Important takeaways

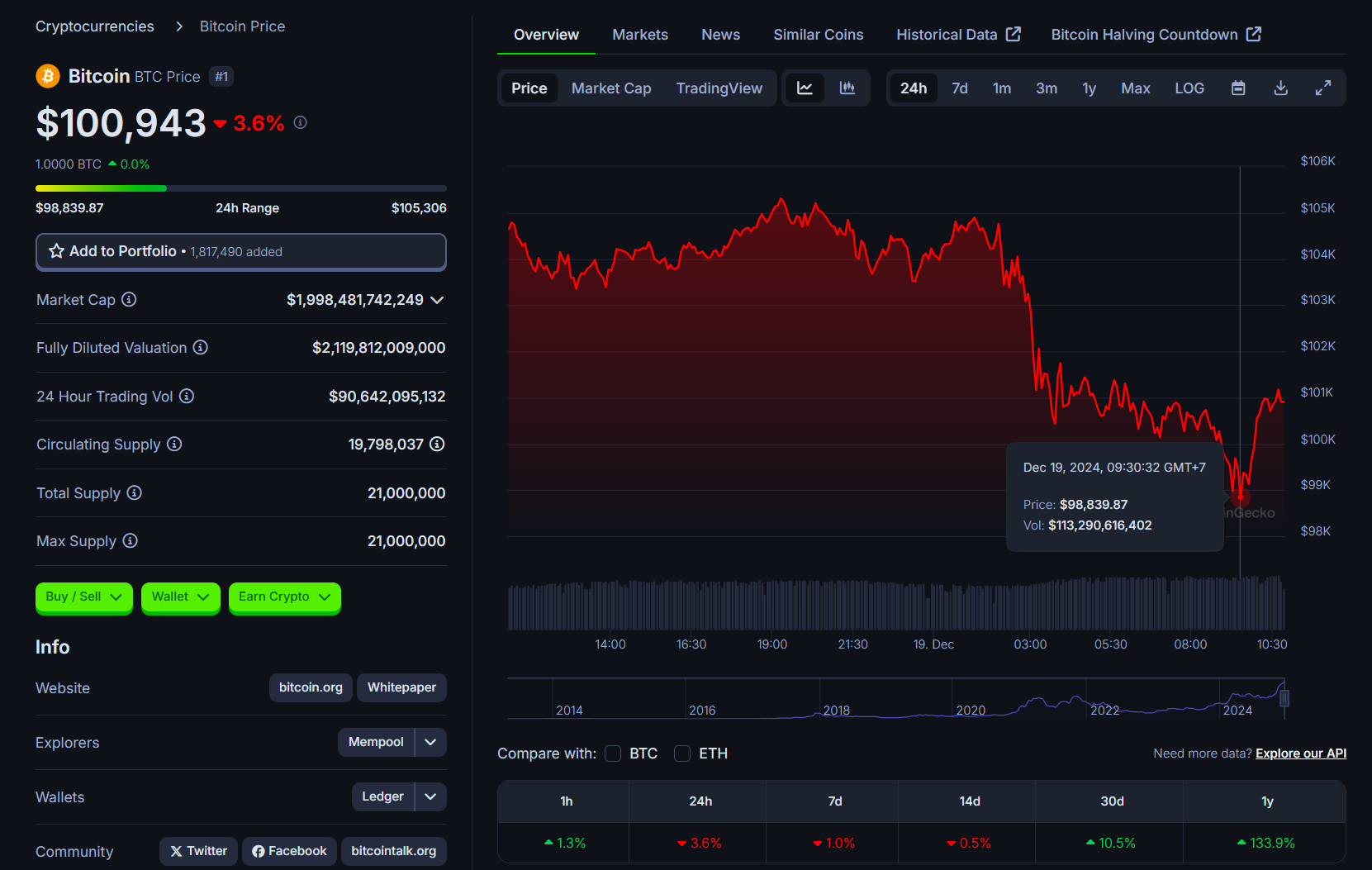

- Bitcoin price fell below $100,000 due to a hawkish Federal Reserve stance.

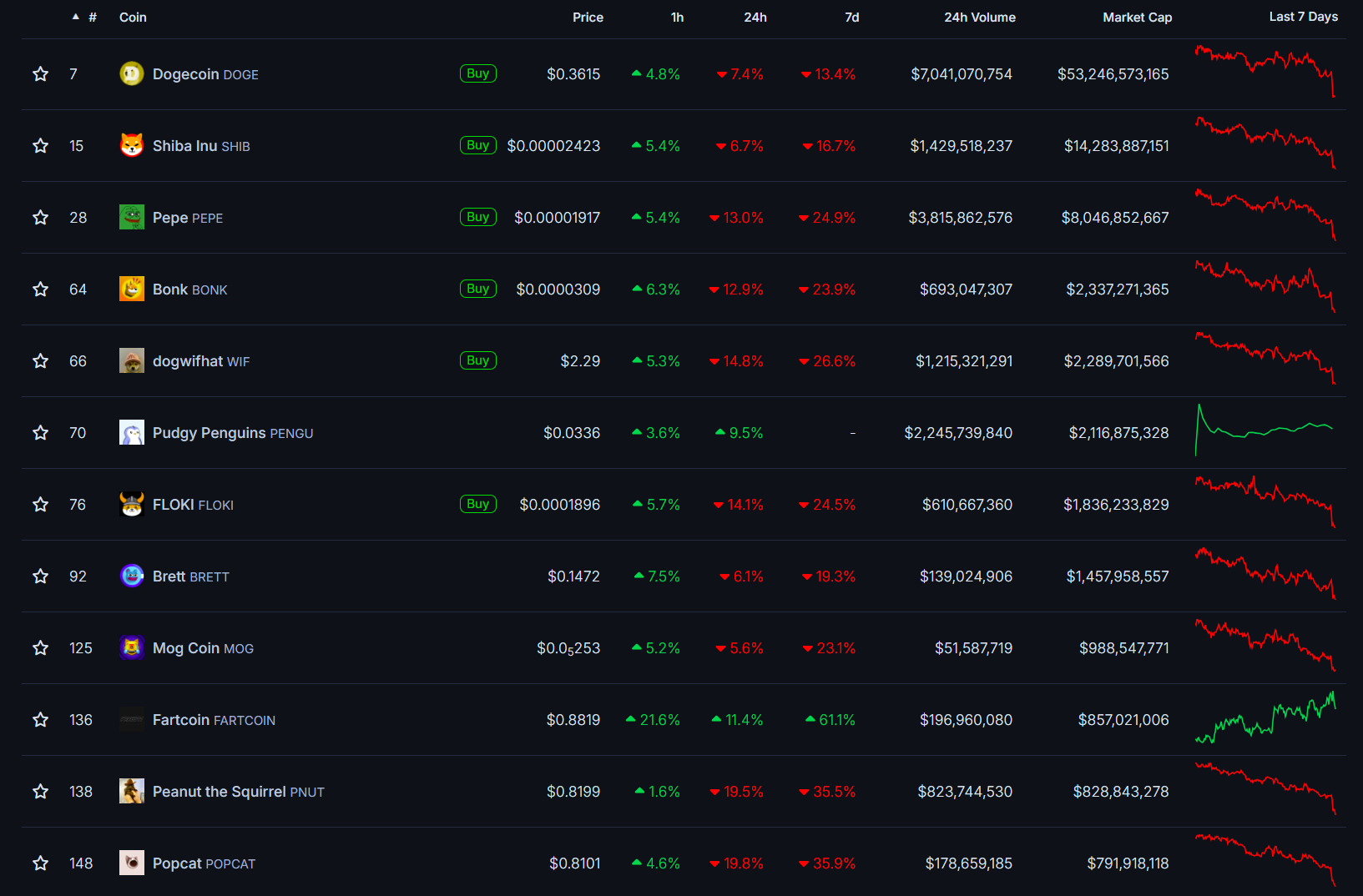

- Meme tokens experienced sharp declines during the market selloff.

Bitcoin fell nearly 6% to trade below $100,000 amid a market-wide selloff after the Fed adopted a hawkish tone at Wednesday’s FOMC meeting, according to data from CoinGecko.

The Fed lowered its benchmark interest rate with 25 points as expected but predicted only two rate cuts in 2025, down from its previous forecast of four cuts. Fed Chairman Jerome Powell indicated that the central bank would be more cautious when considering further adjustments to the key interest rate.

The Fed’s surprisingly hawkish stance has analysts adjusting their interest rate cut forecasts. Analyst at Morgan Stanley noted that they no longer expect a rate cut in January 2025.

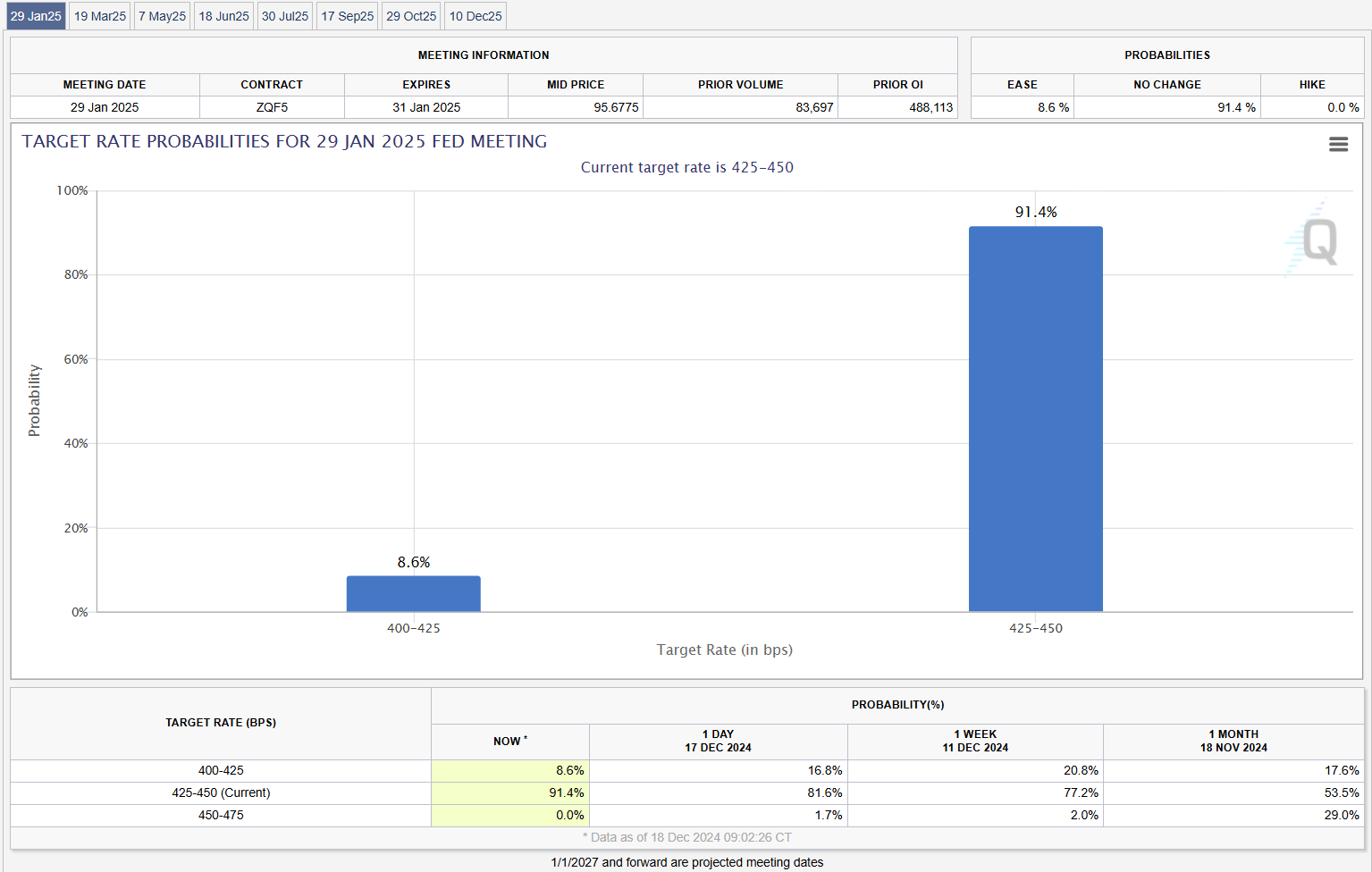

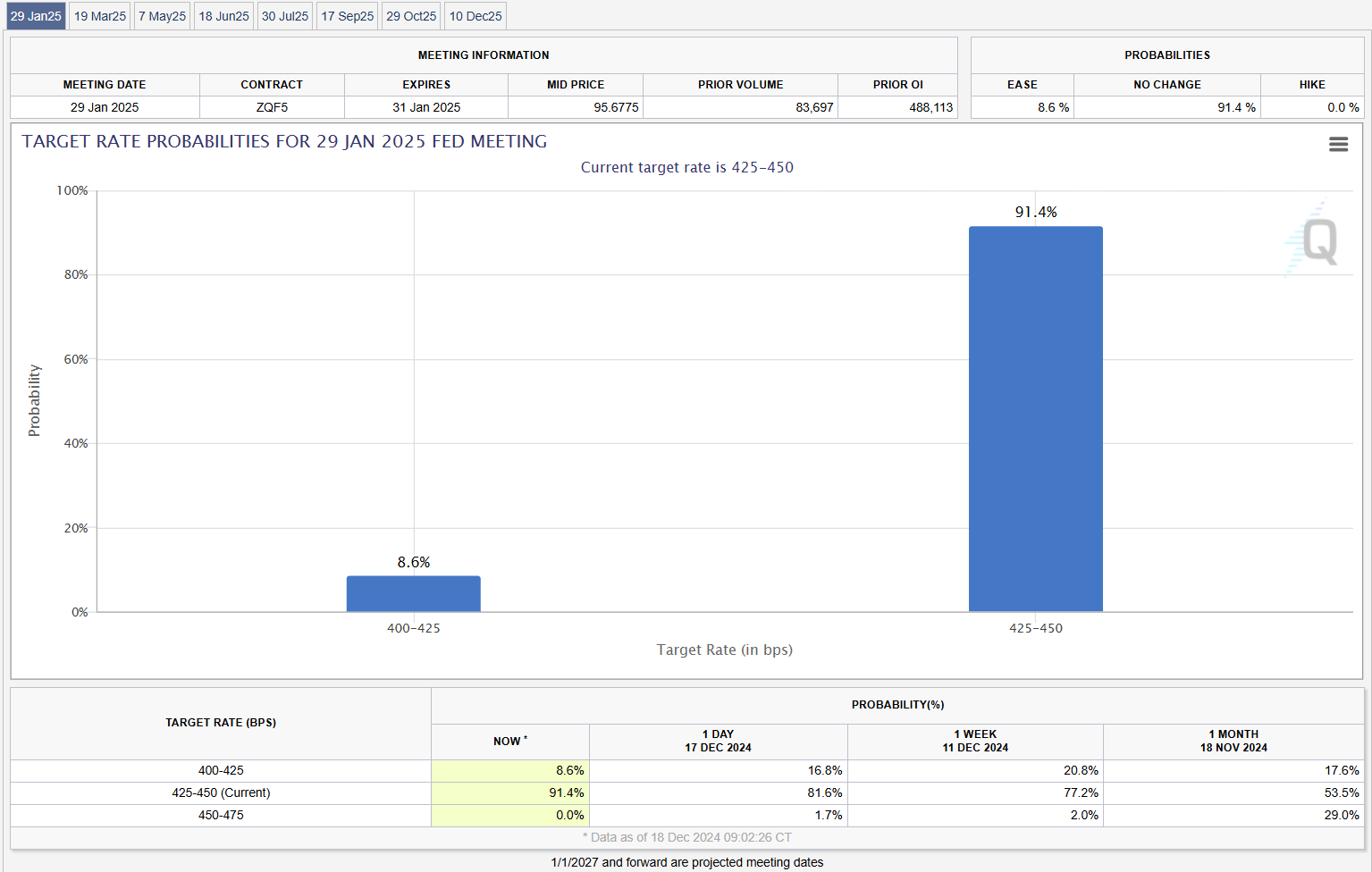

Likewise, the market’s expectations for an interest rate cut at the Fed’s meeting in January have decreased. The probability of a rate cut at the Fed’s January meeting fell to 8.6%, based on the CME FedWatch Tool datawhile the probability of holding current rates rose to 91% from around 81% a day earlier.

Equity and crypto markets reacted strongly to Powell’s hawkish signals. The Nasdaq fell more than 3% and the Dow posted its longest losing streak in 50 years. The dollar hit a two-year high as bond yields rose above the curve.

Bitcoin briefly lost $5,000 during Powell’s speech and fell to $98,900 on Wednesday evening before recovering above $100,000. Other crypto assets also declined, with Ethereum falling over 5% to $3,600, Ripple falling nearly 9% and Dogecoin down 8%, per CoinGecko data.

Meme tokens experienced the sharpest declines in 24 hours, with Popcat (POPCAT) falling 20% and Peanut the Squirrel (PNUT) falling 19%. Other meme coins including Pepe (PEPE), dogwifhat (WIF), Bonk (BONK) and Floki (FLOKI) all recorded double-digit losses.