Key takeaways

- US consumer prices rose 2.7% annually in November, keeping inflation above the Federal Reserve’s 2% target.

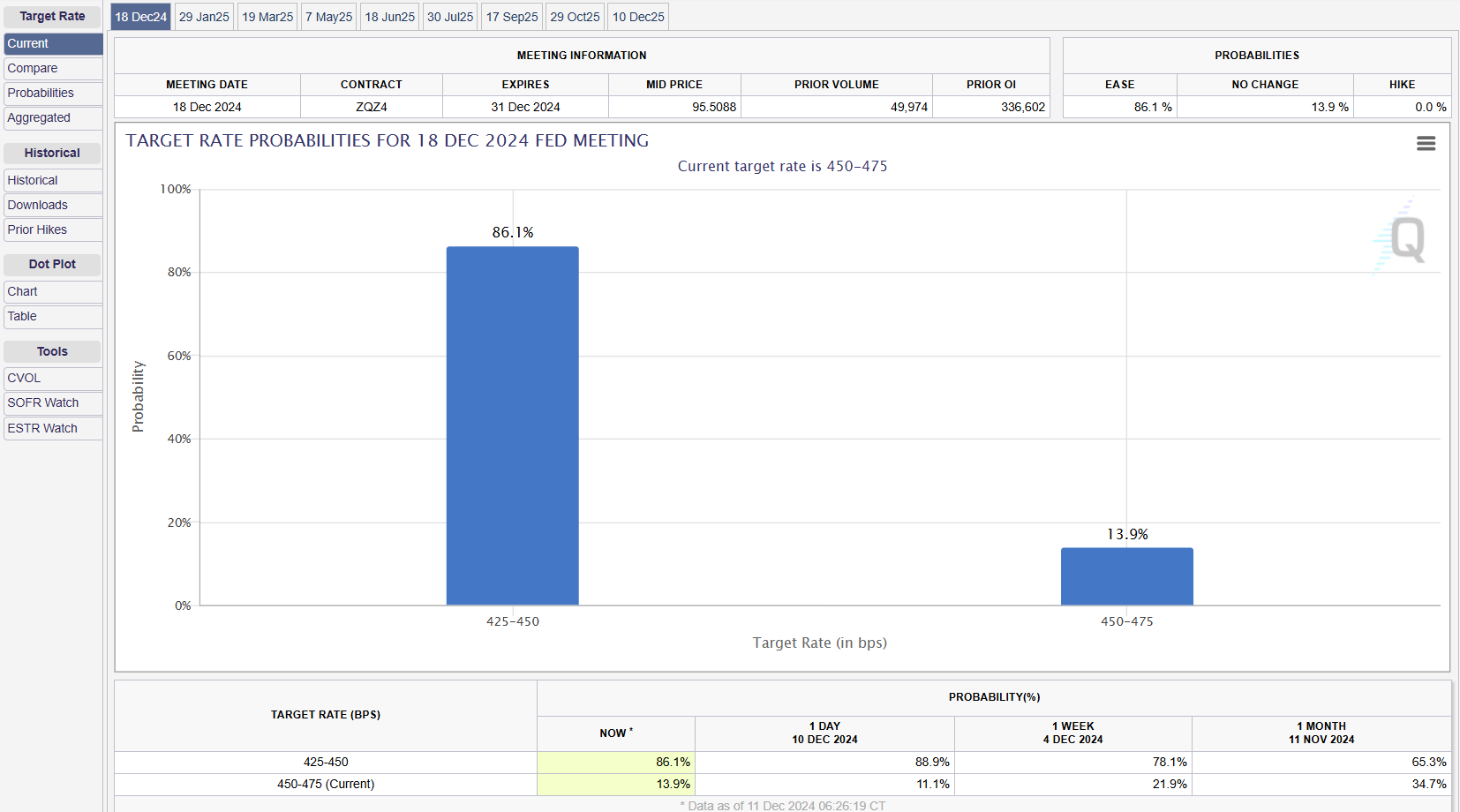

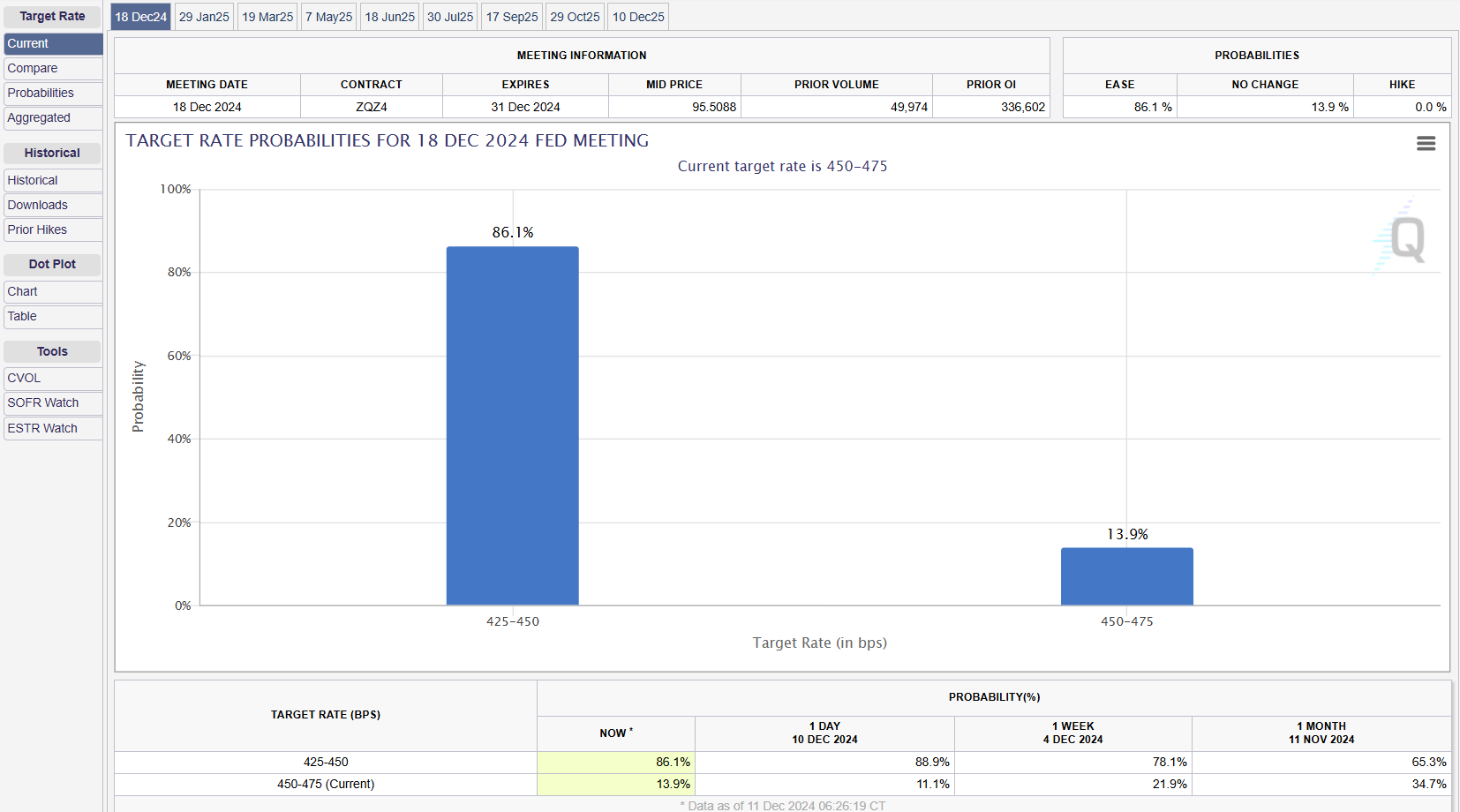

- Traders expect a quarter-point cut in the federal funds rate at the upcoming Federal Reserve meeting.

Fresh November CPI data on Wednesday showed consumer prices rose as expected, keeping the Federal Reserve on track for a rate cut next week, especially as the November jobs report released earlier this month indicated solid job growth.

The consumer price index climbed 0.2% month over month, matching both October’s increase and economist estimates, according to the Bureau of Labor Statistics data was released on Wednesday.

The core CPI, which excludes volatile food and energy prices, rose 0.3% from October and maintained an annual pace of 3.3%, matching analysts’ expectations.

The inflation report comes as markets widely expect the Fed to cut interest rates at its December 17-18 meeting. Traders are pricing in an 86% probability of a quarter-point cut in the federal funds rate, according to CME Group’s FedWatch tool.

The November jobs report, which showed a sharp increase of 227,000 jobs, further strengthened the case for easing monetary policy. The figure beat expectations and marked a robust recovery from the previous month’s lackluster performance.

The figure not only topped the Dow Jones consensus estimate of 214,000 but also reflected upward revisions to job gains for October and September, bringing the three-month average wage growth to 173,000.

Although inflation has cooled significantly from its peak of around 9% in June 2022, recent data suggest that prices are stabilizing at levels above the Fed’s target.

Bitcoin was trading above $98,000 before the inflation data was released, recovering from a recent dip below $94,000. The crypto asset has increased by 2% over the past seven days, per CoinGecko data.