The Cryptocurrency industry is currently undergoing a huge shaking. The market was prepared to witness Bitcoin (BTC) soar when Donald Trump took over as US 47th president. But the world’s largest Cryptocurrency moved in a whole new direction. Kungmyntet has fought in terms of price and currently acts 23% during its maximum time of $ 109,114.88. This peak was achieved just two months ago in January 2025. But BTC’s last crash came as a huge shock for the market.

Also read: Donald Trump responds to US stock market accident, the president says this

Bitcoin strives to move on among new investors

This week has been rough for bitcoin as the asset experiences increased volatility. Kungmyntet was shopping for a high over $ 87,000 earlier this week. But earlier today, BTC fell to a low of $ 81 282.10 and caused panic on the market. At the time of writing, access was $ 83,098.02.

Also read: XRP to $ 2.07 – Will it crash or hit $ 3.78? Analysts predict the next move!

There are several reasons for Bitcoin’s latest crash. But everyone surrounds mainly Trump’s customs. Concerns about a worldwide economic decline has been raised by the introduction of customs imposed products. This can further cause investors to withdraw from high -risk assets such as Cryptocurrencies. While individuals like Michael Saylor have pointed out how Bitcoin is free from customs, the access seems to be strongly affected by the news alone.

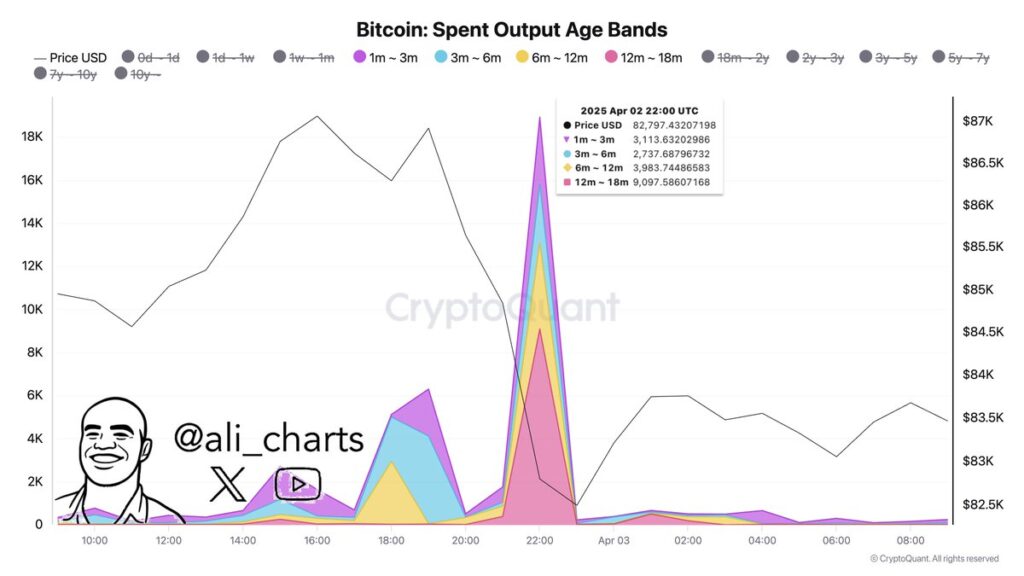

Sayor’s latest statement highlights how more experienced investors are still locked in King Coin. But beginners who have just entered the market are probably panic. According to a new tweet by analyst Ali Martinez, an astonishing 18 930 BTC was sold reportedly by short -term holders shortly after Trump’s customs message.

Further to highlight the latest scenario, Ben Kurland, CEO of Crypto Research Platform, told CNBC,

“Bitcoin moves at the intersection of story, liquidity and leverage. Right now it is mostly about a high-beet-macro-asset, tracking real returns, speed expectations and dollar strength. Exchanges are withdrawn, risk resources captured a bid, and Bitcoin answered directly.

Also read: Top 3 Crypto courses to watch this weekend