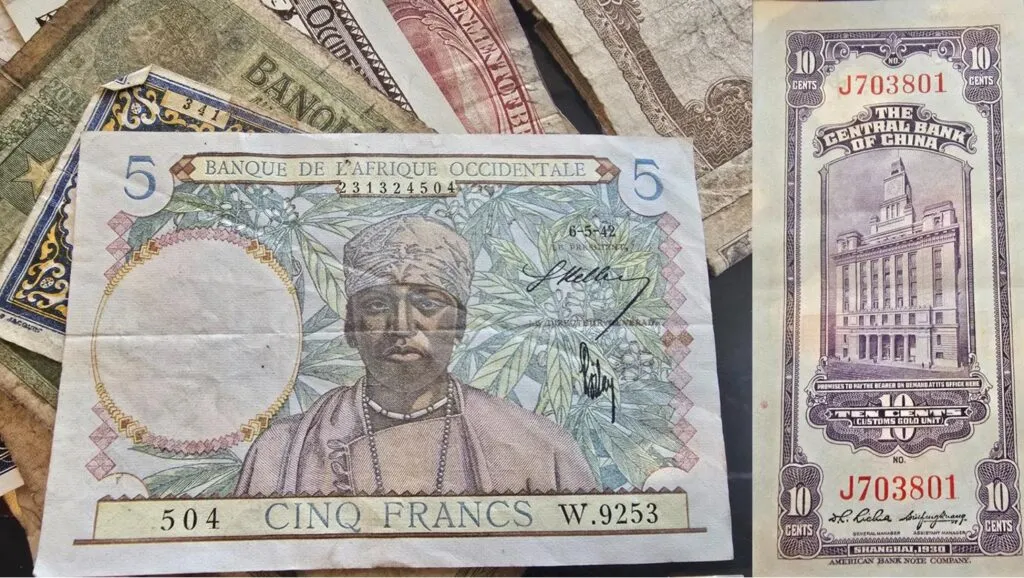

A few days ago, my father pulled out his currency collection from deep storage. It contained paper money That my grandparents and he had gathered from all over the world during their service during the Second World War and the Cold War. Some were beautifully printed bills from Vichy France, Japan-COCKAPE KOREA, Nationalist China, the Soviet Union before the world and even “liberation money.” Many bore the names of countries that no longer exist, and some of these currencies had once been supported by gold.

Now they are nothing more than collector goods, artistic remains of economic systems that have since disappeared but at one time have been a matter of survival in often very hostile and challenging economic conditions.

To investigate these bills and read about the nations behind them reminded me of how quickly monetary reality can change. Governments fall. Borders shift. Currencies disappear. What has once gone as a legal tender becomes history, and confidence in money, often taken for granted, fades just as quickly.

As the global financial system goes through Another turbulent phaseThe gold rises again, not only in price but in relevance. It is re -examined as a safe sanctuary and a foundation for the next monetary era.

In 2023, central banks bought Over 1,000 tonnes of goldThe highest level in over fifty years. This steady and deliberate feature suggests that growing distrust in Fiat currencies. Gold is no longer considered just an older asset; It is placed as insurance against a future where Fiat does not have its value.

Fiat -money relies on trust – in governments, in central banks and in the idea that tax discipline will be sewn. History offers little reason to believe that this trust is sustainable. The German Papiermark collapsed in the 1920s. The Soviet ruble disappeared after the Soviet Union. Zimbabwe, Venezuela, Argentina and others have seen their currencies lose value or disappear completely. Even today, inflation Continues to chip away at the purchasing strength of Lira, Peso and others.

Peter SchiffA long-term advocate for gold, has said: “All Fiat currencies eventually return to their inherent value-zero.” It may sound extreme, but it is a recurring lesson from history. This is one reason why individuals, institutions and governments are once again turning to gold. But storing it is not enough. During the digital age, people need a way to use gold as real money.

It’s here tokenization comes in. Using blockchain technology, physical gold, arched and reviewed, can be represented as digital tokens. The BSV blockchain Offers a platform built for this purpose. With its large block size, low fees and high flow, BSV supports the fast and cheap transmission of value all over the world. At BSV, gold can be divided into small units, sent directly and used in smart contracts while remaining tied to physical metal.

This is not hypothetical. Business is already working on issuing tokenized gold on bsv. These symbols would be supported by real, solid assets stored in secure facilities, while BSV -Blockchain provides a transparent and unchanging general ledger. Users can shop in gold without having to move the metal itself. Payments, wages and savings can all be handled in an asset that has preserved purchasing power for thousands of years.

James Rickards, author of Currency warHas long warned of a threatening recovery in the international monetary system.

“We are in the early stages of a currency war, and gold will be the ultimate winner,” he said.

He imagines a future where gold is again central to global trade, this time in a digitized form. Tokenized gold on BSV matches that vision; it is a modern form of audio moneyUseful on a global scale.

BSV’s infrastructure makes this possible. Its efficiency and low transaction costs enable real use of tokenized metals. Unlike other blockchains plagued by congestion or high fees, BSV was designed to scale. It supports microtransactions, embedded data and complex ApplicationsAll on a single chain.

Tokenization of gold and silver at BSV offers more than protection against inflation. It creates a global payment network anchored in physical value. This is not about going back to the past gold standard. It’s about moving on with a system where money is real, reliable and useful in digital form.

As the currencies continue to weaken and trust on financial institutions erodes, the need for alternatives becomes stronger. Blockchain-supported gold offers a way to restore trust. It gives individuals and companies a stable, transparent and internationally accepted exchange medium.

The currency remarks in my father’s collection were once symbols of economic strength. Now they are relics. Their stories remind us that even the most reliable systems can be crumbled. With tokenized gold at BSV, we have a chance to build more resistant and useful money that has its value, travels easily and works for everyone, everywhere.

This can be one of the most important economic transformations of our time, and BSV already makes it real.

See: What is blockchain-driven gold and can you buy coffee with it?

https://www.youtube.com/watch?v=oxiy-alkzau Title = “Youtube video player” Framebord = “0” Allow = “Accelerometer; Autoplay; Clipboard Writing; Encrypted Media; Gyroscopes; Image-in-Image; Web-Share” Reference Policy = “Strict-Origin-When-Cross-ORIGIN” permitted Lorscreen>