The US-based Bitcoin ETFs (stock exchange traded funds) have continued to fight for investors’ participation and interest in recent weeks. In the last week of February, the cryptob -based financial products witnessed a record breaking $ 1.14 billion a day withdrawal.

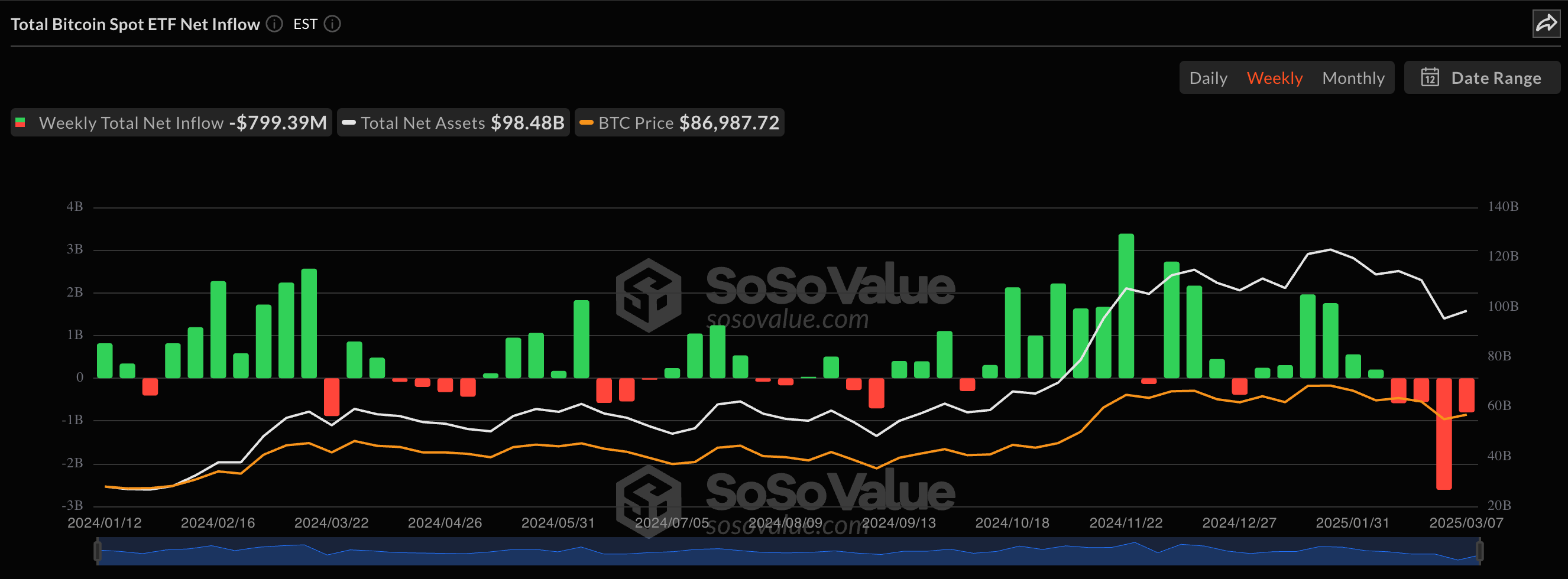

The story was not much different for Bitcoin ETFs to start March and register a net outflow of almost $ 800 million over the past week. This growing trend reflects the change in appetite and the sense of institutional investors, especially in the United States.

Bitcoin ETFs after $ 409 million daily net outflow

According to the latest Market dataThe US Bitcoin ETF market published a daily net outflow of about $ 409 million on Friday 7 March. This marked the fifth day in a row for the Bitcoin Exchange traded funds.

Ark & 21 shares Bitcoin ETF (with Ticker ArkB) saw the largest volume of withdrawals (over $ 160 million) on Friday. This was carefully followed by Fidelity Wise Origin Bitcoin Fund (FBTC), which published net outflows of approximately $ 155 million to close the week.

Blackrock’s Bitcoin Trust (Ibit), Largest Bitcoin Exchanging Fund With net assets, in net value decreased by $ 39.85 million on Friday. At the same time, Grayscales Bitcoin Trust (GBTC) and Bitwise’s BTC Fund (BITB) with total outflows of about $ 36.5 million and $ 18.6 million followed $ 18.6 million a day.

Source: SoSoValue

Interestingly, Vaneck’s Bitcoin Fund (with Ticker Hodl) was the only US-based Bitcoin ETFs who registered a net inflow on Friday. The stock exchange traded fund died about $ 617,500 in value to close the week.

As already mentioned, this single day performance marked the fifth straight day of net outflows for Bitcoin ETFs. The cryptob -based products will not yet record an inflow day in March, as they last published a net daily influx on Friday 28 February.

This $ 409 million withdrawal set Bitcoin ETF’s weekly performance to a net outflow of $ 799.9 million over the past week. Interestingly this represents this Fourth week in a row (and the second highest ever) of net outflows for the cryptoby -traded funds.

Bitcoin price

The performance of the BTC-Stock Trade Funds in recent weeks reflects slightly sluggish bitcoin price action within the same period. The price of Bitcoin has not been able to maintain any positive momentum from the slightly improved cryptocimate in the United States.

From this writing, the main Cryptocurrency is valued at about $ 86,100, which reflects an over 1% price decline over the past 24 hours. But within the weekly time frame, the Bitcoin price increases by more than 2%, according to data from Coytecko.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Image from iStock, chart from tradingview

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.