Bitcoin 10x potential has at the time of writing caught investors’ attention as Strategy2 CEO Michael Saylor makes a bold forecast on Cryptocurrency’s future. Despite ongoing problems with market vollatility, the Bitcoin Price pre -pregnancy models currently imply significant growth in the future, with the adoption rate and also security risks that remain key factors for consideration.

Michael Saylor: Bitcoin is about to become the largest asset in the world in the next 48 months.

Easy 10x … pic.twitter.com/Jc1i2hbte1

– Bitcoin Archive (@BTC_archive) March 13, 2025

Michael Saylor stated:

“Bitcoin will be the largest asset in 48 months, easily 10x!”

Can bitcoin 10x in four years? Analyze market volatility, adoption and security risks

The possibility of Bitcoin 10X growth within four years requires a thorough analysis in view of the asset’s historical performance and various large market trends that are currently shaping the Cryptocurrency landscape.

Growth forecasts support 10X Opportunity

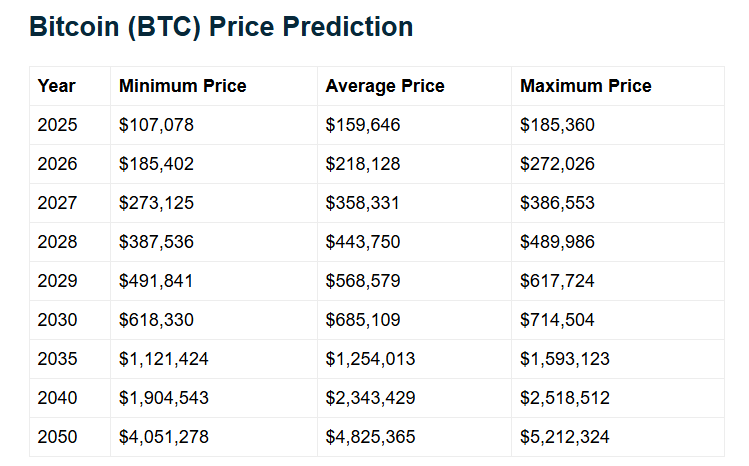

The current Bitcoin price pre -data data indicates significant estimate potential in several significant valuation measurements. According to several important forecasts, Bitcoin was able to reach between $ 185,402 and $ 272,026 in 2026, in line with Saylor’s ambitious growth time line. This course utilizes upward momentum with forecasts showing values that potentially reaches $ 358 331 in 2027, as evidenced by several essential indicators integrated over various large market analyzes performed by financial authorities.

Volatility is still a challenge

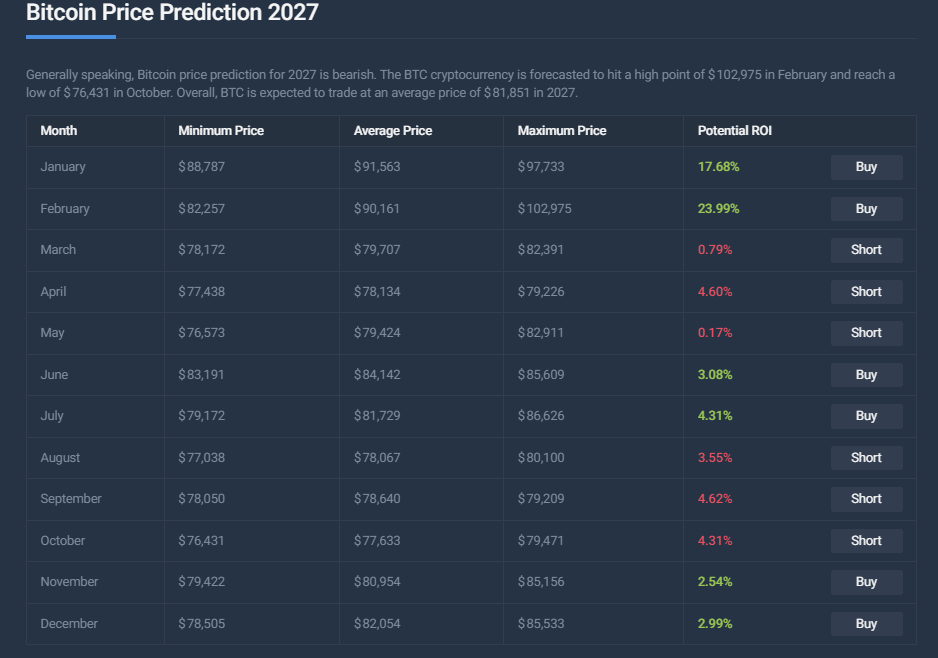

Market volatility provides some critical barriers to Bitcoin 10X growth in the coming years. Price information for 2027 shows, right now, fluctuations between $ 76,431 and $ 102,975 for different months, which highlights the somewhat unpredictable nature of the Cryptocurrency markets. Bitcoin adoption of many significant financial sectors will continue to run these price nersins

Institutional interest fuel bitcoin 10x potential

Large financial institutions are increasingly integrating Bitcoin into their investment portfolios and catalyzes speed for potential Bitcoin 10x performance in medium term. This strategic transition from traditional assets to Cryptocurrency represents a basic transformation in investment methods in several essential parts of the financial sector.

Security risks continue to affect the Bitcoin adoption rate through various major challenges in the ecosystem. Exchanges and even wallet suppliers develop improved security protocols to address these problems, which can affect how quickly bitcoin reaches 10x milestone that Saylor predicts within the established time frame.

Long -term bitcoin 10x outlook

Look beyond Saylor’s 4-year time frame, forecasts suggest even more dramatic growth potential through several important market developments. The Bitcoin Price Presence models currently indicate potential values exceeding $ 4 million in 2050, which represents several 10x increases compared to current values seen at the time of writing.

The road to Bitcoin 10X growth faces several significant challenges, including uncertainty about legislation and adoption barriers over many significant jurisdictions. However, Sayor’s forecast integrates various major technical analyzes that catalyze significant estimate potential as institutional investments accelerate through several important market sectors. Bitcoin’s position as a value store continues to be established over several strategic financial frameworks globally. Whether Bitcoin is effectively transformed into the world’s largest asset within the estimated four-year time frame remains to be validated, but the growth track that is highlighted by various extensive price pre-operative models indicates significant strategic upward investors seeking exposure to CryptoPurrency-sections within their diversified portfolios.

Also read: BNB Price Transfer: $ 580 Breakthrough with 6.19% Rise – Key Driver