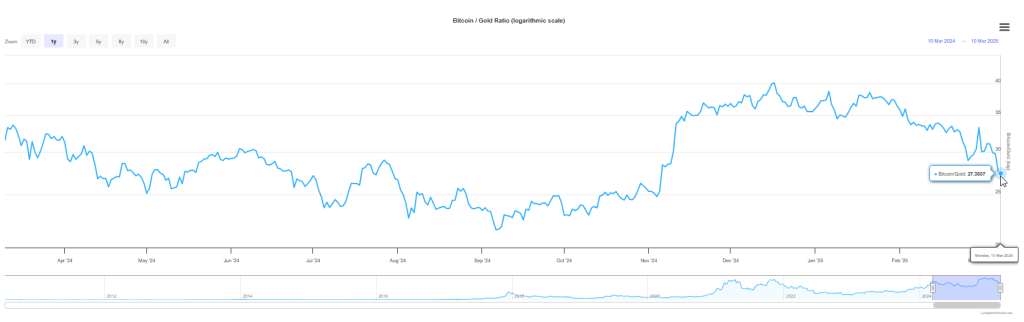

‘Bitcoin Like Gold’ Has become at the time of writing and such a significant comparison in economic discussions between different major institutions and analytical frameworks. German bank recently confirmed this opinionAlso, Bitcoin’s potential emphasizes as a store of value in the midst of Cryptocurrency security risks and, you know, the increasing crypto market vollatility that has recently characterized the market and all this. The comparison emphasizes Bitcoin’s scarcity and decentralized nature, such characteristics and functions that support the Bitcoin Reserve Standard concept that now receive attention from several important financial organizations through several significant regulatory considerations.

Only in: 🇩🇪 Deutsche Bank says Bitcoin is “as gold” and the US strategic Bitcoin Reserve “can set international standards.”

– watcher.guru (@watcherguru) March 12, 2025

Also read: Shiba Inu Price Prediction vs Hedera Coin: Which will reach $ 1 first?

How bitcoin can become standard in the midst of crypto market vollatility and security risks

Deutsche Bank’s Bitcoin-Gold comparison

We reported this on March 12, 2025 and said:

“Only I: 🇩🇪 Deutsche Bank says Bitcoin is” as gold “and the US strategic Bitcoin Reserve” can set international standards. “

US Bitcoin Reserve Standard Potential

The concept of a Bitcoin Reserve standard has been appealed after Deutsche Bank suggested that the US could establish a strategic Bitcoin reserve through several important regulatory methods. Such a development would deal with Bitcoin adoption challenges by providing regulatory clarity and also a framework for other nations to follow in the coming years.

Also read: US Core PPI falls to 3.4% – lower than expectations

Institutional adoption trends

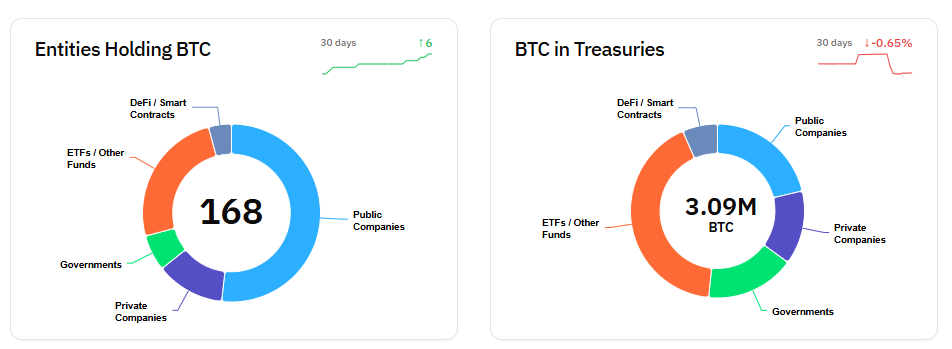

Despite ongoing crypto market voltility, the institutional interest in bitcoin continues to grow through various large investment channels. Large financial players are increasingly looking at Bitcoin as gold as a hedge against inflation and currently also financial uncertainty. The regulatory development and institutional participation gradually overcomes the Bitcoin adoption challenges that once limited mainstream acceptance.

Also read: Cryptocurrency: 3 coins that can float when the Ripple-Sec judgment is announced

Global economic consequences

The comparison between Bitcoin that Gold of Deutsche Bank signals a significant perception of permits over several important financial paradigms. This recognition can potentially reduce crypto -market voltility as more institutional investors implement long -term strategies and focus on value preservation. The Bitcoin Reserve Standard Concept, if implemented in several important economies, would mitigate Cryptocurrency -through several significant internationally recognized protocols and thus establish extensive protective mechanisms for many significant investor segments and institutional participants.

The institutional recognition of bitcoin as gold has currently catalyzed a basic development in understanding digital assets over many significant financial frameworks and such. Through various major regulatory developments and also institutional integration efforts are handled and solved Bitcoin adoption challenges and dissolve and thus establish Bitcoin’s position as a digital store of value despite the periodic cryptom -market vollatility that continues to influence, right now, the wider cryptocurrency.

Also read: Bitcoin’s 10x Boom: Michael Saylor predicts that it will top global assets in four years!