The JFK files reveal their war against central banks, which reflects today’s Bitcoin against CBDCS fight. With Trump’s latest de-classification of Kennedy murder files, we can now see the connection between monetary policy and power structures that have been given new relevance, especially with the current crypto market voltility and also the increase in CBDCs as government-controlled alternatives to decentralized currencies such as Bitcoin and others.

Also read: How President Trump’s executive order affects crypto markets

How JFK’s legacy forms Bitcoin’s challenge to central banks and the onset of CBDCS

Kennedy’s challenge for central banks

President Trump stated:

“Their families and the American people deserve openness and truth.

A de -rated intelligence memo noted:

“The day after the murder, Gary Underhill left Washington in a hurry … A small click within the CIA was responsible for the murder, he left and he was in serious danger.”

Bitcoin vs CBDCs represent a similar type of tension between decentralized and state-controlled financial systems, with Cryptocurrencies as Bitcoin that challenges the central authority just like Kennedy did years ago in the JFK files.

Bitcoin as financial freedom options

Also read: Warren Commission results challenged by new analysis

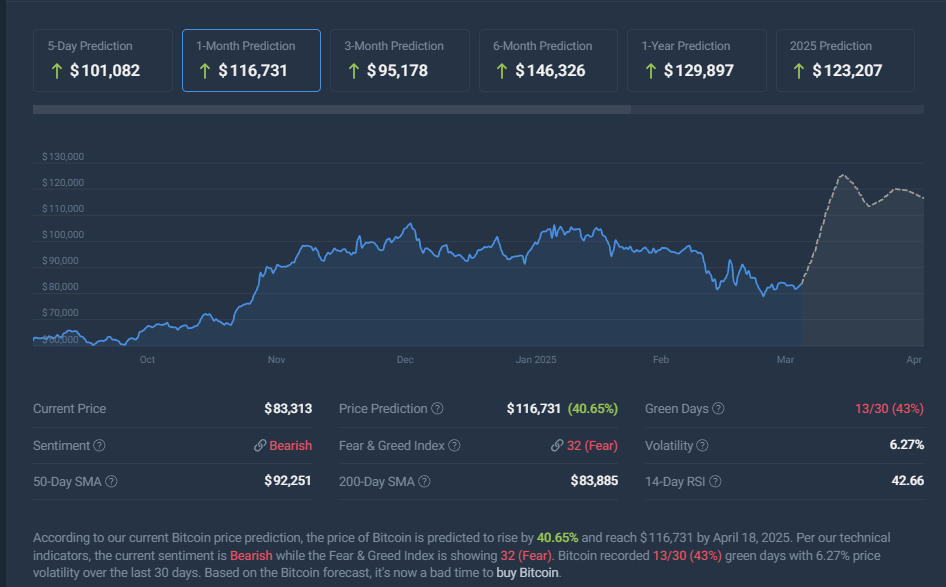

At the time of writing, the Crypto Market Volatility Bitcoin trading shows about $ 83,313 with a somewhat baisse -like feel, but technical indicators also predict potential growth to $ 116 731 by April 2025.

CBDC: Central banks fight back

The increase in CBDC shows how central authorities adapt to maintain control over digital money systems. Unlike Bitcoin vs CBDCs, these central bank’s digital currencies enable complete monitoring and potential restrictions that Kennedy tried to avoid with silver-supported currency, which was suggested by the JFK files.

FBI documents revealed:

“Ruby’s connections to the mob made people believe that JFK’s murder was part of a major plot.”

This historical resistance pattern against challenges to economic power structures type of parallels modern tensions between bitcoin and centralized control.

Also read: Central Bank’s digital currencies: surveillance tools or innovation?

With Bitcoin projected to reach approximately $ 123,207 in 2025And given the ongoing crypto market voltility, this technical solution to centralized monetary control Kennedy’s mission of financial sovereignty is now being confronted by the increase in CBDC and other government -supported digital currencies.