Key conclusions

- MicroStrategy shareholders will vote to increase the authorized common stock to 10.3 billion shares.

- The vote will address changes to the company’s equity incentive plan and procedural changes for directors.

MicroStrategy shareholders will vote on key proposals to increase authorized shares and revise the equity incentive plan – a strategic move in support of the company’s Bitcoin strategy.

“The proposals we are asking you to consider reflect a new chapter in our evolution as a Bitcoin Treasury Company and our ambitious goals for the future,” said MicroStrategy Co-Founder and Executive Chairman Michael Saylor.

The vote is expected to take place at a special session in 2025; the exact date will be announced later notification filed with the SEC.

The meeting, which will be held via webcast, will allow shareholders to vote on four proposals, including increasing the number of common shares to 10.3 billion shares from 330 million and preferred shares to 1 billion shares from 2025. 5 million.

The proposed expansion is intended to support the ’21/21′ plan, which involves raising $42 billion to fund future bitcoin acquisitions over three years. Saylor said last week, the company will reassess its capital deployment strategy once the $42 billion target is met.

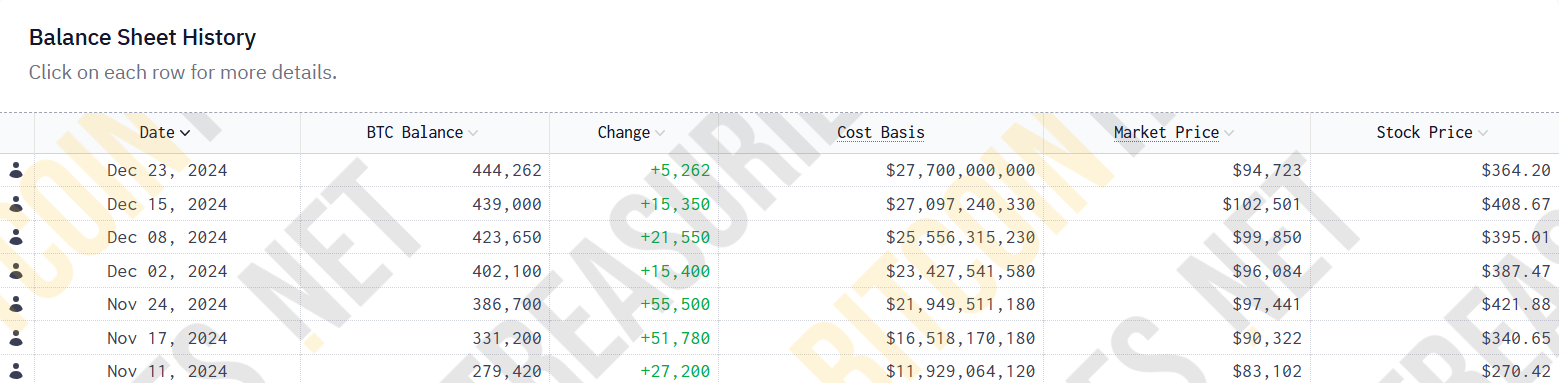

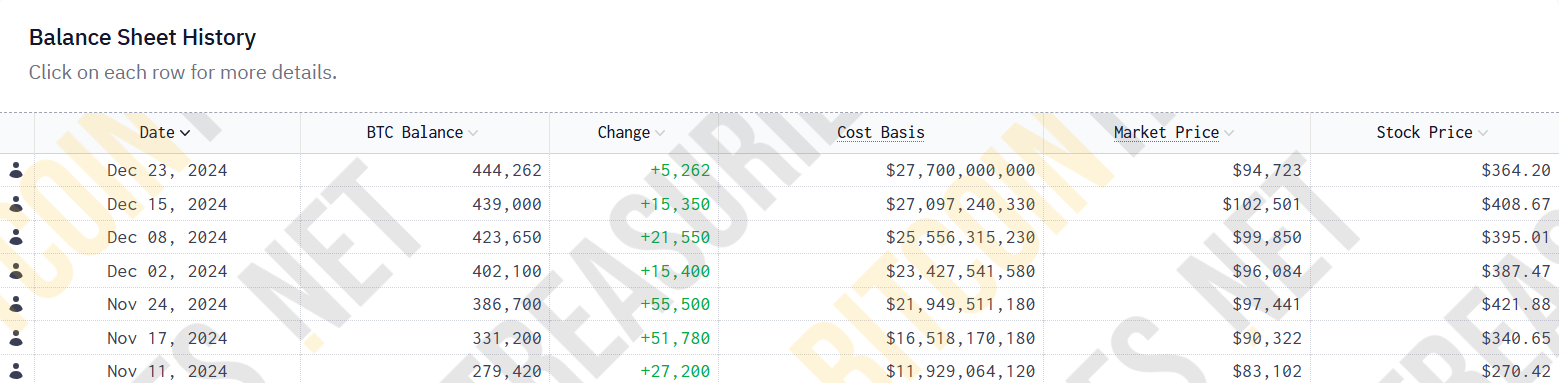

Since announcing its plan, MicroStrategy has acquired approximately 192,042 BTC worth approximately $18 billion. This means that in less than two months, he reached approximately 42% of the planned investment goal.

The Virginia-based company is also seeking shareholder approval to amend its existing equity incentive plan. If the amendment is approved, the amendment will automatically grant the three newly appointed directors – Brian Brooks, Jane Dietze and Gregg Winiarski – equity awards of $2 million upon their initial appointment to the board.

This proposal reflects the company’s strategy to attract and retain qualified executives as it continues to focus on its Bitcoin mining strategy.

Shareholders will also decide on a procedural measure that allows the general meeting to be adjourned if there are not enough votes to approve any proposal and allows additional votes to be collected if necessary.

MicroStrategy’s proposals are next in line inclusion in the Nasdaq-100 the index took effect on December 23. The move is expected to lead to increased buying from index-tracking funds such as the popular Invesco QQQ Trust, which could increase MicroStrategy’s stock liquidity and visibility among investors.