Ethereum is up 2.75% in the past 24 hours as the crypto market continues to experience a general price recovery in 2025. Notably, data from Ethereum investor activity shows a corresponding increase in bullish sentiment with the expectation of a sustained uptrend in the near term.

Ethereum Taker Buy Sell Ratio Closer To 1, Bull Trend Set To Resume

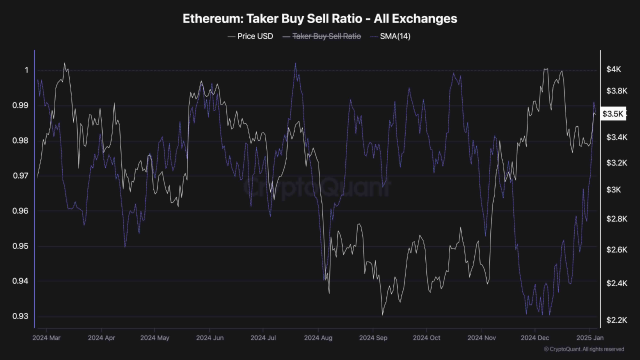

In one Quick post on CryptoQuant, market analyst ShayanBTC postulated that the Ethereum market may experience further price growth based on the Taker Buy Sell Ratio – an important trading metric in the futures market used to measure the balance between aggressive buying and selling.

The Taker Buy Sell Ratio is used to measure market sentiment by showing whether buyers or sellers are more aggressive in market orders. A ratio above 1 indicates that buyers are dominant, while a ratio below 1 signals greater selling pressure.

Following Ethereum’s recovery from above $3,000, the ratio has registered a significant increase in the market’s buy orders. This development suggests that Ethereum traders are becoming increasingly hopeful of a price gain in the short term.

If the Ethereum bulls can sustain the current uptrend, the altcoin will expected to return to $4,000 where its next significant resistance level lies. However, Shayan BTC notes that for a bullish trend to be confirmed, the Taker Buy Sell Ratio must rise above 1, indicating that buyers are taking control of the market.

Altcoins are tipped to reach $2 trillion valuation during Altseason

In other news, cryptanalyst Michaël van de Poppe has stated that the altcoin market has recently undergone a correction that has reached a crucial support level. These digital coins are now in an upward trend as the alt season prepares to go into full effect. With the heightened expectations surrounding the current bull cycle, van de Poppe predicts that the altcoin market cap could reach $2 trillion in valuation during the alt season.

As the largest altcoin by market capitalization, Ethereum is likely to play a major role in igniting and driving the bullish momentum around the altcoin market during this period. With Ethereum holding a 29.7% dominance of the altcoin market, the token’s market cap could reach around $594 billion during the alt season if van de Poppe’s prediction holds true.

For context, altseason is a period where altcoins (i.e. cryptocurrencies other than Bitcoin) experience significant price gains and surpass Bitcoin in terms of percentage growth.

At press time, Ethereum is trading at $3,652, reflecting a price increase of 1.37% over the past 24 hours. Meanwhile, the altcoin’s daily trading volume has decreased by 25.76% and is valued at $16.29 billion.