- Robinhood is overlooked red flags such as transaction delays and suspicious activity, which violates regulations.

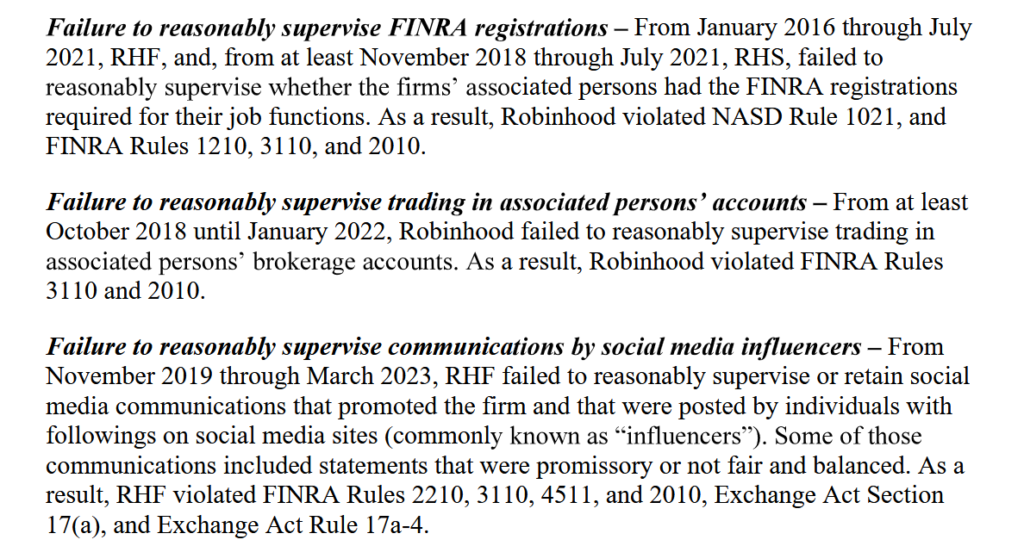

- The company failed to monitor misleading services from paid impacters.

- Robinhood will strengthen compliance, hire a consultant and pay $ 3.75 million in repayment.

Robinhood, has agreed to pay an astonishing $ 29.75 million to solve the Fine Probes for its supervisory and compliance practice.

Robinhood’s regulatory error

The deal follows a series of mistakes that landed Robinhood in the regulators’ cross chairs, such as anti-allowance, supervisory and customer protection rule.

The issues began in the midst of increased market instability, such as Gamestop Trading Bubble in early 2021. Robinhood proved to have overlooked “red flags” indicating potential illegal activity. Such as weeks long delays in treatment transactions, manipulative orders and anomal account activity.

Robinhood also created thousands of accounts with incomplete customer identification verification, in violation of anti-money wash standards.

More worrying in the investigation was that Robinhood did not monitor social media messages. Some of the posts made by sponsored participants, tricked investors through false or promissory visits that were considered misleading of Fine.

In response to the results, Robinhood promised to conduct procedures to strengthen its compliance procedures. Which includes commitment from an independent consultant to review their systems and further protect customer interests. The company also has a customer recovery of $ 3.75 million to harm customers who were deceived by misleading information.

This debate is a sharp reminder for investors that even the most successful platforms can have serious operational deficiencies.

While Robinhood offers a compelling commission -free trading model. And its latest misunderstanding emphasizes the importance of doing their homework and being familiar with the platforms we use to manage our investments. Always look for the fine print as system errors. And lack of surveillance and conflicts of interest can put investors at risk.

Marked crypto news today

Unknown attack on Pectra Upgrade further delay launch on Main