Key dealers

- Strategy purchased 6,911 BTC for $ 584.1 million increasing total holding at 506,137 BTC.

- The company is planning a capital increase of $ 42 billion to further expand its Bitcoin acquisitions.

Michael Saylor, CEO of Strategy, has suggested an imminent Bitcoin acquisition after a recent purchase that operated the company’s total holding over 500,000 BTC.

On March 30, Saylor’s Strategy’s Bitcoin portfolio tracker shared on X with the caption, “needs even more orange”, which indicates that the company remains committed to expanding its Bitcoin reserves.

These posts have historically preceded new Bitcoin acquisition messages within the following week.

Need even more orange. pic.twitter.com/lv5qgup6oy

– Michael Saylor⚡ (@Saylor) March 30, 2025

On Monday, the strategy announced that it had added 6,911 btcWorth about $ 584 million, until its holding. The purchase was made at an average price of $ 84,529 per bitcoin between March 17 and March 23.

With this latest acquisition, the Nasdaq-listed company has increased its Bitcoin holdings to $ 506,137, valued at over $ 42 billion at current market prices, making it the first listed company that exceeds 500,000 BTC.

Strategy acquired its Bitcoin at an average price of $ 66,608 per BTC, with total costs amounted to approximately $ 33.7 billion, including fees and expenses, according to data from sailortracker.

Despite the latest price fluctuations, the company still holds $ 8.3 billion in unrealized profits.

Bitcoin is currently shopping for $ 83,000 and shows a small recovery after dipping to $ 82 100 on Saturday, per tradingview.

Strategy: S strf Perpetual preferred stock -offering

On March 21, the strategy announced the pricing of its 10.00% Series A Perpetual Strife Preferred Stock (Strf) offer.

The company increased the share offer from $ 500 million to $ 722.5 million, with a view to Collect approximately $ 711 million in the net profit to finance further Bitcoin acquisitions and support activities.

The offer was scheduled to settle on March 25, subject to customary closing terms. This movement is part of the company’s “21/21 plan”, which is aimed at a total capital increase of $ 42 billion for Bitcoin acquisition.

Strategy has previously used parts of the net profit from Strk and MRT shares offers to finance its Bitcoin plan.

Earlier this month, the company sold 13,100 STRK shares for approximately $ 1.1 million, with $ 20.99 billion of STRK shares that are still available for issue and sales during the program.

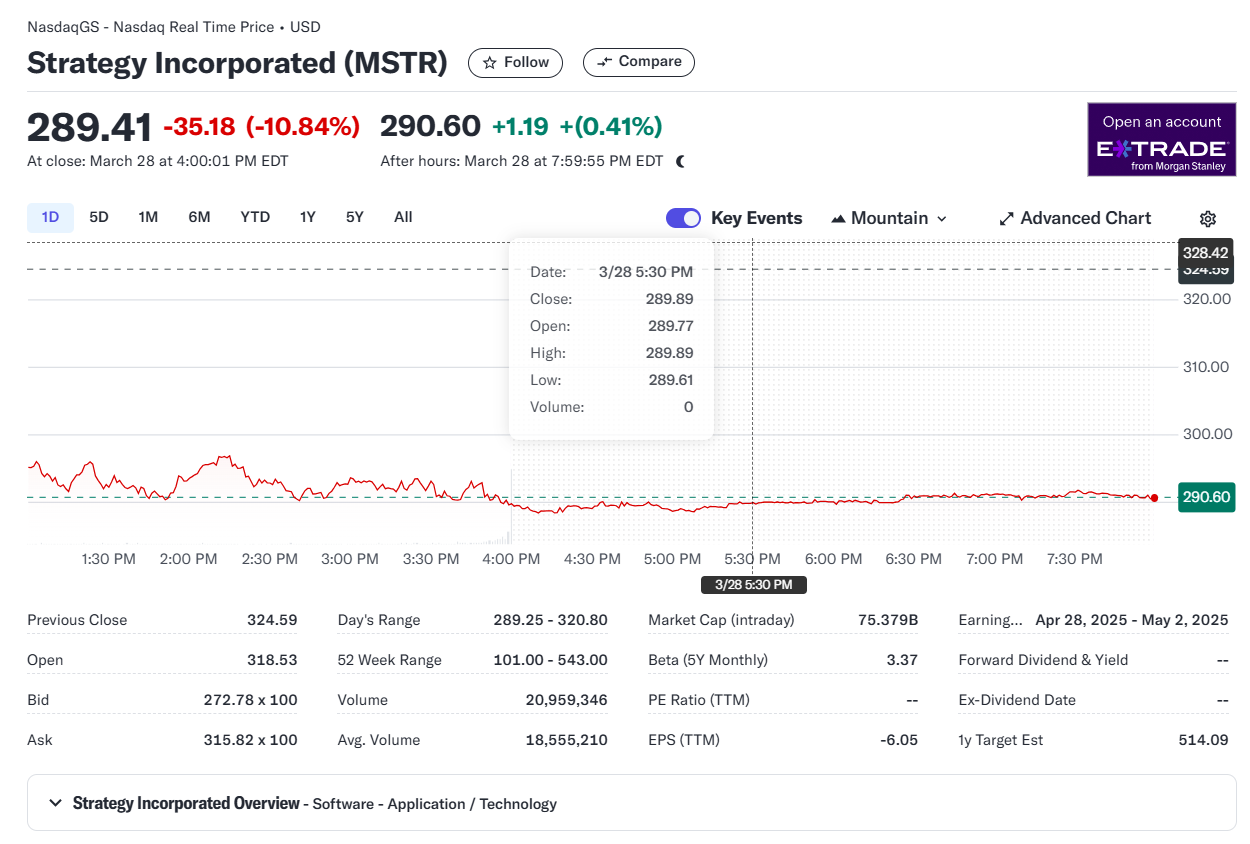

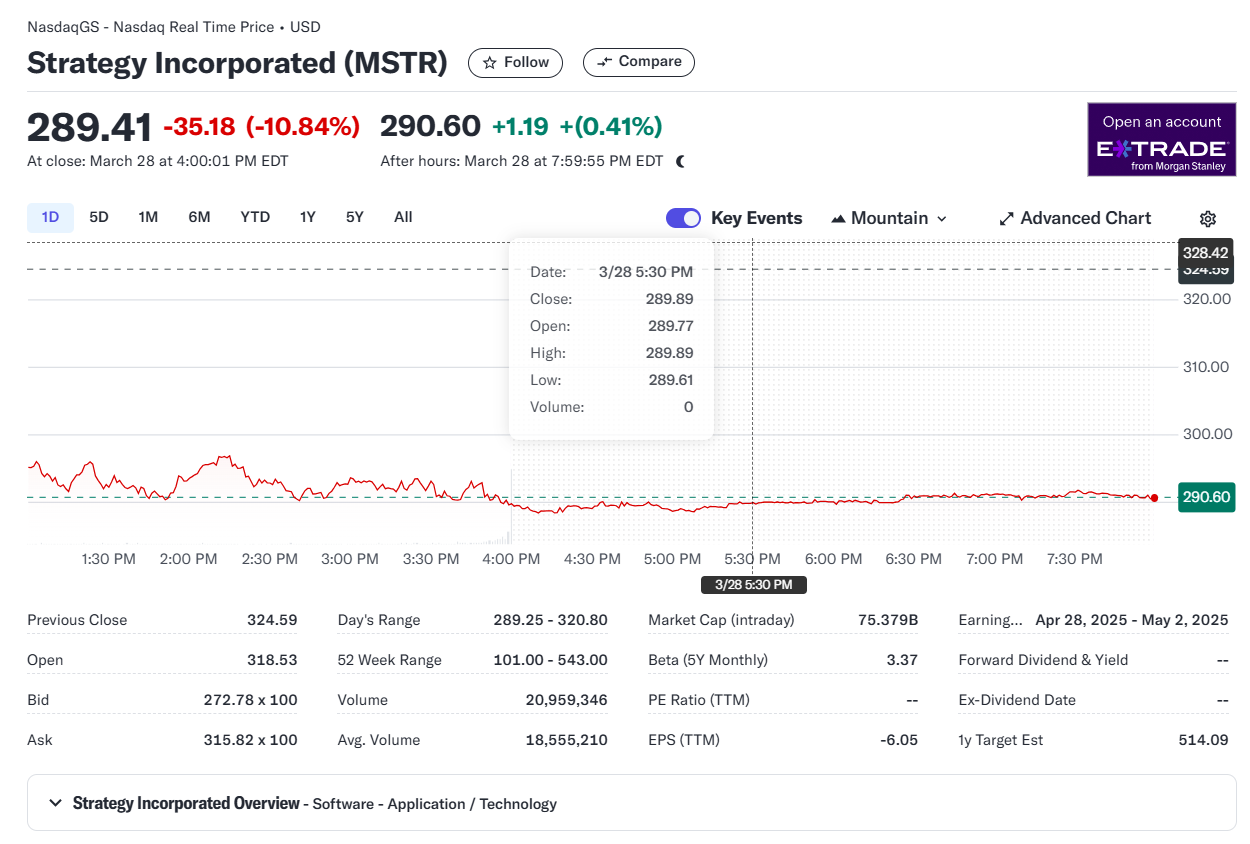

Strategy warehouse, MSTR, closed almost 11% on Friday at $ 289, according to Yahoo Finance data.

Although the share has increased by about 70% over the past year, its performance has been negative.