In recent weeks, Cryptocurrency has been overwhelmed by a high degree of uncertainty and volatility that is triggered by the ever -changing global macroeconomy. This unreleased market condition saw Bitcoin Price dance between $ 74,000 and $ 83,000 within a few days.

The price of BTC fell toward $ 74,000 At the beginning of the past week when crypto investors were panicked after US President Donald Trump announced new commercial duties. On Thursday, April 10, the main Cryptocurrency level returned at $ 83,000 after President Trump paused trade tariffs at all countries except China.

Is Bitcoin now a “mature asset”?

The Bitcoin Prize has been quite reactively on virtually all the news in global trade, which shows the very volatile state of the Cryptocurrency market. However, an analysis species on the chain has explained that the volatility of the current Bitcoin market fades compared to previous sections.

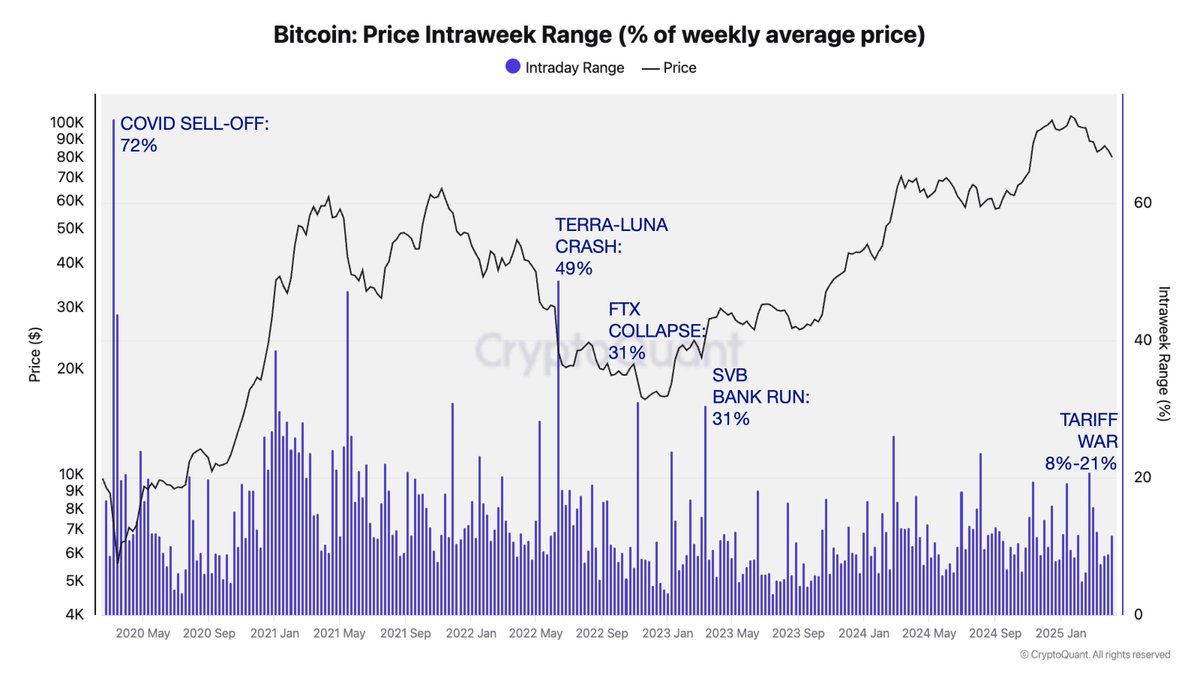

In a new post on the social media platform X, Cryptoquants Research Manager, Julio Moreno, revealed The fact that the Bitcoin Prize Volatility in the ongoing global trading drama has been “so far lower” than that of other past events, such as the Covid-19 crash, Terra-Luna-collapse, FTX case and Silicon Valley Bank (SVB) Bank Run.

The relevant indicator here is Price Intraweek Range Metric, which estimates the percentage change in the average weekly price for Bitcoin. According to Data from CryptoquantBitcoin Price Intraweek interval climbed to a maximum period of 72% during the Covid-19 decline in April 2020.

Source: @jjcmoreno on X

The diagram above shows that BTC Intraweek Range Metric increased to 49% after the crash of the Terra Luna ecosystem in May 2022. Meanwhile, the indicator reached 31% after the collapse of the Sam-Bank-to-Bank-led FTX exchange at the end of 2022 and the SvB bank in the beginning of 202.

With escalating trade tension Between the US and China stands Bitcoin Price Intraweek Range Metric between 8% – 21%. This reduced volatility suggests that the main Cryptocurrency has matured as an asset, with deeper liquidity and a better market structure.

The relatively stable price measure can be connected to the growing base for long -term holders and stable companies’ adoption, as institutional actors begin to see the world’s largest cryptocurrency less as a high -risk access and more as a hedging against macroeconomic uncertainties.

Bitcoin price

From this writing, the price of BTC amounts to about $ 83,700, which reflects an increase of 5% over the past 24 hours.

The price of BTC returns to above $83,000 on the daily timeframe | Source: BTCUSDT chart on TradingView

Image from iStock, chart from tradingview

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.