Key dealers

- Strategy plans to raise $ 500 million through a preferred share offer to expand its Bitcoin holdings.

- The preferred share has a 10% annual fixed dividend rate, with potential steps of unpaid.

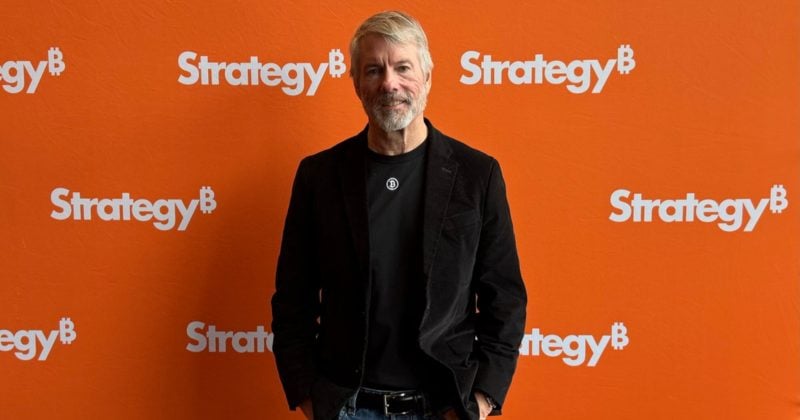

Strategy, the world’s largest business holder in Bitcoin, announced on Tuesday’s launch of StRF (Strife), a new ever -preferred share offer, available to institutional investors and chooses retail investors.

Strategy today announced the launch of $ STLF (“Strife”), a new eternally preferred share offer, accessible to institutional investors and chooses non-institutional investors. For more information, click here. $ mstrershttps://t.co/yxnMogcegq

– Strategy (@strategy) March 18, 2025

Strategy also revealed its plan to offer 5 million shares in Serie A eternal battle to prefer shares in a public offer to raise money for Bitcoin purchases and operating capital.

The preferred share will have a 10% annual fixed dividend rate, payable quarterly from June 30, 2025. If dividends are not paid according to schedule, composite dividends will be collected to an initial interest rate of 11% per year, which increases by 100 points each quarter up to a maximum of 18% annually until they are paid in full.

The initial liquidation preference will be $ 100 per share, with daily adjustments based on market prices and trading activity. Strategy maintains the right to redeem all shares if the outstanding amount falls below 25% of the total shares issued or at certain tax events.

Morgan Stanley, Barclays Capital, Citigroup Global Markets and Moelis & Company serve as a joint book manager for the offer, which will be made through an effective shelf registration declaration submitted to Sec.

Strategy said on Monday that it had Bought 130 bitcoin at an average price of $ 82,981 per symbol between March 10 and 16.

The latest purchase, reported in a SEC archiving, provides the strategy’s total Bitcoin holding to 499 226 BTC, valued at approximately $ 41.6 billion.

The acquisition was funded through the sale of 123,000 shares of its 8.00% Series A Perpetual Strike Preferred shares, generating about $ 10.7 million. From the latest update, the strategy has over 2% of the entire Bitcoin range.