Important takeaways

- Concern gripped crypto markets following the Fed’s surprisingly hawkish message following its rate cut decision.

- Despite the crash, Bitcoin has seen a 130% gain this year, as investors continue to accumulate.

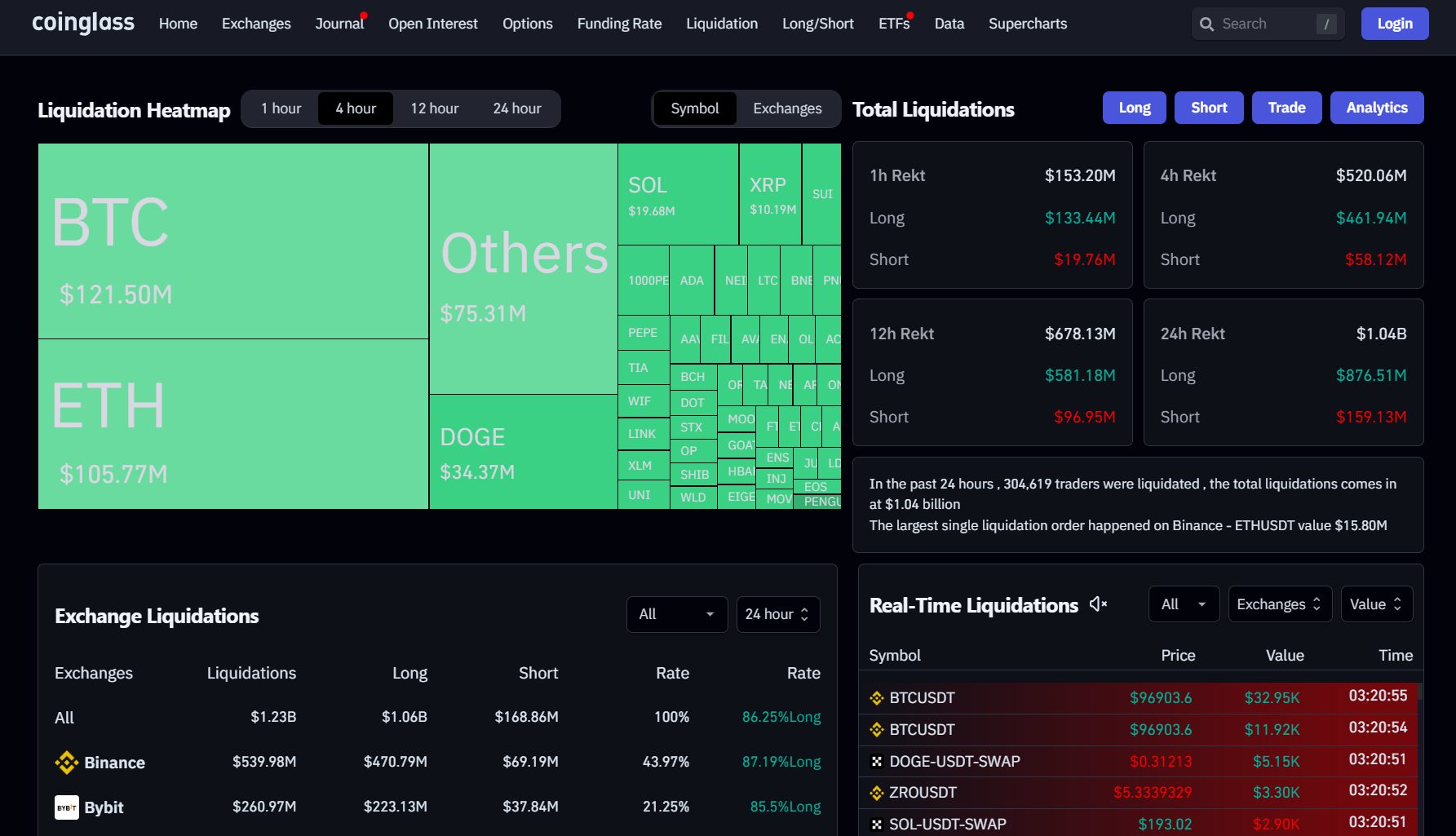

Leveraged liquidations across crypto assets surged to $1 billion after a brutal selloff sent Bitcoin below $96,000 on Thursday, according to Coinglass data.

Long positions accounted for the vast majority of losses at about $878 million, compared to $160 million for short positions.

Bitcoin recovered above $97,000 at press time but remains below its daily peak of $102,000, CoinGecko data shows.

It wasn’t just Bitcoin; most crypto assets also fell in value. The total market cap of the crypto market fell by 9.5% to $3.4 trillion at the time of reporting.

Ether lost 8%, Ripple lost 5%, and Solana and Dogecoin experienced even steeper double-digit losses in the past 24 hours. Smaller-cap assets were hit particularly hard, with only Movement (MOVE) paring its losses.

The Fed’s hawkish stance

Markets likely reacted in turmoil to the Fed’s unexpectedly hawkish announcement after the rate cut decision. The Fed on Wednesday delivered a 25 basis point rate cut, but signaled fewer cuts in 2025.

Uncertainties in the economy, especially with the incoming administration, prompted the central bank to take a more cautious stance. Fed Chairman Jerome Powell said it is wise to “hold the brakes” when the economic outlook is unclear.

Inflation has cooled from its peak of around 9% in June 2022, but remains stubbornly above the Fed’s target. Lowering interest rates can stimulate economic growth by making borrowing cheaper, but it can also contribute to higher inflation.

There are concerns on Wall Street that Trump’s proposed economic policies, including tariffs, could worsen inflation, even if they could boost economic growth in the short term.

Bitcoin ETF Performance

Elsewhere in the Bitcoin ETF market, emerging indicators point to a potential shift in sentiment.

Although US spot bitcoin ETFs have maintained a 14-day positive inflow streak, recent net inflows have been disproportionately concentrated within BlackRock’s IBIT. Other ETFs have reported either zero net inflows or net outflows.

Data shows that Grayscale’s low-cost Bitcoin ETF shed around $188 million on Thursday, a record low since its launch, while Grayscale’s Bitcoin Trust saw around $88 million in net outflows.

Additional data released later today will provide a more comprehensive assessment of the ETF’s performance.

Healthy fix?

Despite the selloff, Bitcoin is up about 130% this year. MicroStrategy, which owns nearly 2% of Bitcoin’s supply, continues its acquisition strategy. The company has bought $3 billion worth of Bitcoin so far this month.

Many crypto traders see the recent pullback as a healthy correction.

“It’s the same story every time, and it never changes. Markets are not designed for the majority to win. Corrections are a natural part of bull markets,” popular analyst “Titan of Crypto” stated.

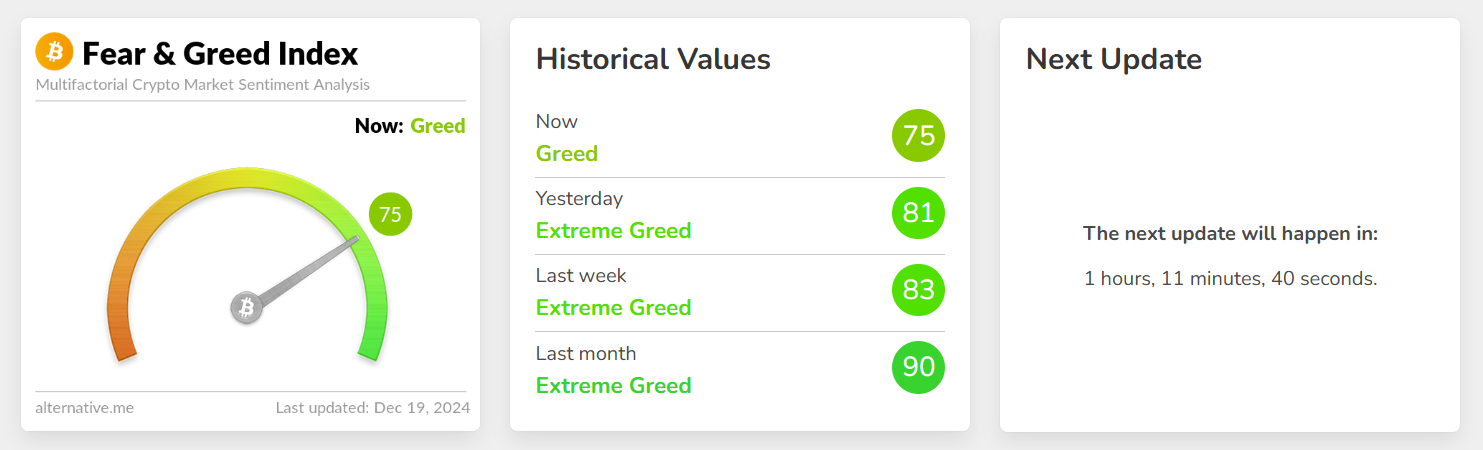

The Crypto Fear and Greed Indexwhich measures the emotional state of the crypto market, is currently at 75, indicating a sense of greed among crypto investors despite recent market volatility and price corrections.