employees are young people. We introduced this system as part of the benefits for young people who are familiar with payment apps. By being more practical for them, we hope to encourage the stock of staff resources,” commented on a spokesman for the company.

See: New Age of Payment Solutions

https://www.youtube.com/watch?v=W4varzerwuw Title = “Youtube video player” Ramborder = “0” Allow = “Accelerometer; Autoplay; Clipboard writing; encrypted media; Gyroscopes; Image-in-Image; Web-Share” Reference Policy = “Strict-Origin-When-Cross-Origin” Permitting Lorscreen = “” “” “”